United Airlines 2010 Annual Report Download - page 149

Download and view the complete annual report

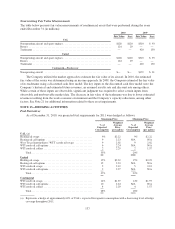

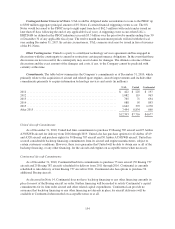

Please find page 149 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$235 million purchase of mileage credits has been treated as a loan from Chase and is reported as long-term debt

in the consolidated balance sheet. The liability will be reduced ratably in 2016 as the mileage credits are issued to

Chase.

Convertible Debt Securities.

Following the Merger, UAL, Continental and the trustees for Continental’s 4.5% Convertible Notes, 5%

Convertible Notes and 6% Convertible Junior Subordinated Debentures entered into supplemental indenture

agreements which provide that Continental’s convertible debt, which was previously convertible into shares of

Continental common stock, will be convertible into shares of UAL common stock upon the terms and conditions

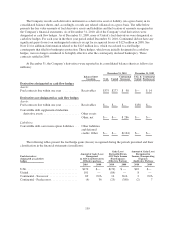

specified in the indentures. For purposes of the Continental separate-entity reporting, as a result of the

Continental debt becoming convertible into the stock of a non-consolidated entity, the embedded conversion

options in Continental’s convertible debt are required to be separated and accounted for as though they are free-

standing derivatives. As a result, the carrying value of Continental’s debt, net of current maturities, on a separate-

entity reporting basis as of October 1, 2010 and December 31, 2010, was $5,931 million and $5,536 million,

respectively, which is $71 million and $73 million, respectively, lower than the consolidated UAL carrying

values on those dates.

In addition, UAL’s contractual commitment to provide common stock to satisfy Continental’s obligation

upon conversion of the debt is an embedded call option on UAL common stock that is also required to be

separated and accounted for as though it is a free-standing derivative. The fair value of the indenture derivatives

on a separate-entity reporting basis as of October 1, 2010 and December 31, 2010, was an asset of $520 million

and $286 million, respectively. The fair value of the embedded conversion options as of October 1, 2010 and

December 31, 2010, was a liability of $230 million and $164 million, respectively. The initial contribution of the

indenture derivatives to Continental by UAL was accounted for as additional-paid-in-capital in Continental’s

separate-entity financial statements. Changes in fair value of both the indenture derivatives and the embedded

conversion options subsequent to October 1, 2010 are recognized currently in nonoperating income (expense).

The decline in fair value of the indenture derivatives and the embedded conversion options during the three

months ended December 31, 2010 was largely due to the conversion of Continental’s 5.0% Convertible Notes,

which were redeemed with UAL shares in the fourth quarter of 2010. The net impact of the conversion of

Continental’s 5.0% Convertible Notes and the adjustments to fair value of the indenture derivatives and the

embedded conversion options was not material to Continental’s results of operations for the three months ended

December 31, 2010.

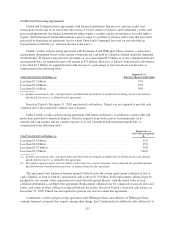

Continental 4.5% Notes. In December 2009, Continental issued $230 million in principal amount of 4.5%

Convertible Notes due 2015 (the “Continental 4.5% Notes”). The Continental 4.5% Notes, which were

convertible into Continental common stock prior to the Merger, became convertible into UAL common stock at a

conversion price of approximately $18.93 per share of UAL common stock. Continental does not have the option

to pay the conversion price in cash. However, holders of the notes may require Continental to repurchase all or a

portion of the notes for cash at par plus any accrued and unpaid interest if certain changes in control of

Continental occur.

Continental 5% Notes. Continental’s $175 million 5% Convertible Notes, which were convertible into

Continental common stock prior to the Merger, became convertible into UAL common stock at a conversion

price of $19.0476 per share of UAL common stock. Prior to the Merger, the Continental 5% Notes were

convertible into shares of Continental common stock. In the fourth quarter of 2010, Continental called the notes

for redemption. The holders of substantially all of these notes exercised their right to convert their notes into

shares of UAL common stock in lieu of cash redemption. During the fourth quarter of 2010, 9.2 million shares of

UAL common stock were issued in connection with the conversion of these notes.

147