United Airlines 2010 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

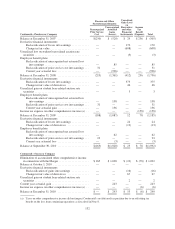

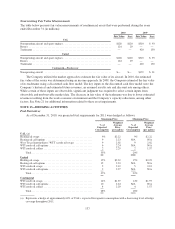

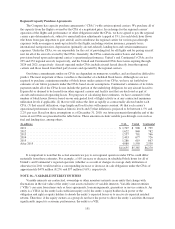

NOTE 14—DEBT

(In millions) At December 31,

2010 2009

United:

Secured

Notes payable, fixed interest rates of 5.74% to 12.00% (weighted average rate

of 8.89% as of December 31, 2010), payable through 2022 .............. $ 2,469 $ 2,464

Floating rate notes, LIBOR plus 0.20% to 11.30%, payable through 2020 ..... 1,165 1,496

9.875% senior secured notes and 12.0% second lien due 2013 .............. 700 —

12.75% senior second lien notes due 2013 ............................. 173 175

Amended credit facility, LIBOR plus 2.0%, due 2014 .................... 1,237 1,255

Unsecured

4.5% senior limited subordination convertible notes due 2021 .............. 726 726

6% senior notes due 2031........................................... 615 580

5% senior convertible notes due 2021 ................................. 150 150

Other ........................................................... 72 78

7,307 6,924

Less: unamortized debt discount ................................. (281) (347)

Less: current portion of long-term debt—United ..................... (1,546) (544)

Long-term debt, net—United ........................................ $ 5,480 $ 6,033

Continental: (Successor) (Predecessor)

Secured

Notes payable, fixed interest rates of 4.75% to 9.25% (weighted average rate

of 7.0% as of December 31, 2010), payable through 2022 ............... $ 3,290 $ 3,077

Floating rate notes, LIBOR plus 0.35% to 5.0%, payable through 2020 ....... 1,407 1,957

6.75% senior secured notes due 2015 ................................. 800 —

Advance purchases of mileage credits ................................. 273 275

Other ........................................................... — 5

Unsecured

8.75% notes due 2011 ............................................. 200 200

6.0% convertible junior subordinated debentures due 2030 ................ 248 248

4.5% convertible notes due 2015 ..................................... 230 230

5% convertible notes due 2023 ...................................... — 175

Other ........................................................... 6 8

$ 6,454 $ 6,175

Less: unamortized debt (discount) premium (a) ..................... 20 (105)

Less: current maturities ........................................ (865) (972)

Long-term debt, net—Continental (a) ................................. $ 5,609 $ 5,098

UAL Consolidated:

6% senior convertible notes due 2029 ................................. $ 345 $ 345

Long-term debt, net—UAL (consolidated) ............................. $ 11,434 $ 6,378

(a) As further described below under “Convertible Debt Securities,” there is a basis difference between UAL and

Continental debt values, because we were required to apply different accounting methodologies. The Continental debt

balances presented above do not equal the Continental balance sheet by the amount of this adjustment.

141