United Airlines 2010 Annual Report Download - page 52

Download and view the complete annual report

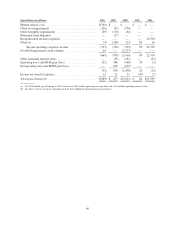

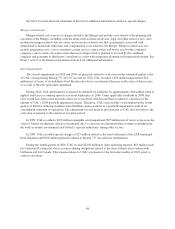

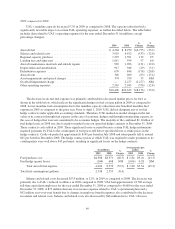

Please find page 52 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sharing Program. UAL did not record any expense for this plan in 2009. Partially offsetting these benefits were

the impacts of average wage and benefit cost increases and a $38 million increase related to on-time performance

bonuses paid to operations employee groups during 2009, which were not paid in 2008.

The increase in regional capacity purchase expense of 10% in 2009 as compared to 2008 is consistent with

the 11% increase in regional capacity during the same period.

Landing fees and other rent increased $57 million, or 6%, in 2009 as compared to 2008 primarily due to

higher rates.

During 2009, aircraft maintenance materials and outside repairs decreased by $131 million, or 12%, as

compared to the prior year primarily due to a lower volume of engine and airframe maintenance repairs as a

result of United’s early retirement of 100 aircraft from its operating fleet and the timing of maintenance on other

fleet types.

Distribution expenses decreased $176 million, or 21%, in 2009 as compared to 2008 primarily due to lower

passenger revenues on lower traffic and yields driving reductions in commissions, credit card fees and GDS fees.

UAL also implemented several operating cost savings programs for both commissions and GDS fees which

produced realized savings in 2009.

Aircraft rent expense decreased by $63 million, or 15%, in 2009 as compared to 2008 primarily as a result

of UAL’s retirement of its entire fleet of Boeing 737 aircraft, some of which were financed through operating

leases.

UAL’s other operating expenses decreased $376 million, or 13%, in 2009 as compared to 2008. This

decrease was primarily due to cost savings initiatives and lower variable costs associated with a 9.7% decrease in

mainline capacity. In addition, other operating expenses decreased due to a reduction in maintenance cost of

sales, which was due to lower sales of engine maintenance services.

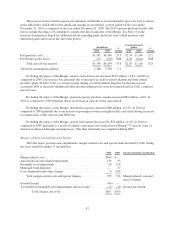

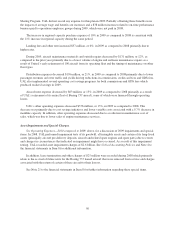

Asset Impairments and Special Charges.

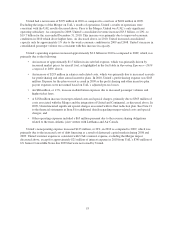

See Operating Expenses—2010 compared to 2009, above, for a discussion of 2009 impairments and special

items. In 2008, UAL performed impairment tests of its goodwill, all intangible assets and certain of its long-lived

assets (principally aircraft pre-delivery deposits, aircraft and related spare engines and spare parts) due to events

and changes in circumstances that indicated an impairment might have occurred. As a result of this impairment

testing, UAL recorded asset impairment charges of $2.6 billion. See Critical Accounting Policies and Note 4 to

the financial statements in Item 8 for additional information.

In addition, lease termination and other charges of $25 million were recorded during 2008 which primarily

relate to the accrual of future rents for the Boeing 737 leased aircraft that were removed from service and charges

associated with the return of certain of these aircraft to their lessors.

See Note 21 to the financial statements in Item 8 for further information regarding these special items.

50