United Airlines 2010 Annual Report Download - page 162

Download and view the complete annual report

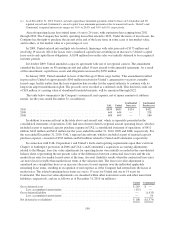

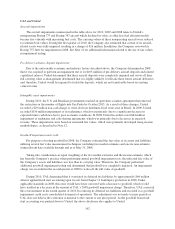

Please find page 162 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United has the right, but is not required, to repurchase the pre-purchased miles from its co-branded credit

card partner during the term of the agreement. The Amendment contains termination penalties that may require

United to make certain payments and repurchase outstanding pre-purchased miles in cases such as United’s

insolvency, bankruptcy false representations or other material breaches.

The Amendment requires that our co-branded credit card partner make annual guaranteed payments to

United between 2008 and 2017. Between 2008 and 2012, our co-branded credit card partner’s annual guaranteed

payment is satisfied through the purchase of a specified minimum number of miles. Afterwards, our co-branded

credit card partner’s annual guaranteed payment is satisfied through awarding pre-purchased miles, purchasing

miles and through other contractual payments. Between 2008 and 2012, our co-branded credit card partner is

allowed to carry forward those miles purchased subject to the annual guarantee that have not been awarded to its

cardholders. Any miles carried forward subject to this provision will result in a net increase to our “Advance

purchase of miles” deferred revenue in our consolidated balance sheets.

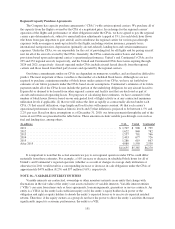

In connection with the Amendment, United received a payment of $100 million in exchange for the

extension of the license previously granted to its co-branded credit card partner to be the exclusive issuer of

Mileage Plus Visa cards through 2017. This amount is reflected as Mileage Plus deferred revenue in the UAL

and United financial statements and is being recorded as other operating revenue over the period the fees are

earned.

As part of the Amendment, United granted its co-branded credit card partner a first lien in specified Mileage

Plus assets and a second lien on those assets that are provided as collateral under our Amended Credit Facility.

See Note 14 for additional information regarding these assets. The Amendment may be terminated by either

party upon the occurrence of certain events as defined, including but not limited to a change in law that has a

material adverse impact, insolvency of one of the parties, or failure of the parties to perform their obligations.

The security interest is released if United repurchases the full balance of the pre-purchased miles or United

achieves a certain fixed charge coverage ratio. As described in Note 3, a modification of this contract, which may

be necessary, in light of the Merger, would require the application of new accounting guidance, which may result

in materially different revenue recognition.

Continental also has an advanced purchase of miles agreement with the same credit card partner. However,

the United and Continental agreements have different terms, which required different accounting treatment.

Continental’s agreement has certain repayment provisions (not present in United’s agreement) which requires

Continental to account for the advanced purchase of miles as debt. See Note 14 for additional information.

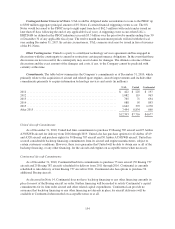

NOTE 20—RELATED PARTY TRANSACTIONS

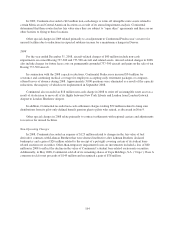

United and Continental

United and Continental participate in extensive code sharing, frequent flyer reciprocity and other

cooperative activities. The other cooperative activities are considered normal to the daily operations of both

airlines. As a result of these other cooperative activities, Continental paid United $18 million and United paid

Continental $8 million in the fourth quarter of 2010. There were no material intercompany receivables or

payables between United and Continental as of December 31, 2010. These payments do not include interline

billings, which are common among airlines for transportation-related services.

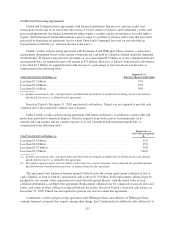

United

During 2009, UAL contributed cash of $559 million to United consisting of the net proceeds that UAL

generated from UAL equity and debt issuances in 2009. In 2008, United contributed cash of $257 million to

UAL for use in UAL’s payment of its January 2008 special distribution to its common stockholders. In addition,

during 2008, UAL contributed cash and other assets to United totaling $173 million, the majority of which

related to proceeds UAL had generated from the sale of its common stock.

160