United Airlines 2010 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UAL and United

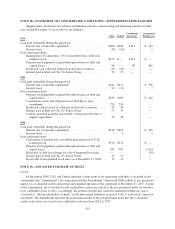

Aircraft impairments

The aircraft impairments summarized in the table above for 2010, 2009 and 2008 relate to United’s

nonoperating Boeing 737 and Boeing 747 aircraft which declined in value, as older less fuel efficient models

became less valuable with increasing fuel costs. The carrying values of these nonoperating aircraft were reduced

to estimated fair values. During the first quarter of 2010, the Company also estimated that certain of its aircraft-

related assets were fully impaired resulting in a charge of $16 million. In addition, the Company reviewed its

Boeing 737 fleet for impairment in 2008. See Note 12 for additional information related to the use of fair values

in impairment testing.

Pre-delivery advance deposit impairment

Due to the unfavorable economic and industry factors described above, the Company determined in 2008

that it was required to perform an impairment test of its $105 million of pre-delivery aircraft deposits and related

capitalized interest. United determined that these aircraft deposits were completely impaired and wrote off their

full carrying value as management determined that it is highly unlikely it will take these future aircraft deliveries

and, therefore, United would be required to forfeit the deposits, which are not transferable based on existing

contract terms.

Intangible asset impairments

During 2010, the U.S. and Brazilian governments reached an open skies aviation agreement that removed

the restriction on the number of flights into Sao Paulo by October 2015. As a result of these changes, United

recorded a $29 million non-cash charge to write-down its indefinite-lived route asset in Brazil. In 2009, United

recorded $150 million impairment of its tradenames, which was primarily due to a significant decrease in

expected future cash flows due to poor economic conditions. In 2008, United recorded a total $64 million

impairment of tradename and code sharing agreements, which was primarily due to decreases in expected

revenue. These impairments were based on estimated fair values, which were primarily developed using income

methodologies, as described in Note 12.

Goodwill impairment and credit

For purposes of testing goodwill in 2008, the Company estimated the fair value of its assets and liabilities

utilizing several fair value measurement techniques, including two market estimates and one income estimate,

using relevant data available through and as of May 31, 2008.

Taking into consideration an equal weighting of the two market estimates and the income estimate, which

has been the Company’s practice when performing annual goodwill impairment tests, the indicated fair value of

the Company’s assets and liabilities was less than its carrying value. Therefore, the Company performed

additional goodwill impairment testing and determined that goodwill was completely impaired. An impairment

charge was recorded in the second quarter of 2008 to write-off the full value of goodwill.

During 2010, UAL determined that it overstated its deferred tax liabilities by approximately $64 million

when it applied fresh start accounting upon its exit from Chapter 11 bankruptcy protection in 2006. Under

applicable standards in 2008, this error would have been corrected with a decrease to goodwill, which would

have resulted in a decrease in the amount of UAL’s 2008 goodwill impairment charge. Therefore, UAL corrected

this overstatement in the fourth quarter of 2010 by reducing its deferred tax liabilities and recorded it as goodwill

impairment credit in its consolidated statement of operations. The adjustment was not made to prior periods as

UAL does not believe the correction is material to the current or any prior period. As the goodwill from fresh

start accounting was pushed down to United, the above disclosure also applies to United.

162