United Airlines 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

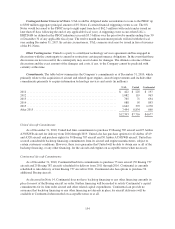

Contingent Senior Unsecured Notes. UAL would be obligated under an indenture to issue to the PBGC up

to $500 million aggregate principal amount of 8% Notes if certain financial triggering events occur. The 8%

Notes would be issued to the PBGC in up to eight equal tranches of $62.5 million (with each tranche issued no

later than 45 days following the end of any applicable fiscal year). A triggering event occurs when UAL’s

EBITDAR (as defined in the PBGC indenture) exceeds $3.5 billion over the prior twelve months ending June 30

or December 31 of any applicable fiscal year. The twelve month measurement periods will end with the fiscal

year ending December 31, 2017. In certain circumstances, UAL common stock may be issued in lieu of issuance

of the 8% Notes.

Other Contingencies. United is a party to a multiyear technology services agreement and has engaged in

discussions with the counterparty to amend or restructure certain performance obligations. In the event that these

discussions are not successful, the counterparty may assert claims for damages. The ultimate outcome of these

discussions and the exact amount of the damages and costs, if any, to the Company cannot be predicted with

certainty at this time.

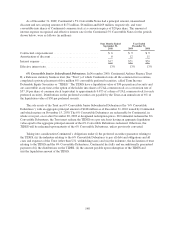

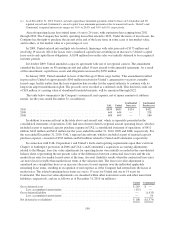

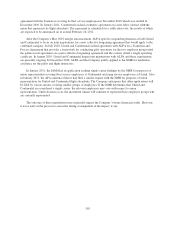

Commitments. The table below summarizes the Company’s commitments as of December 31, 2010, which

primarily relate to the acquisition of aircraft and related spare engines, aircraft improvements and include other

commitments primarily to acquire information technology services and assets (in millions).

UAL United Continental

2011 ............................................................. $ 422 $ 225 $ 197

2012 ............................................................. 1,082 119 963

2013 ............................................................. 765 71 694

2014 ............................................................. 988 95 893

2015 ............................................................. 1,642 372 1,270

After 2015 ........................................................ 7,494 6,834 660

$12,393 $7,716 $4,677

United Aircraft Commitments

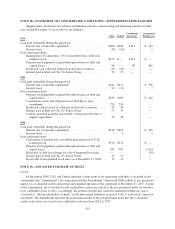

As of December 31, 2010, United had firm commitments to purchase 25 Boeing 787 aircraft and 25 Airbus

A350XWB aircraft for delivery from 2016 through 2019. United also has purchase options for 42 Airbus A319

and A320 aircraft and purchase rights for 50 Boeing 787 aircraft and 50 Airbus A350XWB aircraft. United has

secured considerable backstop financing commitments from its aircraft and engine manufacturers, subject to

certain customary conditions. However, there is no guarantee that United will be able to obtain any or all of the

backstop financing, or any other financing, for the aircraft and engines on acceptable terms when necessary.

Continental Aircraft Commitments

As of December 31, 2010, Continental had firm commitments to purchase 75 new aircraft (50 Boeing 737

aircraft and 25 Boeing 787 aircraft) scheduled for delivery from 2011 through 2016. Continental is currently

scheduled to take delivery of four Boeing 737 aircraft in 2011. Continental also has options to purchase 94

additional Boeing aircraft.

As discussed in Note 14, Continental does not have backstop financing or any other financing currently in

place for most of the Boeing aircraft on order. Further financing will be needed to satisfy Continental’s capital

commitments for its firm order aircraft and other related capital expenditures. Continental can provide no

assurance that backstop financing or any other financing not already in place for aircraft deliveries will be

available to Continental when needed on acceptable terms or at all.

154