United Airlines 2010 Annual Report Download - page 155

Download and view the complete annual report

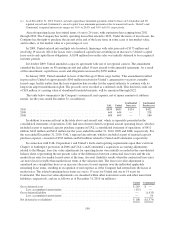

Please find page 155 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.more senior debt classes. These credit enhancements lower the Company’s total borrowing cost. The other

purpose of the pass-through trusts is to receive principal and interest payments on the equipment notes purchased

by the pass-through trusts from the Company and remit these proceeds to the pass-through trusts’ certificate

holders.

The Company does not invest in or obtain a financial interest in the pass-through trusts. Rather, the

Company has an obligation to make its interest and principal payments on their equipment notes held by the

pass-through trusts. The Company was not intended to have any voting or non-voting equity interest in the pass-

through trusts or to absorb variability from the pass-through trusts. Based on this analysis, the Company

determined that it is not required to consolidate the pass-through trusts.

See Note 17 for a discussion of the Company’s fuel consortia guarantees and United’s municipal bond

guarantees.

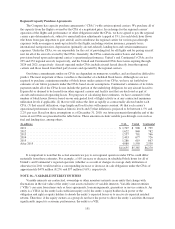

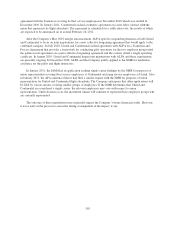

NOTE 17—COMMITMENTS AND CONTINGENCIES

General Guarantees and Indemnifications. In the normal course of business, the Company enters into

numerous real estate leasing and aircraft financing arrangements that have various guarantees included in the

contracts. These guarantees are primarily in the form of indemnities under which the Company typically

indemnifies the lessors and any tax/financing parties against tort liabilities that arise out of the use, occupancy,

operation or maintenance of the leased premises or financed aircraft. Currently, the Company believes that any

future payments required under these guarantees or indemnities would be immaterial, as most tort liabilities and

related indemnities are covered by insurance (subject to deductibles). Additionally, certain leased premises such

as fueling stations or storage facilities include indemnities of such parties for any environmental liability that

may arise out of or relate to the use of the leased premises.

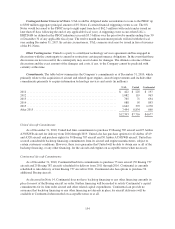

Legal and Environmental Contingencies. The Company has certain contingencies resulting from litigation

and claims incident to the ordinary course of business. Management believes, after considering a number of

factors, including (but not limited to) the information currently available, the views of legal counsel, the nature of

contingencies to which the Company is subject and prior experience, that the ultimate disposition of these

contingencies will not materially affect the Company’s consolidated financial position or results of operations.

The Company records liabilities for legal and environmental claims when a loss is probable and reasonably

estimable. These amounts are recorded based on the Company’s assessments of the likelihood of their eventual

disposition. The amounts of these liabilities could increase or decrease in the near term, based on revisions to

estimates relating to the various claims.

The Company believes that it will have no financial exposure for claims arising out of the events of

September 11, 2001 in light of the provisions of the Air Transportation Safety and System Stabilization Act of

2001, the resolution of the majority of the wrongful death and personal injury cases by settlement and the

withdrawal of all related proofs of claim from UAL Corporation’s Chapter 11 bankruptcy protection, and the

limitation of claimants’ recoveries to insurance proceeds.

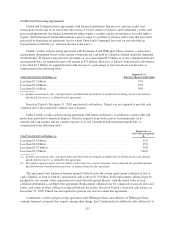

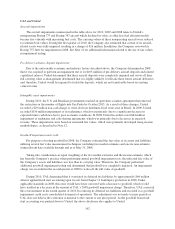

Trans-Atlantic Joint Venture. In December 2010, pursuant to antitrust immunity approval granted by the

DOT, United, Continental, Air Canada and Lufthansa executed a revenue-sharing joint venture agreement

covering transatlantic routes. The joint venture is expected to deliver highly competitive flight schedules, fares

and service. The European Commission, which has been conducting a parallel review of the competitive effects

of the joint venture, similar to the DOT’s review, has not yet completed its review. The joint venture has a

revenue sharing structure that results in payments among participants based on a formula that compares current

period unit revenue performance on trans-Atlantic routes to a historic period or “baseline,” which is reset

annually. The payments are calculated on a quarterly basis and subject to a cap. In the fourth quarter of 2010,

upon executing the joint venture agreement, United and Continental recorded charges to other operating expense

of $65 million each related to their revenue sharing obligations for the first three quarters of 2010.

153