United Airlines 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

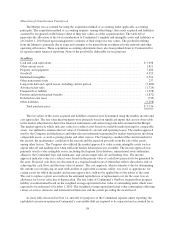

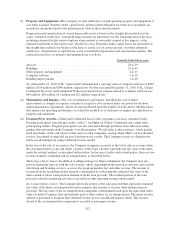

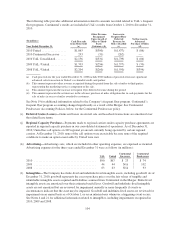

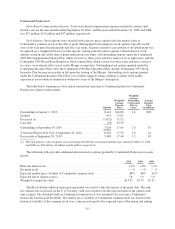

Property and Equipment—Property and equipment was recorded at cost and was depreciated to estimated

residual value over its estimated useful life using the straight-line method. Jet aircraft and rotable spare parts

were assumed to have residual values of 15% and 10%, respectively, of original cost; other categories of property

and equipment were assumed to have no residual value. The estimated useful lives of Continental property and

equipment were as follows:

Estimated Useful Life

Jet aircraft and simulators 25 to 30 years

Rotable spare parts

Average lease term or

useful life for related aircraft

Buildings and improvements 10 to 30 years

Vehicles and equipment 5 to 10 years

Computer software 3 to 5 years

Frequent Flyer Program Accounting—Continental accounted for mileage credits earned by flying on

Continental under an incremental cost model, rather than a deferred revenue model. For those frequent flyer

accounts that had sufficient mileage credits to claim the lowest level of free travel, Continental recorded a

liability for either the estimated incremental cost of providing travel awards that were expected to be redeemed

for travel on Continental or the contractual rate of expected redemption on alliance carriers. Incremental cost

included the cost of fuel, meals, insurance and miscellaneous supplies, less any fees charged to the passenger for

redeeming the rewards, but did not include any costs for aircraft ownership, maintenance, labor or overhead

allocation. The liability was adjusted periodically based on awards earned, awards redeemed, changes in the

incremental costs and changes in the frequent flyer program. Changes in the liability were recognized as

passenger revenue in the period of change. Continental recorded an adjustment of $27 million to increase

passenger revenue and reduce its frequent flyer liability during 2008 for the impact of redemption fees after

Continental increased such fees during 2008.

NOTE 3—RECENTLY ISSUED ACCOUNTING STANDARDS

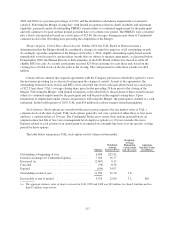

In October 2009, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

No. 2009-13, Multiple Deliverable Revenue Arrangements—A Consensus of the FASB Emerging Issues Task

Force. This guidance defines whether multiple deliverables exist, how the deliverables should be separated and

how the consideration should be allocated to one or more units of accounting. This guidance establishes a selling

price hierarchy for determining the selling price of a deliverable. The selling price used for each deliverable will

be based on vendor-specific objective evidence, if available, third-party evidence if vendor-specific objective

evidence is not available, or estimated selling price if neither vendor-specific or third-party evidence is available.

The Company is required to apply this guidance prospectively for revenue arrangements entered into or

materially modified after January 1, 2011.

The Company will prospectively apply this guidance to new sales of air transportation that include a

mileage credit component beginning in the first quarter of 2011. The adoption of this standard will decrease the

value of the mileage credit component that we record as deferred revenue and increase the passenger revenue we

record at the time air transportation is provided. This change will occur because of the different assumptions we

will use to determine the estimated selling price of the mileage credit component under the new standard. The

total impact of the new accounting standard may be material and will depend on many factors, including the

volume of air transportation sales with mileage credit components.

In addition, United and Continental both have significant contracts to sell mileage credits to their

co-branded credit card partners. These contracts may be modified in 2011 as a result of the Merger. A modified

contract would be subject to the new standard in the period the contract modification is executed. We may record

material adjustments to revenue in the period we modify the contract based on the provisions of the new

standard, which requires us to adjust our deferred revenue balance as if we had been applying the new standard

since the contract initiation. The amount of any modification impact cannot be readily determined until such

contract modifications are executed.

106