United Airlines 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(f) Property and Equipment—The Company records additions to owned operating property and equipment at

cost when acquired. Property under capital leases and the related obligation for future lease payments are

recorded at an amount equal to the initial present value of those lease payments.

Depreciation and amortization of owned depreciable assets is based on the straight-line method over the

assets’ estimated useful lives. Leasehold improvements are amortized over the remaining term of the lease,

including estimated facility renewal options when renewal is reasonably assured at key airports, or the

estimated useful life of the related asset, whichever is less. Properties under capital leases are amortized on

the straight-line method over the life of the lease or, in the case of certain aircraft, over their estimated

useful lives. Amortization of capital lease assets is included in depreciation and amortization expense. The

estimated useful lives of property and equipment are as follows:

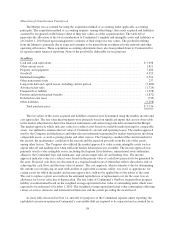

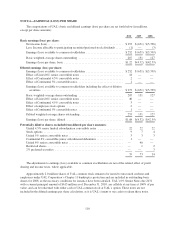

Estimated Useful Life (in years)

Aircraft .................................................... 28to30

Buildings .................................................. 25to45

Other property and equipment .................................. 4to15

Computer software ........................................... 5to10

Building improvements ....................................... 1to40

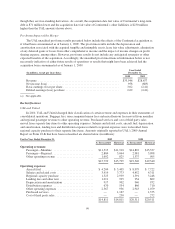

As of December 31, 2010, UAL, United and Continental had a carrying value of computer software of $454

million, $114 million and $340 million, respectively. For the year ended December 31, 2010, UAL, United,

Continental Successor and Continental Predecessor depreciation expense related to computer software was

$69 million, $58 million, $11 million and $22 million, respectively.

(g) Maintenance and Repairs—The cost of maintenance and repairs, including the cost of minor

replacements, is charged to expense as incurred, except for costs incurred under our power-by-the-hour

engine maintenance agreements, which are expensed based upon the number of hours flown. Modifications

that enhance the operating performance or extend the useful lives of airframes or engines are capitalized as

property and equipment.

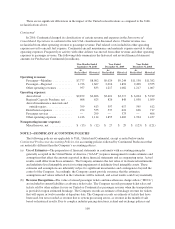

(h) Frequent Flyer Awards—United and Continental have loyalty programs to increase customer loyalty.

Program participants earn mileage credits (“miles”) for flights on United, Continental and certain other

participating airlines. Program participants can also earn miles through purchases from other non-airline

partners that participate in the Company’s loyalty programs. We sell miles to these partners, which include

retail merchants, credit card issuers, hotels and car rental companies, among others. Miles can be redeemed

for free, discounted or upgraded air travel and non-travel awards. The Company records its obligation for

future award redemptions using a deferred revenue model.

In the case of the sale of air services, the Company recognizes a portion of the ticket sales as revenue when

the air transportation occurs and defers a portion of the ticket sale that represents the fair value of the miles

under the residual method, as described further below. In the case of miles sold to third parties, there are two

revenue elements: marketing and air transportation, as described below.

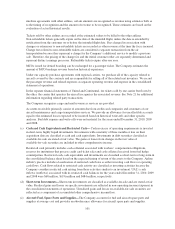

Marketing-related element. In addition to selling mileage for future redemption, the Company may also

provide marketing services with the sale of miles, which, depending on the particular customer, may include

advertising and branding services, access to the program member list, and other services. The amount of

revenue from the marketing-related element is determined by subtracting the estimated fair value of the

miles earned or future transportation element from the total proceeds. The residual portion of the sales

proceeds related to marketing activities is recorded as other operating revenue when earned.

Air transportation element. The Company defers the portion of the sales proceeds that represents estimated

fair value of the future air transportation and recognizes that amount as revenue when transportation is

provided. The fair value of the air transportation component is determined based upon the equivalent ticket

value of similar Company fares and amounts paid to other airlines for air transportation. The initial revenue

deferral is presented as frequent flyer deferred revenue in our consolidated balance sheets. The revenue

related to the air transportation component is recorded as passenger revenue.

102