United Airlines 2010 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

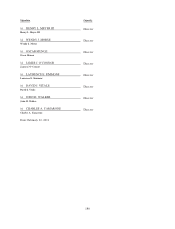

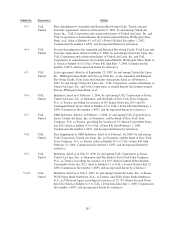

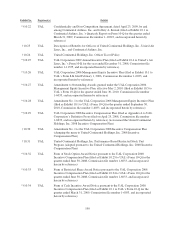

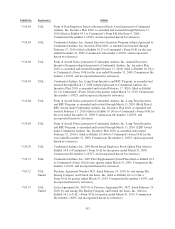

Schedule II

Valuation and Qualifying Accounts

For the Years Ended December 31, 2010, 2009 and 2008

(In millions)

Description

Balance at

Beginning of

Period

Assumed in

Merger/

Acquisition

Accounting

Adjustment

Additions

Charged to

Costs and

Expenses

Deductions

(a)

Balance at

End of

Period

Allowance for doubtful accounts—UAL:

2010 ...................................... $ 14 $ — $ 4 $ 12 $ 6

2009 ...................................... 24 — 31 41 14

2008 ...................................... 27 — 25 28 24

Allowance for doubtful accounts—United:

2010 ...................................... $ 14 — $ 3 $ 12 $ 5

2009 ...................................... 24 — 31 41 14

2008 ...................................... 27 — 25 28 24

Allowance for doubtful accounts—Continental:

Oct. 1 to Dec. 31, 2010 (Successor Company) ..... $ 5 $ (5) $ 1 $— $ 1

Jan. 1 to Sep. 30, 2010 (Predecessor Company) .... 7 — 1 3 5

2009 (Predecessor Company) .................. 7 — 7 7 7

2008 (Predecessor Company) .................. 7 — 9 9 7

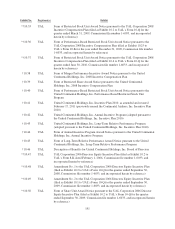

Obsolescence allowance—spare parts—UAL:

2010 ...................................... $ 61 $ — $ 215 $212 $ 64

2009 ...................................... 48 — 55 42 61

2008 ...................................... 25 — 26 3 48

Obsolescence allowance—spare parts—United:

2010 ...................................... $ 61 $ — $ 212 $212 $ 61

2009 ...................................... 48 — 55 42 61

2008 ...................................... 25 — 26 3 48

Obsolescence allowance—spare parts—Continental:

Oct. 1 to Dec. 31, 2010 (Successor Company) ..... $ 121 $ (121) $ 3 $— $ 3

Jan. 1 to Sep. 30, 2010 (Predecessor Company) .... 113 — 9 1 121

2009 (Predecessor Company) .................. 102 — 12 1 113

2008 (Predecessor Company) .................. 80 — 23 1 102

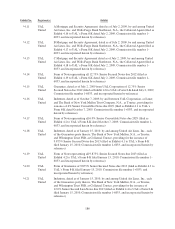

Valuation allowance for deferred tax assets—UAL:

2010 ...................................... $3,060 $1,487 $ 90 $466 $4,171

2009 ...................................... 2,886 — 190 16 3,060

2008 ...................................... 1,743 — 1,143 — 2,886

Valuation allowance for deferred tax assets—United:

2010 ...................................... $2,977 $ — $ 30 $383 $2,624

2009 ...................................... 2,812 — 182 17 2,977

2008 ...................................... 1,685 — 1,127 — 2,812

Valuation allowance for deferred tax assets—Continental:

Oct. 1 to Dec. 31, 2010 (Successor Company) ..... $ 362 $1,125 $ 2 $105 $1,384

Jan. 1 to Sep. 30, 2010 (Predecessor Company) .... 563 — — 201 362

2009 (Predecessor Company) .................. 788 — (225) — 563

2008 (Predecessor Company) .................. 192 — 596 — 788

(a) Deduction from reserve for purpose for which reserve was created.

183