United Airlines 2010 Annual Report Download - page 121

Download and view the complete annual report

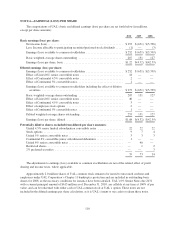

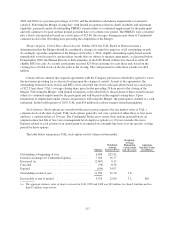

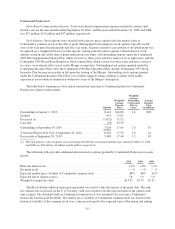

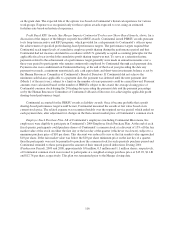

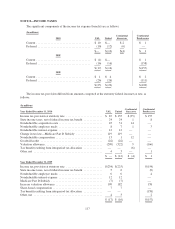

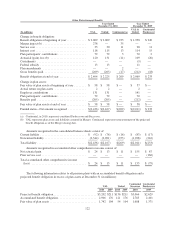

Please find page 121 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition to the deferred tax assets listed in the table above, UAL has an $871 million unrecorded tax

benefit at December 31, 2010, primarily attributable to the difference between the amount of the financial

statement expense and the allowable tax deduction for UAL common stock issued to certain unsecured creditors

and employees pursuant to UAL Corporation’s Chapter 11 bankruptcy protection. This unrecorded tax benefit is

accounted for by analogy to Accounting Standards Codification Topic 718 which requires recognition of the tax

benefit to be deferred until it is realized as a reduction of taxes payable. Although not recognized for financial

reporting purposes, this unrecognized tax benefit is available to reduce future income and is incorporated into our

federal and state NOL carry forwards, which are discussed below.

The federal and state net operating loss (“NOL”) carry forwards relate to prior years’ NOLs, which may be

used to reduce tax liabilities in future years. These tax benefits are mostly attributable to federal pre-tax NOL

carry forwards of $11.6 billion for UAL (including the NOLs discussed in the preceding paragraph). If not

utilized these federal pre-tax NOLs will expire as follows (in billions): $2.4 in 2022, $1.6 in 2023, $2.4 in 2024,

$2.0 in 2025 and $3.2 after 2025. In addition, the majority of state tax benefits of the net operating losses of $187

million for UAL expires over a five to 20 year period.

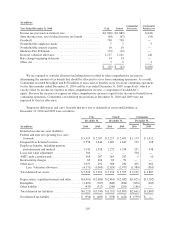

Both UAL Corporation and Continental experienced an “ownership change” as defined under Section 382 of

the Internal Revenue Code of 1986, as amended, as a result of the Merger. However, the Company currently

expects that these ownership changes will not significantly limit its ability to use its NOL and AMT credit

carryforwards in the carryforward period because the size of the limitation exceeds our NOL and AMT credit

carryforwards.

The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income

(including the reversals of deferred tax liabilities) during the periods in which those deferred tax assets will

become deductible. The Company’s management assesses the realizability of its deferred tax assets, and records

a valuation allowance when it is more likely than not that a portion, or all, of the deferred tax assets will not be

realized. As a result, the Company has a valuation allowance against its deferred tax assets as of December 31,

2010 and 2009 to reflect management’s assessment regarding the realizability of those assets. The Company will

maintain a valuation allowance on deferred tax assets until there is sufficient positive evidence of future

realization. The current valuation allowances of $4.2 billion, $2.6 billion and $1.4 billion for UAL, United and

Continental, respectively, if reversed in future years (as a result of change in future judgment) will reduce income

tax expense. The current valuation allowance reflects increases from December 31, 2009 of $1.1 billion and $821

million for UAL and Continental, respectively, and a decrease from December 31, 2009 of $353 million for

United.

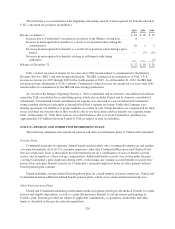

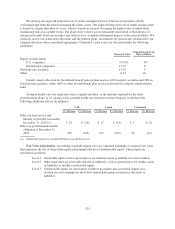

UAL’s unrecognized tax benefits related to uncertain tax positions were $32 million, $16 million and $20

million at December 31, 2010, 2009 and 2008, respectively. Included in the ending balance at 2010 is $6 million

that would affect UAL’s effective tax rate if recognized. The Company does not expect significant increases or

decreases in its unrecognized tax benefits within the next twelve months.

There are no significant amounts included in the balance at December 31, 2010 for tax positions for which

the ultimate deductibility is highly certain but for which there is uncertainty about the timing of such

deductibility.

The Company records penalties and interest relating to uncertain tax positions in other operating expenses

and interest expense, respectively, in its consolidated statements of operations. The Company has not recorded

any significant expense or liabilities related to interest or penalties in its consolidated financial statements.

119