United Airlines 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224

|

|

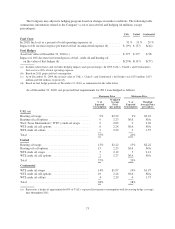

The Company may adjust its hedging program based on changes in market conditions. The following table

summarizes information related to the Company’s cost of aircraft fuel and hedging (in millions, except

percentages):

UAL United Continental

Fuel Costs

In 2010, fuel cost as a percent of total operating expenses (a) ................... 31% 31% 29%

Impact of $1 increase in price per barrel of fuel on annual fuel expense (b) ........ $ (99) $ (57) $(42)

Fuel Hedges

Asset fair value at December 31, 2010 (c) .................................. $375 $277 $98

Impact of 10% decrease in forward prices of fuel, crude oil and heating oil

on the value of fuel hedges (d) ......................................... $(274) $(197) $(77)

(a) Includes related taxes and excludes hedging impacts and special charges. In 2009, UAL’s, United’s and Continental’s

fuel cost was 26% of total operating expense.

(b) Based on 2011 projected fuel consumption.

(c) As of December 31, 2009, the net fair value of UAL’s, United’s and Continental’s fuel hedges was $133 million, $133

million and $14 million, respectively.

(d) Based on fuel hedge positions at December 31, 2010, as summarized in the table below.

As of December 31, 2010, our projected fuel requirements for 2011 were hedged as follows:

Maximum Price Minimum Price

%of

Expected

Consumption

Weighted

Average

Price

(per gallon)

%of

Expected

Consumption

Weighted

Average Price

(per gallon)

UAL (a)

Heating oil swaps ................................ 9% $2.22 9% $2.22

Heating oil call options ............................ 9 2.23 N/A N/A

West Texas Intermediate (“WTI”) crude oil swaps ...... 9 2.02 9 2.02

WTI crude oil call options ......................... 6 2.24 N/A N/A

WTI crude oil collars ............................. 2 2.29 2 1.57

Total .......................................... 35% 20%

United

Heating oil swaps ................................ 15% $2.22 15% $2.22

Heating oil call options ............................ 15 2.23 N/A N/A

WTI crude oil swaps .............................. 5 2.12 5 2.12

WTI crude oil call options ......................... 2 2.27 N/A N/A

Total .......................................... 37% 20%

Continental

WTI crude oil swaps .............................. 14% $1.97 14% $1.97

WTI crude oil call options ......................... 10 2.24 N/A N/A

WTI crude oil collars ............................. 4 2.29 4 1.57

Total .......................................... 28% 18%

(a) Represents a hedge of approximately 60% of UAL’s expected first quarter consumption with decreasing hedge coverage

later throughout 2011.

73