United Airlines 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Senior Notes could result in a default and a subsequent acceleration of the applicable debt obligations. In

addition, the indentures governing the United Senior Notes contain a cross-acceleration provision pursuant to

which a default resulting in the acceleration of indebtedness under the Amended Credit Facility would result in a

default under such indentures. A default under the indentures governing the United Senior Notes could allow

holders of the United Senior Notes to accelerate the maturity of the obligations in these agreements.

Credit Card Processing Agreements. United and Continental have agreements with financial institutions

that process customer credit card transactions for the sale of air travel and other services. Under certain of

United’s and Continental’s credit card processing agreements, the financial institutions either require, or under

certain circumstances have the right to require, that United and Continental maintain a reserve equal to a portion

of advance ticket sales that have been processed by that financial institution, but for which United and

Continental have not yet provided the air transportation.

As of December 31, 2010, United and Continental provided a reserve of $25 million each, as required under

their respective credit card processing agreements with JPMorgan Chase and affiliates of JPMorgan Chase.

Additional reserves may be required under these or other credit card processing agreements of United or

Continental in certain circumstances, such as decreases in credit ratings, decreases in United’s or Continental’s

unrestricted cash balance below amounts required by the processing agreements, or decreases in minimum ratios

of unrestricted cash to current liabilities. In addition, in certain circumstances, an increase in the future reserve

requirements as provided by the terms of one or more of United’s and Continental’s material credit card

processing agreements could materially reduce the Company’s liquidity. See Note 17 to the financial statements

in Item 8 for a detailed discussion of the obligations under the Company’s credit card processing agreements.

Capital Commitments and Off-Balance Sheet Arrangements. The Company’s business is capital intensive,

requiring significant amounts of capital to fund the acquisition of assets, particularly aircraft. In the past, the

Company has funded the acquisition of aircraft through outright purchase, by issuing debt, by entering into

capital or operating leases, or through vendor financings. The Company also often enters into long-term lease

commitments with airports to ensure access to terminal, cargo, maintenance and other required facilities.

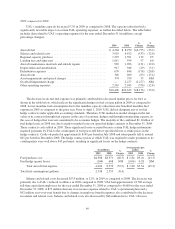

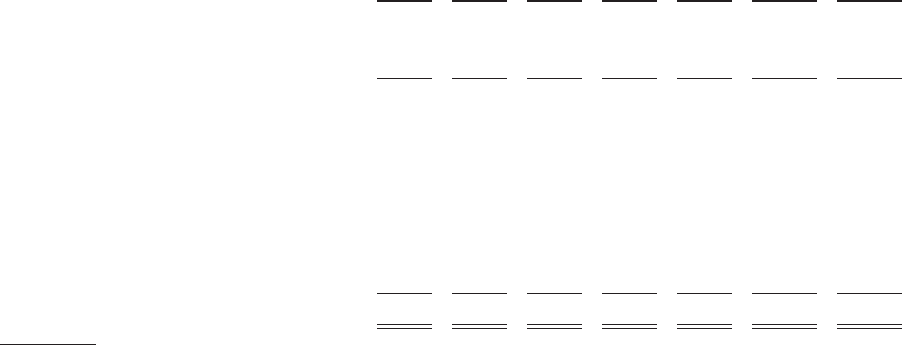

The table below provides a summary of UAL’s material contractual obligations as of December 31, 2010 (in

millions):

2011 2012 2013 2014 2015

After

2015 Total

Long-term debt (a) .................... $2,411 $1,320 $1,835 $2,101 $1,953 $ 4,486 $14,106

Capital lease obligations—principal

portion ............................ 252 124 119 116 117 562 1,290

Total debt and capital lease obligations ..... 2,663 1,444 1,954 2,217 2,070 5,048 15,396

Interest on debt and capital lease

obligations (b) ...................... 855 742 665 589 470 1,955 5,276

Aircraft operating lease obligations ........ 1,711 1,635 1,576 1,503 1,218 3,234 10,877

Capacity purchase agreements (c) ......... 1,707 1,622 1,557 1,403 1,286 4,080 11,655

Other operating lease obligations .......... 1,100 1,077 891 816 705 5,988 10,577

Postretirement obligations (d) ............ 162 163 166 171 176 974 1,812

Pension obligations (e) .................. 126 175 157 156 156 2,556 3,326

Capital purchase obligations (f) ........... 422 1,082 765 988 1,642 7,494 12,393

Total contractual obligations ........... $8,746 $7,940 $7,731 $7,843 $7,723 $31,329 $71,312

(a) Long-term debt presented in UAL’s financial statements is net of a $261 million debt discount which is

being amortized over the debt terms. Contractual payments are not net of the debt discount. Contractual

long-term debt includes $101 million of non-cash obligations as these debt payments are made directly to

the creditor by a company that leases three aircraft from United. The creditor’s only recourse to United is

repossession of the aircraft.

59