United Airlines 2010 Annual Report Download - page 148

Download and view the complete annual report

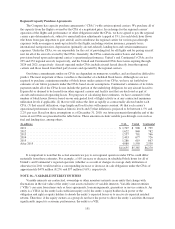

Please find page 148 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The indenture for the Continental Senior Secured Notes includes covenants that, among other things, restrict

Continental’s ability to sell assets, incur additional indebtedness, issue preferred stock, make investments or pay

dividends. In addition, if Continental fails to maintain a collateral coverage ratio of 1.5 to 1.0, Continental must

pay additional interest on notes at the rate of 2% per annum until the collateral coverage ratio equals at least 1.5

to 1.0. The indenture for the Continental Senior Secured Notes also includes events of default customary for

similar financings. In conjunction with the issuance of the notes, Continental repaid a $350 million senior

secured term loan credit facility that was due in June 2011.

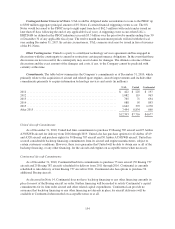

Continental EETCs. Continental has several EETC financings outstanding, which are similar in structure to

the United EETCs described above. In December 2010, Continental created two pass-through trusts, one of

which issued approximately $363 million aggregate principal amount Class A pass-through certificates with a

stated interest rate of 4.75% and one which issued approximately $64 million aggregate principal amount of

Class B pass-through certificates with a stated interest rate of 6.0%. The proceeds of the issuance of the Class A

and Class B pass-through trusts, which amounted to approximately $427 million, have been and will be used to

purchase equipment notes issued by Continental. Of the $427 million in proceeds, $188 million was received in

2010 and the remaining amount is expected to be received in 2011. The proceeds have been and are expected to

be used to fund the acquisition of new aircraft and in the case of currently owned aircraft, for general corporate

purposes. In 2009, through two transactions Continental created three pass through trusts to issue a total of

approximately $1.0 billion of certificates. In connection with these transactions, Continental issued $390 million

of equipment notes in 2009 and $644 million of equipment notes in 2010. The proceeds from the issuances were

used to finance the acquisition of new aircraft and in the case of currently owned aircraft, for general corporate

purposes. Consistent with the United EETC structure described above, Continental records the debt obligation

upon issuance of the equipment notes rather than upon the initial issuance of EETCs. See Note 16 for additional

information related to the Continental EETCs.

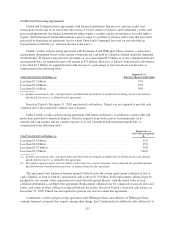

Notes Secured by Spare Parts Inventory. Continental has two series of notes totaling $304 million, which

bear interest at LIBOR plus a margin that are secured by the majority of its spare parts inventory. In connection

with these equipment notes, Continental entered into a collateral maintenance agreement requiring it, among

other things, to maintain a loan-to-collateral value ratio of not greater than 45% with respect to the senior series

of equipment notes and a loan-to-collateral value ratio of not greater than 75% with respect to both series of

notes combined. Continental must also maintain a certain level of rotable components within the spare parts

collateral pool. These ratios are calculated semi-annually based on an independent appraisal of the spare parts

collateral pool. If any of the collateral ratio requirements are not met, Continental must take action to meet all

ratio requirements by adding additional eligible spare parts to the collateral pool, redeeming a portion of the

outstanding notes, providing other collateral acceptable to the bond insurance policy provider for the senior series

of equipment notes or any combination of the above actions.

Advance Purchases of Mileage Credits. In December 2009, Continental entered into an amendment of its

Debit Card Marketing Agreement with JPMorgan Chase Bank, N.A. (“JPMorgan Chase”) under which

JPMorgan Chase purchases frequent flyer mileage credits to be earned by One Pass members for making

purchases using a Continental branded debit card issued by JPMorgan Chase. JPMorgan Chase paid Continental

$40 million in early 2010 for the advance purchase of frequent flyer mileage credits beginning January 1, 2016,

or earlier in certain circumstances. The purchase of mileage credits has been treated as a loan from JPMorgan

Chase and is reported as long-term debt in the consolidated balance sheet.

In June 2008, Continental entered into an amendment and restatement of its Bankcard Joint Marketing

Agreement (the “Bankcard Agreement”) with Chase Bank USA, N.A. (“Chase”), under which Chase purchases

frequent flyer mileage credits to be earned by OnePass members for making purchases using a Continental

branded credit card issued by Chase. The Bankcard Agreement provided for a payment to Continental of $413

million, of which $235 million is related to the advance purchase of frequent flyer mileage credits for the year

2016. The assets that secure the Continental Senior Secured Notes also secure, on a junior lien basis,

Continental’s obligations to JPMorgan Chase and Chase with respect to the frequent flyer mileage credits. The

146