United Airlines 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

There are no significant differences in the impact of the United reclassifications as compared to the UAL

reclassifications above.

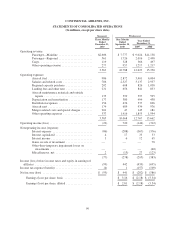

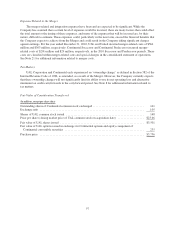

Continental

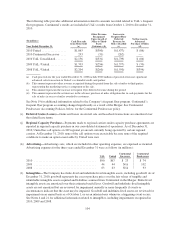

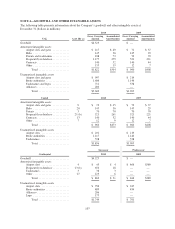

In 2010, Continental changed its classification of certain revenue and expenses in the Statements of

Consolidated Operations to conform to the new UAL classification discussed above. Charter revenue was

reclassified from other operating revenue to passenger revenue. Fuel related costs included in other operating

expense moved to aircraft fuel expense. Continental aircraft maintenance and materials expense moved to other

operating expenses. Frequent flyer activity with other airlines was moved from other revenue and other operating

expenses to passenger revenue. The following table summarizes the historical and revised financial statement

amounts for Predecessor Continental (in millions).

Nine Months Ended

September 30, 2010

Year Ended

December 31, 2009

Year Ended

December 31, 2008

As

Reclassified Historical

As

Reclassified Historical

As

Reclassified Historical

Operating revenues:

Passenger—Mainline ............. $7,777 $8,002 $9,024 $9,244 $11,138 $11,382

Passenger—Regional ............. 1,726 1,667 2,016 1,894 2,498 2,355

Other operating revenues .......... 957 833 1,217 1,082 1,217 1,007

Operating expenses:

Aircraft fuel .................... $2,872 $2,806 $3,401 $3,317 $ 6,004 $ 5,919

Regional Capacity Purchase, net .... 608 625 826 848 1,038 1,059

Aircraft maintenance materials and

outside repairs ................. 399 413 597 617 595 612

Distribution expenses ............. 474 555 537 624 626 717

Passenger services ............... — 299 — 373 — 406

Other operating expenses .......... 1,416 1,114 1,855 1,402 1,994 1,437

Nonoperating income (expense):

Miscellaneous, net ............... $ (13) $ (12) $ 27 $ 29 $ (123) $ (121)

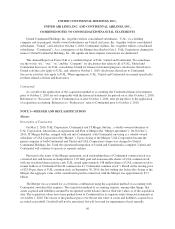

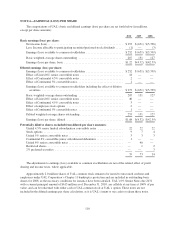

NOTE 2—SIGNIFICANT ACCOUNTING POLICIES

The following policies are applicable to UAL, United and Continental, except as noted below under

Continental Predecessor Accounting Policies, for accounting policies followed by Continental Predecessor that

are materially different than the Company’s accounting policies.

(a) Use of Estimates—The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America (“GAAP”) requires management to make estimates and

assumptions that affect the amounts reported in these financial statements and accompanying notes. Actual

results could differ from those estimates. The Company estimates the fair value of its financial instruments

and indefinite-lived intangible assets for testing impairment of indefinite-lived intangible assets. These

estimates and assumptions are inherently subject to significant uncertainties and contingencies beyond the

control of the Company. Accordingly, the Company cannot provide assurance that the estimates,

assumptions and values reflected in the valuations will be realized, and actual results could vary materially.

(b) Revenue Recognition—The value of unused passenger tickets and miscellaneous charge orders (“MCOs”)

are included in current liabilities as advance ticket sales. The Company records passenger ticket sales and

tickets sold by other airlines for use on United or Continental as passenger revenue when the transportation

is provided or upon estimated breakage. The Company records an estimate of breakage revenue for tickets

that will expire in twelve months at departure date. The Company records an estimate of tickets that have

been used, but not recorded as revenue due to system processing errors, as revenue in the month of sale

based on historical results. Due to complex industry pricing structures, refund and exchange policies and

100