United Airlines 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

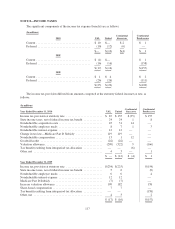

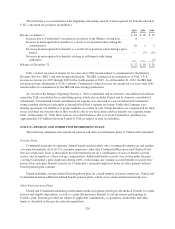

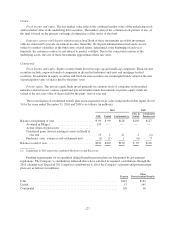

We develop our expected long-term rate of return assumption based on historical experience and by

evaluating input from the trustee managing the plans’ assets. Our expected long-term rate of return on plan assets

is based on a target allocation of assets, which is based on our goal of earning the highest rate of return while

maintaining risk at acceptable levels. The plans strive to have assets sufficiently diversified so that adverse or

unexpected results from one security class will not have an unduly detrimental impact on the entire portfolio. We

regularly review our actual asset allocation and the pension plans’ investments are periodically rebalanced to our

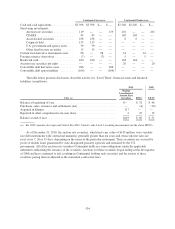

targeted allocation when considered appropriate. Continental’s plan assets are allocated within the following

guidelines:

Percent of Total

Expected Long-Term

Rate of Return

Equity security funds:

U.S. companies ............................................ 35-55% 8%

International companies ...................................... 15-25 8

Fixed-income securities .......................................... 15-25 5

Other ......................................................... 0-15 10

United’s target allocation for the defined benefit pension plan assets is 62% in equity securities and 38% in

fixed income securities, while 100% of other postretirement plan assets are invested in a deposit administration

fund.

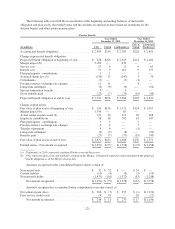

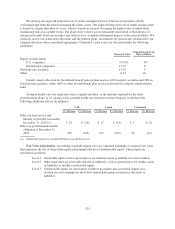

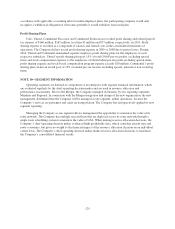

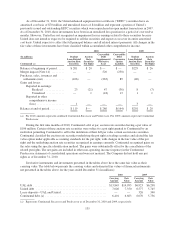

Assumed health care cost trend rates have a significant effect on the amounts reported for the other

postretirement plans. A 1% change in the assumed health care trend rate for the Company would have the

following additional effects (in millions):

UAL United Continental

1% Increase 1% Decrease 1% Increase 1% Decrease 1% Increase 1% Decrease

Effect on total service and

interest cost for the year ended

December 31, 2010 (a) ...... $ 20 $ (16) $ 17 $ (14) $ 3 $ (2)

Effect on postretirement benefit

obligation at December 31,

2010 .................... 297 (245) 272 (223) 25 (22)

(a) Continental represents combined Predecessor and Successor.

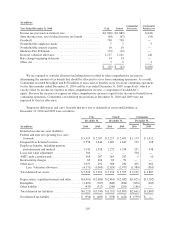

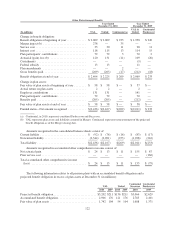

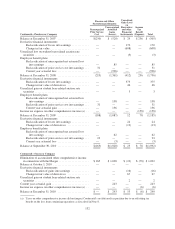

Fair Value Information. Accounting standards require us to use valuation techniques to measure fair value

that maximize the use of observable inputs and minimize the use of unobservable inputs. These inputs are

prioritized as follows:

Level 1 Observable inputs such as quoted prices for identical assets or liabilities in active markets

Level 2 Other inputs that are observable directly or indirectly, such as quoted prices for similar assets

or liabilities or market-corroborated inputs

Level 3 Unobservable inputs for which there is little or no market data and which require us to

develop our own assumptions about how market participants would price the assets or

liabilities

125