United Airlines 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

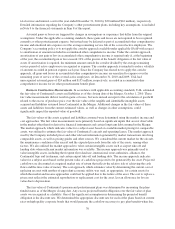

situation funds. Investments in private equity funds are valued at the net asset value of shares held by the plans’

trusts at year end. The allocation of assets was as follows at December 31, 2010:

Percent of Total

Expected Long-Term

Rate of Return

Equity security funds:

U.S. companies .................................. 50% 8%

International companies ............................ 21 8

Fixed-income securities ................................ 20 5

Private equity funds ................................... 9 10

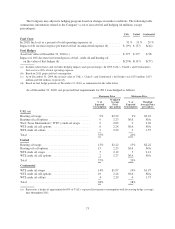

Pension expense increases as the expected rate of return on plan assets decreases. When calculating pension

expense for 2011, we will assume that our plans’ assets will generate a weighted-average long-term rate of return

of 7.75%. Lowering the expected long-term rate of return on plan assets by an additional 50 basis points (from

7.75% to 7.25%) would increase UAL’s estimated 2011 pension expense by approximately $8 million.

Future pension obligations for the Continental plans were discounted using a weighted average rate of

5.52% at December 31, 2010. UAL determines the appropriate discount rate for each of its plans based on current

rates on high quality corporate bonds that would generate the cash flow necessary to pay plan benefits when

due. This approach can result in different discount rates for different plans, depending on each plan’s projected

benefit payments. The pension liability and future pension expense both increase as the discount rate is

reduced. Lowering the discount rate by 50 basis points (from 5.52% to 5.02%) would increase the pension

liability at December 31, 2010 by approximately $290 million and increase the estimated 2011 pension expense

by approximately $36 million.

Future changes in plan asset returns, plan provisions, assumed discount rates, pension funding law and

various other factors related to the participants in our pension plans will impact our future pension expense and

liabilities. We cannot predict with certainty what these factors will be in the future.

Other Postretirement Benefit Accounting. United’s postretirement plan provides certain health care

benefits, primarily in the U.S., to retirees and eligible dependents, as well as certain life insurance benefits to

certain retirees reflected as “Other Benefits.” Continental’s retiree medical programs permit retirees who meet

certain age and service requirements to continue medical coverage between retirement and Medicare

eligibility. Eligible employees are required to pay a portion of the costs of their retiree medical benefits, which in

some cases may be offset by accumulated unused sick time at the time of their retirement. Plan benefits are

subject to co-payments, deductibles and other limits as described in the plans.

The Company accounts for other postretirement benefits by recognizing the difference between plan assets

and obligations, or the plan’s funded status, in its financial statements. Under GAAP, other postretirement benefit

expense is recognized on an accrual basis over employees’ approximate service periods and is generally

calculated independently of funding decisions or requirements. The Company has not been required to pre-fund

its current and future plan obligations, which has resulted in a significant net obligation, as discussed below.

UAL’s benefit obligation was $2.5 billion and $2.1 billion for the other postretirement benefit plans at

December 31, 2010 and 2009, respectively. The year-over-year increase is due to Continental plan obligations

assumed by UAL in the Merger, as well as changes in the assumptions used to value the obligation for United’s

plan, such as the decrease in the discount rate.

The calculation of other postretirement benefit expense and obligations requires the use of a number of

assumptions, including the assumed discount rate for measuring future payment obligations and the health care

cost trend rate. UAL determines the appropriate discount rate for each of its plans based on current rates on high

quality corporate bonds that would generate the cash flow necessary to pay plan benefits when due. UAL’s

weighted average discount rate to determine its benefit obligations as of December 31, 2010 was 5.13%, as

compared to 5.69% for December 31, 2009. The health care cost trend rate assumed by United and Continental

for 2010 was 8.5% and 7.5%, respectively, as compared to assumed trend rates for 2011 of 8.0% and 7.5%,

respectively. A 1.0% increase/(decrease) in assumed health care trend rates would increase/(decrease) UAL’s

69