United Airlines 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Aircraft fuel has been the Company’s single largest operating expense for the last several years. In addition,

aircraft fuel is a globally traded commodity with significant price volatility. Aircraft fuel prices fluctuate based

on market expectations of supply and demand, among other factors. Increases in fuel prices may adversely

impact the Company’s financial performance, operating cash flows and financial position as greater amounts of

cash may be required to obtain aircraft fuel for operations. To protect against increases in the prices of aircraft

fuel, the Company routinely hedges a portion of its future fuel requirements, provided the hedges are expected to

be cost effective. The Company uses fixed price swaps, purchased call options, collars or other commonly used

financial hedge instruments based on fuel or closely related commodities, such as heating and crude oils. The

Company strives to maintain fuel hedging levels and exposure generally consistent with industry standards, so

that the Company’s fuel cost is not disproportionate to the fuel costs of its major competitors. The Company does

not enter into derivative instruments for non-risk management purposes.

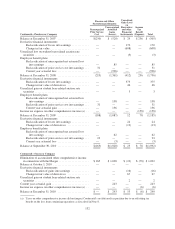

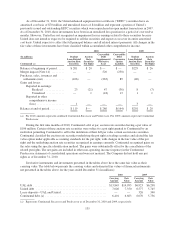

Prior to April 1, 2010, United’s instruments classified as economic hedges were not designated as cash flow

or fair value hedges under accounting principles related to hedge accounting. All changes in the fair value of

economic hedges were recorded in income, with the offset to either current assets or liabilities in each reporting

period. Economic fuel hedge gains and losses were classified as part of aircraft fuel expense, and fuel hedge

gains and losses from instruments that are not deemed economic hedges were classified as part of nonoperating

income/expense.

Effective April 1, 2010, United designated substantially all of its outstanding fuel derivative contracts as

cash flow hedges under applicable accounting standards. In addition, substantially all new fuel derivative

contracts entered into subsequent to April 1, 2010 by United were designated as cash flow hedges. Continental

applied cash flow hedge accounting for all periods presented in these financial statements.

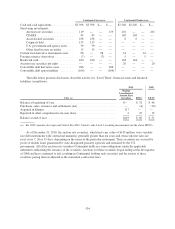

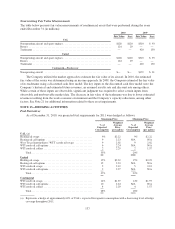

Accounting pronouncements pertaining to derivative instruments and hedging are complex with stringent

requirements, including documentation of hedging strategy, statistical analysis to qualify a commodity for hedge

accounting both on a historical and a prospective basis, and strict contemporaneous documentation that is

required at the time each hedge is designated as a cash flow hedge. As required, the Company assesses the

effectiveness of each of its individual hedges on a quarterly basis. The Company also examines the effectiveness

of its entire hedging program on a quarterly basis utilizing statistical analysis. This analysis involves utilizing

regression and other statistical analyses that compare changes in the price of aircraft fuel to changes in the prices

of the commodities used for hedging purposes.

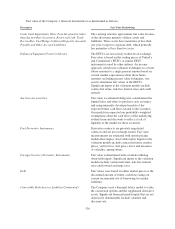

Upon proper qualification, the Company accounts for its fuel derivative instruments as cash flow

hedges. All derivatives designated as hedges that meet certain requirements are granted special hedge accounting

treatment. Generally, utilizing the special hedge accounting, all periodic changes in fair value of the derivatives

designated as hedges that are considered to be effective are recorded in accumulated other comprehensive

income (loss) (“AOCI”) until the underlying fuel is consumed and recorded in fuel expense. The Company is

exposed to the risk that its hedges may not be effective in offsetting changes in the cost of fuel and that its hedges

may not continue to qualify for special hedge accounting. Hedge ineffectiveness results when the change in the

fair value of the derivative instrument exceeds the change in the value of the Company’s expected future cash

outlay to purchase and consume fuel. To the extent that the periodic changes in the fair value of the derivatives

are not effective, that ineffectiveness is classified as other nonoperating income (expense).

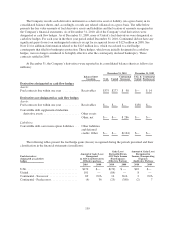

If the Company terminates a derivative prior to its contractual settlement date, then the cumulative gain or

loss recognized in AOCI at the termination date remains in AOCI until the forecasted transaction occurs. In a

situation where it becomes probable that a hedged forecasted transaction will not occur, any gains and/or losses

that have been recorded to AOCI would be required to be immediately reclassified into earnings. All cash flows

associated with purchasing and settling derivatives are classified as operating cash flows in the statements of cash

flow.

138