United Airlines 2010 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

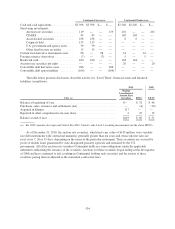

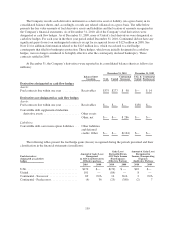

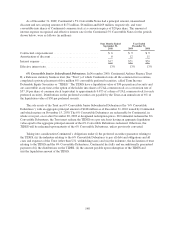

The following table provides additional information about the UAL 4.5% Notes and UAL 5% Notes, which

are convertible into UAL common stock at the noteholder’s option. UAL may elect to settle a conversion of the

UAL 4.5% Notes or UAL 5% Notes with cash or shares of UAL common stock:

As of December 31, 2010 As of December 31, 2009

($ and shares in millions, except conversion prices) 4.5% Notes 5% Notes 4.5% Notes 5% Notes

Initial value of the equity component ..................... $ 216 $ 38 $216 $ 38

Principal amount of the liability component ................ 726 150 726 150

Unamortized discount of liability component ............... 29 1 80 11

Net carrying amount of liability component ................ 697 149 646 139

Remaining amortization period of discount ................. 6months 1 month

Conversion price ..................................... $32.64 $43.90

Number of shares to be issued upon conversion ............. 22.2 3.4

For the Year Ended December 31,

2010 2009 2008

4.5% Notes 5% Notes 4.5% Notes 5% Notes 4.5% Notes 5% Notes

Contractual coupon interest ............. $ 33 $ 7 $ 33 $ 7 $ 33 $ 7

Amortization of discount ............... 53 10 46 9 40 8

Effective interest rate .................. 12.8% 12.1% 12.8% 12.1% 12.8% 12.1%

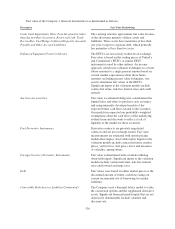

4.5% Notes. The UAL 4.5% Notes due 2021 are unsecured and may be converted by holders into shares of

UAL’s common stock at an initial conversion price of approximately $32.64 per share of UAL common stock.

On each of June 30, 2011 and June 30, 2016, the noteholders have the option to require UAL to repurchase the

notes. UAL may elect to pay the repurchase price in cash, shares of UAL common stock or a combination

thereof. Noteholders may also require UAL to repurchase all or a portion of the notes for cash, common stock or

a combination thereof, at its option, at par plus any accrued and unpaid interest if certain changes in control of

UAL occur. The UAL 4.5% Notes are junior, in right of payment upon liquidation, to UAL’s obligations under

the UAL 5% Notes and UAL 6% Senior Notes discussed below. The UAL 4.5% Notes are callable, at UAL’s

option, at any time at par, plus accrued and unpaid interest, and can be redeemed with cash, shares of UAL

common stock or a combination thereof, beginning in July 2011, except that UAL may elect to pay the

redemption price in shares of UAL common stock only if the closing price of UAL common stock has not been

less than 125% of the conversion price for the 60 consecutive trading days immediately prior to the redemption

date.

5% Notes. The UAL 5% Notes due 2021 are unsecured and may be converted by holders into shares of

UAL’s common stock at an initial conversion price of approximately $43.90 per share of UAL common stock.

The noteholders of the UAL 5% Notes, which had a principal amount of $150 million, had the option to require

UAL to repurchase the notes in February 2011. The noteholders surrendered $148 million of notes on the

repurchase date and UAL settled the obligation in cash. Noteholders may also require UAL to repurchase all or a

portion of the notes for cash, common stock or a combination thereof, at its option, at par plus any accrued and

unpaid interest if certain changes in control of UAL occur. The UAL 5% Notes are callable, at UAL’s option, at

any time at par, plus accrued and unpaid interest, and can be redeemed with cash, shares of UAL common stock

or a combination thereof, beginning in February 2011. In the case of any such redemption, UAL may redeem

these notes with shares of UAL common stock only if the closing price of UAL common stock has traded at no

less than 125% of the conversion price for the 60 consecutive trading days immediately prior to the redemption

date.

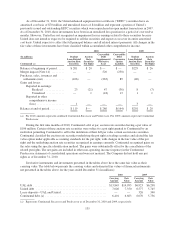

6% Senior Notes. The UAL 6% Senior Notes due 2031 are unsecured. UAL may pay interest in cash, or, on

or prior to December 31, 2011, UAL may pay interest by issuing UAL common stock with a market value as of

the close of business immediately preceding the relevant interest payment date equal to the amount of interest

due or by issuing additional UAL 6% Senior Notes. UAL issued approximately $35 million of UAL 6% Senior

Notes during the year ended December 31, 2010 to pay interest in-kind. Noteholders may also require UAL to

143