United Airlines 2010 Annual Report Download - page 57

Download and view the complete annual report

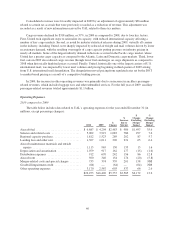

Please find page 57 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Distribution expenses increased 17% in the combined 2010 period as compared to 2009, which was

primarily due to increases in ticket volumes and prices, as some distribution expenses are price-based and some

are volume-based.

Aircraft rent decreased 8% in the combined 2010 period as compared to 2009 primarily due to the

amortization of a lease fair value adjustment which was recorded as part of acquisition accounting.

During the fourth quarter of 2010, Continental recorded $65 million to other operating expense due to the

revenue sharing obligations related to the trans-Atlantic joint venture with Lufthansa and Air Canada for the first

three quarters of 2010.

Merger-related costs and special charges in the combined 2010 period included $230 million of merger-

related expenses due to costs associated with the Merger and integration of United and Continental, as discussed

above. Aircraft-related charges of $89 million in 2009 included $31 million of non-cash impairments on Boeing

737-300 and 737-500 aircraft and related assets, $39 million of other aircraft-related charges and $19 million of

losses related to subleasing regional jets. See Note 21 to the financial statements in Item 8 for additional

discussion of merger-related costs and special charges.

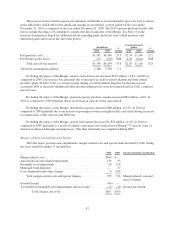

Liquidity and Capital Resources.

As of December 31, 2010, UAL had $8.7 billion in unrestricted cash, cash equivalents and short-term

investments, which is $5.6 billion higher than at December 31, 2009 primarily due to the Merger impact. At

December 31, 2010, UAL also had $388 million of restricted cash, cash equivalents and short-term investments,

which is primarily collateral for estimated future workers’ compensation claims, credit card processing contracts,

letters of credit and performance bonds. We may be required to post significant additional cash collateral to meet

such obligations in the future. Restricted cash and cash equivalents at December 31, 2009 totaled $341 million.

United has a $255 million revolving commitment under its Amended Credit Facility, maturing in February 2012,

of which $253 million and $254 million had been used for letters of credit as of December 31, 2010 and 2009,

respectively. Unless this facility is renewed or replaced, these letters of credit will likely be replaced with cash

collateral. In addition, under a separate agreement, United had a $150 million unused line of credit as of

December 31, 2010.

As is the case with many of our principal competitors, we have a high proportion of debt compared to our

capital. We have a significant amount of fixed obligations, including debt, aircraft leases and financings, leases

of airport property and other facilities and postretirement medical and pension obligations. At December 31,

2010, UAL had approximately $15.4 billion of debt and capital lease obligations. In addition, we have substantial

non-cancelable commitments for capital expenditures, including the acquisition of new aircraft and related spare

engines.

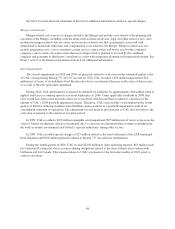

As of December 31, 2010 a substantial portion of the Company’s assets, principally aircraft, spare engines,

aircraft spare parts, route authorities and certain other intangible assets were pledged under various loan and

other agreements. See Note 14 to the financial statements in Item 8 for additional information on assets provided

as collateral by the Company. The Company has limited undrawn lines of credit and most of our otherwise

readily financeable assets are encumbered. The global economic recession severely disrupted the global capital

markets, resulting in a diminished availability of financing and a higher cost for financing that was

obtainable. Although access to the capital markets has improved, as evidenced by our recent financing

transactions, we cannot give any assurances that we will be able to obtain additional financing or otherwise

access the capital markets in the future on acceptable terms (or at all). We must sustain our profitability and/or

access the capital markets to meet our significant long-term debt and capital lease obligations and future

commitments for capital expenditures, including the acquisition of aircraft and related spare engines.

The following is a discussion of UAL’s sources and uses of cash from 2008 to 2010. As UAL applied the

acquisition method of accounting to the Merger, UAL’s cash activities discussed below include Continental

activities only after October 1, 2010.

55