United Airlines 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

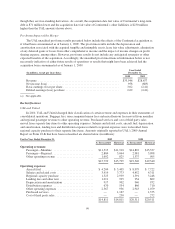

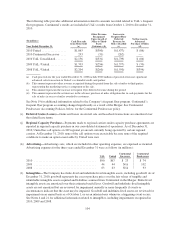

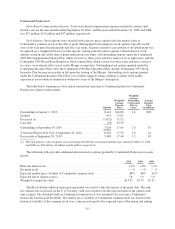

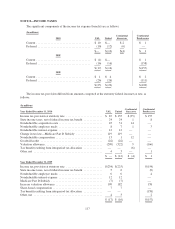

(a) Weighted average life expressed in years.

(b) The United and Continental frequent flyer databases are amortized based on an accelerated amortization schedule to

reflect utilization of the assets. Estimated cash flows correlating to the expected attrition rate of customers in the frequent

flyer databases were considered in the determination of the amortization schedules.

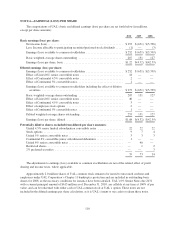

The following table presents information related to the Company’s actual and expected future amortization

expense (in millions):

Actual Amortization: UAL United

Continental

Successor

Continental

Predecessor

2010 .................................................... $ 96 $65 $ 31 $11

2009 .................................................... 69 69 N/A 14

2008 .................................................... 92 92 N/A 14

Projected Amortization:

2011 .................................................... $169 $61 $108

2012 .................................................... 120 55 65

2013 .................................................... 140 52 88

2014 .................................................... 126 46 80

2015 .................................................... 106 37 69

See Note 21 for information related to impairment of goodwill and intangible assets.

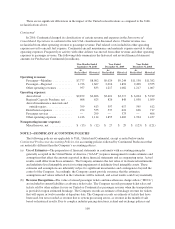

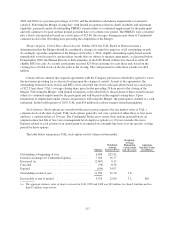

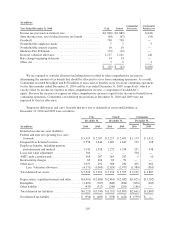

NOTE 5—COMMON STOCKHOLDERS’ EQUITY(DEFICIT) AND PREFERRED SECURITIES

UAL

In the fourth quarter of 2010, approximately 9 million shares of UAL common stock were issued upon the

redemption of Continental’s $175 million aggregate principal amount of 5% Convertible Notes due 2023. See

Note 14 for additional information related to this transaction.

In October 2010, approximately 148 million shares of UAL common stock were issued to Continental

stockholders in exchange for Continental common stock in connection with the Merger. See Note 1 for additional

information related to this transaction.

During 2009 and 2008, UAL issued approximately 7 million and 11 million shares of its common stock,

respectively, as part of a $200 million equity offering program generating net proceeds of $75 million and $122

million, respectively. Of the 2008 sales, $107 million was received in December 2008 and $15 million was

received in January 2009 upon settlement of shares sold during the last three days of 2008. This equity offering

program was completed in September 2009.

In addition, UAL sold approximately 19 million shares of its common stock in an underwritten, public

offering for a price of $7.24 per share in October 2009. The Company received approximately $132 million of

net proceeds from this issuance. UAL contributed the proceeds from both its equity offering program and its

19 million common stock issuance to United, as further discussed in Note 20.

In 2008, approximately 11 million shares of UAL common stock were issued upon preferred stockholders’

elections to exercise their conversion option of all 5 million shares of UAL’s 2% mandatorily convertible

preferred stock. This class of stock was retired in October 2008. UAL and United increased additional paid in

capital by $374 million and decreased the mandatorily convertible preferred stock by the same amount to record

the impact of these conversions.

All treasury shares were acquired for tax withholding obligations related to UAL’s share-based

compensation plan. At December 31, 2010, approximately 94 million shares of UAL common stock were

reserved for future issuance related to the conversion of convertible debt securities and the issuance of equity

based awards under UAL’s incentive compensation plans.

108