United Airlines 2010 Annual Report Download - page 107

Download and view the complete annual report

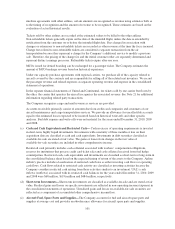

Please find page 107 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(m) Measurement of Impairments—The Company evaluates the carrying value of long-lived assets and

intangible assets subject to amortization whenever events or changes in circumstances indicate that an

impairment may exist. For purposes of this testing, the Company has generally identified the aircraft fleet

type as the lowest level of identifiable cash flows for purposes of testing aircraft for impairment. An

impairment charge is recognized when the asset’s carrying value exceeds its net undiscounted future cash

flows and its fair market value. The amount of the charge is the difference between the asset’s carrying

value and fair market value. See Note 21 for information related to asset impairments recognized in 2010,

2009 and 2008.

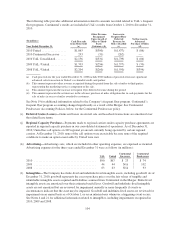

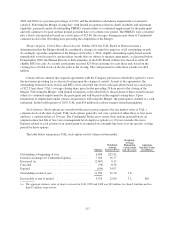

(n) Share-Based Compensation—The Company measures the cost of employee services received in exchange

for an award of equity instruments based on the grant-date fair value of the award. The resulting cost is

recognized over the period during which an employee is required to provide service in exchange for the

award, usually the vesting period. Obligations for certain cash-settled restricted stock units and profit-based

restricted stock units are remeasured throughout the requisite service period based on the market share price

as of the last day of the reporting period. A cumulative adjustment is recorded to adjust compensation

expense based on the current value of the awards. See Note 7 for additional information on the Company’s

share-based compensation plans.

(o) Ticket Taxes—Certain governmental taxes are imposed on the Company’s ticket sales through a fee

included in ticket prices. The Company collects these fees and remits them to the appropriate government

agency. These fees are recorded on a net basis (excluded from operating revenues).

(p) Early Retirement of Leased Aircraft—The Company accrues the present value of future minimum lease

payments, net of estimated sublease rentals (if any) in the period that aircraft are permanently removed from

service. When reasonably estimable and probable, the Company estimates maintenance lease return

condition obligations for items such as minimum aircraft and engine conditions specified in leases and

accrues these amounts over the lease term while the aircraft are operating, and any remaining unrecognized

estimated obligations are accrued in the period that an aircraft is removed from service.

(q) Uncertain Income Tax Positions—The Company has recorded reserves for income taxes and associated

interest that may become payable in future years. Although management believes that its positions taken on

income tax matters are reasonable, the Company nevertheless has established tax and interest reserves in

recognition that various taxing authorities may challenge certain of the positions taken by the Company,

potentially resulting in additional liabilities for taxes and interest. The Company’s uncertain tax position

reserves are reviewed periodically and are adjusted as events occur that affect its estimates, such as the

availability of new information, the lapsing of applicable statutes of limitation, the conclusion of tax audits,

the measurement of additional estimated liability, the identification of new tax matters, the release of

administrative tax guidance affecting its estimates of tax liabilities, or the rendering of relevant court

decisions. See Note 8 for further information related to uncertain income tax positions.

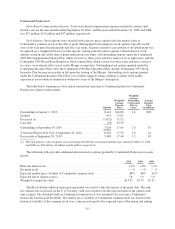

Continental Predecessor Accounting Policies

The following summarizes Continental Predecessor accounting policies that materially differ from the

Company’s accounting policies, described above.

Revenue Recognition—Continental Predecessor recognized passenger revenue for ticket breakage when

the ticket expired unused, rather than over the twelve months preceding expiration.

105