United Airlines 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

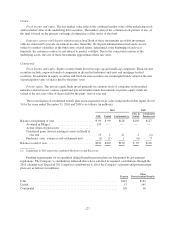

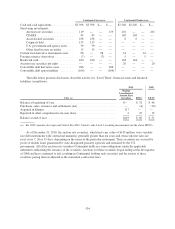

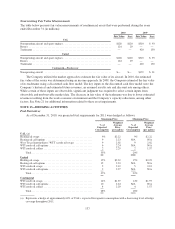

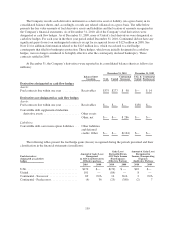

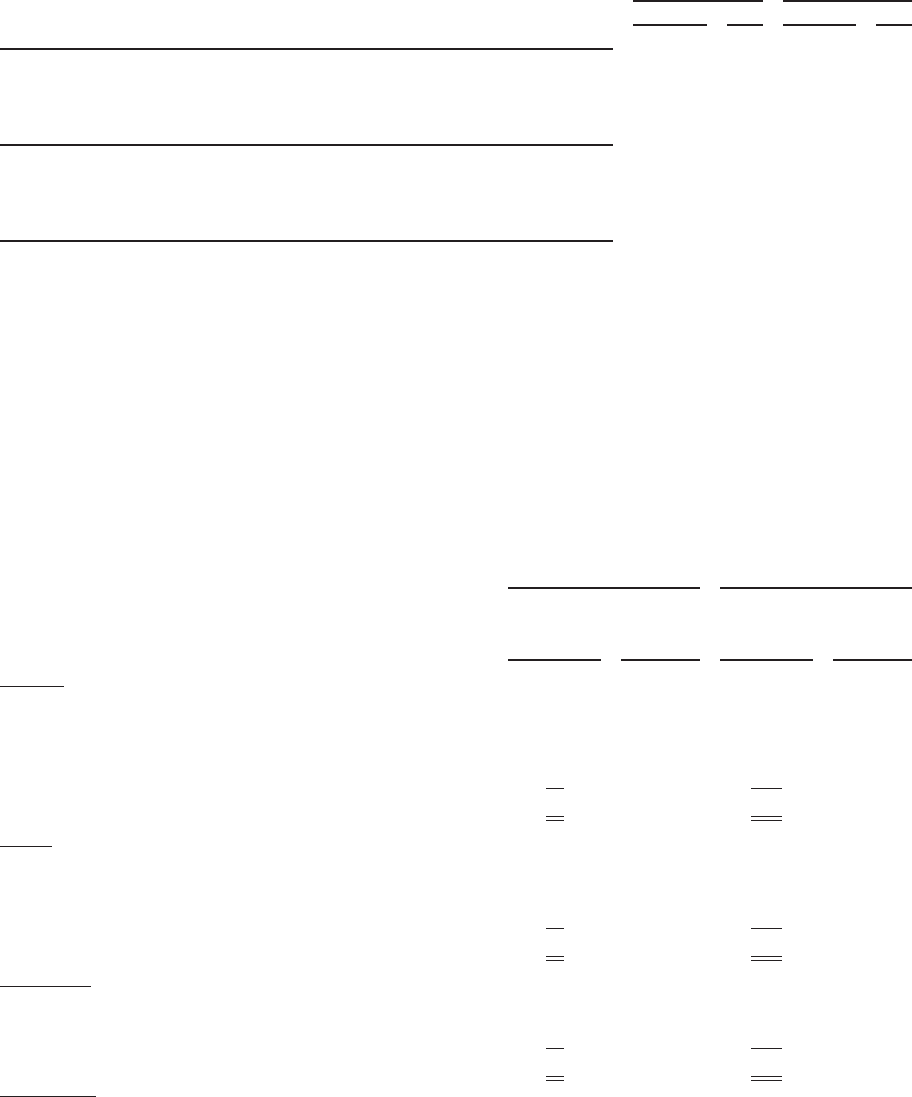

Nonrecurring Fair Value Measurements

The table below presents fair value measurements of nonfinancial assets that were performed during the years

ended December 31 (in millions):

2010 2009

Fair Value Loss Fair Value Loss

UAL

Nonoperating aircraft and spare engines .................................... $128 $120 $310 $ 93

Routes .............................................................. 124 29 — —

Tradename ........................................................... — — 420 150

United

Nonoperating aircraft and spare engines .................................... $128 $120 $310 $ 93

Routes .............................................................. 124 29 — —

Tradename ........................................................... — — 420 150

Continental—Predecessor

Nonoperating aircraft .................................................. $— $— $172 $ 31

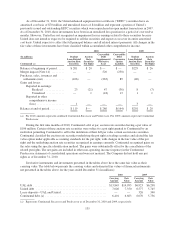

The Company utilized the market approach to estimate the fair value of its aircraft. In 2010, the estimated

fair value of the routes was determined using an income approach. In 2009, the Company estimated the fair value

of its tradename using a discounted cash flow model. The key inputs to the discounted cash flow model were the

Company’s historical and estimated future revenues, an assumed royalty rate and discount rate among others.

While certain of these inputs are observable, significant judgment was required to select certain inputs from

observable and unobservable market data. The decrease in fair value of the tradename was due to lower estimated

revenues resulting from the weak economic environment and the Company’s capacity reductions, among other

factors. See Note 21 for additional information related to these asset impairments.

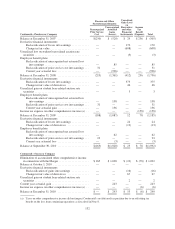

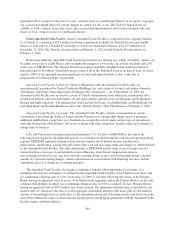

NOTE 13—HEDGING ACTIVITIES

Fuel Derivatives

As of December 31, 2010, our projected fuel requirements for 2011 were hedged as follows:

Maximum Price Minimum Price

%of

Expected

Consumption

Weighted

Average

Price

(per gallon)

%of

Expected

Consumption

Weighted

Average

Price

(per gallon)

UAL (a)

Heating oil swaps ....................................... 9% $2.22 9% $2.22

Heating oil call options ................................... 9 2.23 N/A N/A

West Texas Intermediate (“WTI”) crude oil swaps ............. 9 2.02 9 2.02

WTI crude oil call options ................................. 6 2.24 N/A N/A

WTI crude oil collars ..................................... 2 2.29 2 1.57

Total .............................................. 35% 20%

United

Heating oil swaps ....................................... 15% $2.22 15% $2.22

Heating oil call options ................................... 15 2.23 N/A N/A

WTI crude oil swaps ..................................... 5 2.12 5 2.12

WTI crude oil call options ................................. 2 2.27 N/A N/A

Total .............................................. 37% 20%

Continental

WTI crude oil swaps ..................................... 14% $1.97 14% $1.97

WTI crude oil call options ................................. 10 2.24 N/A N/A

WTI crude oil collars ..................................... 4 2.29 4 1.57

Total .............................................. 28% 18%

(a) Represents a hedge of approximately 60% of UAL’s expected first quarter consumption with a decreasing level of hedge

coverage throughout 2011.

137