United Airlines 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

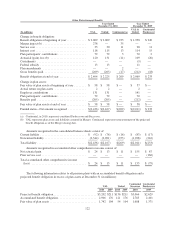

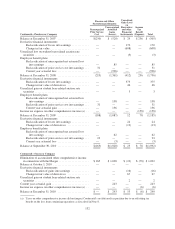

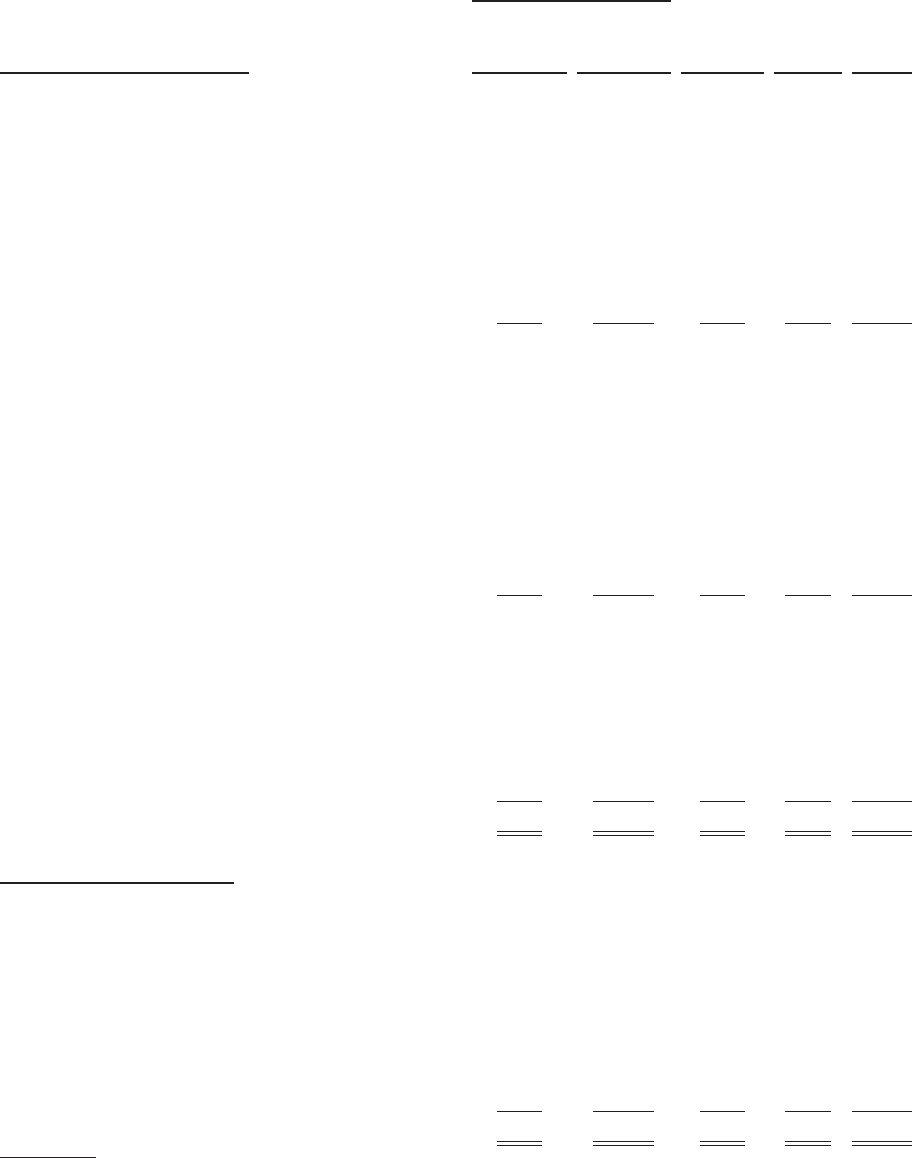

Pension and Other

Postretirement Benefits

Unrealized

Gain (Loss)

on

Derivatives

and other

Financial

Instruments

Income

Tax

Benefit

(Expense)Continental—Predecessor Company

Unrecognized

Prior Service

Cost

Unrecognized

Actuarial

Gains

(Losses) Total

Balance at December 31, 2007 ...................... $(250) $ (520) $ 29 $ 236 $ (505)

Derivative financial instruments:

Reclassification of losses into earnings ............ — — 170 — 170

Change in fair value ........................... — — (608) — (608)

Unrealized loss on student loan-related auction rate

securities ...................................... — — (3) — (3)

Employee benefit plans:

Reclassification of unrecognized net actuarial loss

into earnings ............................... — 85 — — 85

Reclassification of prior service cost into earnings . . . 31 — — — 31

Current year actuarial loss ...................... — (926) — — (926)

Balance at December 31, 2008 ...................... (219) (1,361) (412) 236 (1,756)

Derivative financial instruments:

Reclassification of losses into earnings ............ — — 375 — 375

Change in fair value of derivatives ............... — — 46 — 46

Unrealized gain on student loan-related auction rate

securities ...................................... — — 3 — 3

Employee benefit plans:

Reclassification of unrecognized net actuarial loss

into earnings ............................... — 138 — — 138

Reclassification of prior service cost into earnings . . . 31 — — — 31

Current year actuarial gain ...................... — 136 — — 136

Income tax expense on other comprehensive income (a) . . — — — (158) (158)

Balance at December 31, 2009 ...................... (188) (1,087) 12 78 (1,185)

Derivative financial instruments:

Reclassification of losses into earnings ............ — — 24 — 24

Change in fair value of derivatives ............... — — (13) — (13)

Employee benefit plans:

Reclassification of unrecognized net actuarial loss

into earnings ............................... — 62 — — 62

Reclassification of prior service cost into earnings . . . 23 — — — 23

Current year actuarial loss ...................... — (3) — — (3)

Balance at September 30, 2010 ...................... $(165) $(1,028) $ 23 $ 78 $(1,092)

Continental—Successor Company

Elimination of accumulated other comprehensive income

in connection with the Merger ..................... $165 $1,028 $ (23) $ (78) $ 1,092

Balance at October 1, 2010 ......................... — — — — —

Derivative financial instruments:

Reclassification of gains into earnings ............ — — (16) — (16)

Change in fair value of derivatives ............... — — 67 — 67

Unrealized gain on student loan-related auction rate

securities ...................................... — — 2 — 2

Current year actuarial gain .......................... — 243 — — 243

Income tax expense on other comprehensive income (a) . . — — — (6) (6)

Balance at December 31, 2010 ...................... $— $ 243 $ 53 $ (6) $ 290

(a) Taxes on other comprehensive income did not impact Continental’s net deferred tax position due to an offsetting tax

benefit on the loss from continuing operations as described in Note 8.

132