United Airlines 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

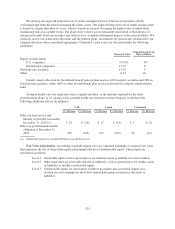

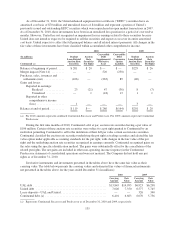

As of December 31, 2010, the United enhanced equipment trust certificate (“EETC”) securities have an

amortized cost basis of $70 million and unrealized losses of $4 million and represent a portion of United’s

previously issued and outstanding EETC securities which were repurchased in open market transactions in 2007.

As of December 31, 2010, these investments have been in an unrealized loss position for a period of over twelve

months. However, United has not recognized an impairment loss in earnings related to these securities because

United does not intend or expect to be required to sell the securities and expects to recover its entire amortized

cost basis. United expects to collect the full principal balance and all related interest payments. All changes in the

fair value of these investments have been classified within accumulated other comprehensive income.

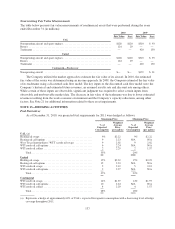

2010 2009

(In millions)

Continental (a)

Student

Loan-Related

Auction Rate

Securities

Auction

Rate

Securities

Put Right

Convertible

Debt

Supplemental

Derivative

Asset

Convertible

Debt

Conversion

Option

Liability

Student

Loan-Related

Auction Rate

Securities

Auction

Rate

Securities

Put Right

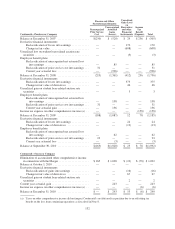

Balance at beginning of period ..... $201 $ 20 $— $— $229 $ 26

Merger impact (Note 14) ......... — — 520 (230) — —

Purchases, sales, issuances and

settlements (net) .............. (106) — (263) 89 (40) —

Gains and losses:

Reported in earnings:

Realized .............. 23 (21) 47 (36) 8 (7)

Unrealized ............ — 1 (18) 13 1 1

Reported in other

comprehensive income

(loss) ................... 1 — — — 3 —

Balance at end of period .......... $119 $— $286 $(164) $201 $ 20

(a) For 2010, amounts represent combined Continental Successor and Predecessor. For 2009, amounts represent Continental

Predecessor.

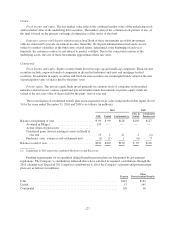

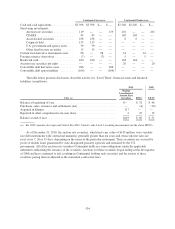

During the first nine months of 2010, Continental sold, at par, auction rate securities having a par value of

$106 million. Certain of these auction rate securities were subject to a put right granted to Continental by an

institution permitting Continental to sell to the institution at their full par value certain auction rate securities.

Continental classified the auction rate securities underlying the put right as trading securities and elected the fair

value option under applicable accounting standards for the put right, with changes in the fair value of the put

right and the underlying auction rate securities recognized in earnings currently. Continental recognized gains on

the sales using the specific identification method. The gains were substantially offset by the cancellation of the

related put rights. The net gains are included in other non-operating income (expense) in the Continental

Predecessor statement of consolidated operations and were not material. The Company did not hold any put

rights as of December 31, 2010.

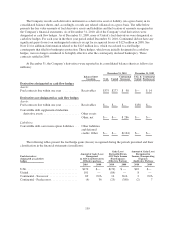

Derivative instruments and investments presented in the tables above have the same fair value as their

carrying value. The table below presents the carrying values and estimated fair values of financial instruments

not presented in the tables above for the years ended December 31 (in millions):

2010 2009

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

UAL debt .................................................. $13,845 $14,995 $6,923 $6,298

United debt ................................................ 7,026 7,350 6,577 5,745

Lease deposits—UAL and United ............................... — — 326 340

Continental debt (a) .......................................... 6,401 6,663 6,070 5,756

(a) Represents Continental Successor and Predecessor as of December 31, 2010 and 2009, respectively.

135