United Airlines 2010 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

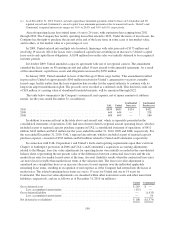

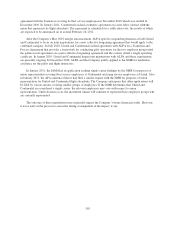

NOTE 18—STATEMENT OF CONSOLIDATED CASH FLOWS—SUPPLEMENTAL DISCLOSURES

Supplemental disclosures of cash flow information and non-cash investing and financing activities for the

years ended December 31 are as follows (in millions):

UAL United

Continental

Successor

Continental

Predecessor

2010

Cash paid (refunded) during the period for:

Interest (net of amounts capitalized) ......................... $600 $489 $111 $ 210

Income taxes ........................................... (16) (16) — 1

Non-cash transactions:

Redemption of Continental’s 5% Convertible Notes with UAL

common stock ........................................ $175 $— $175 $ —

Property and equipment acquired through issuance of debt and

capital leases ......................................... 98 — 98 465

Restricted cash collateral returned on derivative contracts ........ (45) (45) — —

Interest paid in kind on UAL 6% Senior Notes ................. 35 35 — —

2009

Cash paid (refunded) during the period for:

Interest (net of amounts capitalized) ......................... $411 $411 $ 326

Income taxes ........................................... (11) (11) 1

Non-cash transactions:

Property and equipment acquired through issuance of debt and

capital leases ......................................... $183 $183 $ 402

Capital lease assets and obligations recorded due to lease

amendment .......................................... 250 250 —

Restricted cash received as collateral on derivative contracts ..... 49 49 —

Interest paid in kind on UAL 6% Senior Notes ................. 33 33 —

Current operating payables reclassified to long-term debt due to

supplier agreement ..................................... 49 49 —

2008

Cash paid (refunded) during the period for:

Interest (net of amounts capitalized) ......................... $412 $412 $ 365

Income taxes ........................................... 3 3 5

Non-cash transactions:

Conversion of mandatorily convertible preferred stock to UAL

common stock ........................................ $374 $374 $ —

Property and equipment acquired through issuance of debt and

capital leases ......................................... 281 281 1,014

Reduction of debt in exchange for sale of frequent flyer miles .... — — (38)

Interest paid in kind on UAL 6% Senior Notes ................. 31 31 —

Receivable from unsettled stock sales as of December 31, 2008 . . . 15 15 —

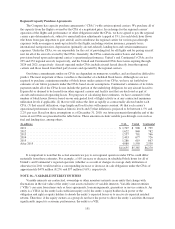

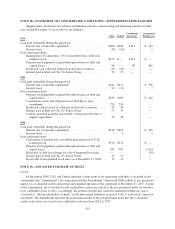

NOTE 19—ADVANCED PURCHASE OF MILES

United

In September 2008, UAL and United amended certain terms of its agreement with their co-branded credit

card partner (the “Amendment”). In connection with the Amendment, United sold $500 million of pre-purchased

miles to its co-branded credit card partner and extended the term of the agreement to December 31, 2017. As part

of the Amendment, the co-branded credit card partner cannot use certain of the pre-purchased miles for issuance

to its cardholders prior to 2011; accordingly, the portion of miles that cannot be redeemed within one year is

classified as “Advanced purchase of miles” in the non-current liabilities section of UAL’s and United’s financial

statements. The Amendment specifies the maximum amount of the pre-purchased miles that the co-branded

credit card partner can award to its cardholders each year from 2011 to 2017.

159