United Airlines 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

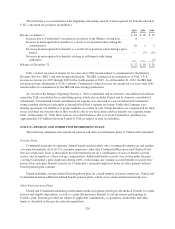

2009 and 2010) at a payment percentage of 150% and the minimum cash balance requirement was deemed

satisfied. Following the Merger closing date, with limited exceptions related to death, disability and retirement

eligibility, payments under all outstanding PBRSUs remain subject to continued employment by the participant

and will continue to be paid on their normal payment date over a three-year period. The PBRSUs were converted

into a fixed cash equivalent based on a stock price of $23.48, the average closing price per share of Continental

common stock for the 20 trading days preceding the completion of the Merger.

Merger Impacts- United Share-Based Awards. In May 2010, the UAL Board of Directors made a

determination that the Merger should be considered a change of control for purposes of all outstanding awards.

Accordingly, upon the completion of the Merger on October 1, 2010, eligible outstanding equity-based awards

immediately vested except for certain officer awards that are subject to separate agreements, as discussed below.

In September 2010, the Human Resources Subcommittee of the UAL Board of Directors elected to settle all

eligible RSUs in cash. As a result, participants received $23.66 in exchange for each share unit, based on the

closing price of UAL stock on the day prior to the closing. The cash payment to settle these awards was $18

million.

Certain officers entered into separate agreements with the Company pursuant to which they agreed to waive

the provisions providing for accelerated vesting upon the change of control. As part of the agreements, the

outstanding restricted stock awards and RSUs were converted into fixed cash equivalents based on a stock price

of $22.33 per share, UAL’s average closing share price for the preceding 20 days prior to the closing of the

Merger. Following the Merger, with limited exceptions as described below, the payment of these awards remains

subject to continued employment by the participant and will be paid on the original vesting dates. Upon

termination of employment under certain circumstances following the Merger, the participant is entitled to a cash

settlement. In the fourth quarter of 2010, UAL paid $19 million in cash for merger-related terminations.

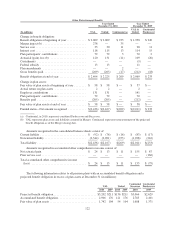

Stock Options. Stock options are awarded with exercise prices equal to the fair market value of UAL’s

common stock on the date of grant. UAL stock options generally vest over a period of either three or four years

and have a contractual life of 10 years. The Continental Predecessor vested stock options generally have an

original contractual life of five years (management level employee options) or 10 years (outside directors).

Expense related to each portion of an option grant is recognized on a straight-line basis over the specific vesting

period for those options.

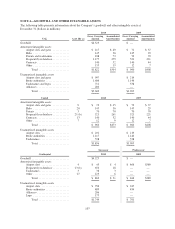

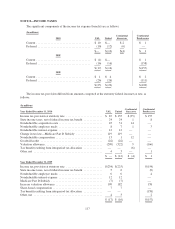

The table below summarizes UAL stock option activity (shares in thousands):

Options

Weighted-

Average

Exercise Price

Weighted-

Average

Remaining

Contractual

Life (in years)

Aggregate

Intrinsic Value

(in millions)

Outstanding at beginning of year ..................... 6,406 $22.42

Issued in exchange for Continental options ............. 7,366 16.77

Exercised (a) ..................................... (2,467) 8.13

Canceled ........................................ (59) 8.56

Expired ......................................... (194) 34.97

Outstanding at end of year .......................... 11,052 21.70 3.6

Exercisable at end of period ......................... 9,729 22.66 3.2 $61

(a) The aggregate intrinsic value of shares exercised in 2010, 2009 and 2008 was $42 million, less than $1 million and less

than $1 million, respectively.

113