United Airlines 2010 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

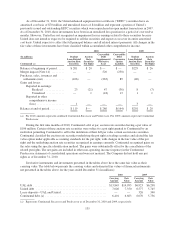

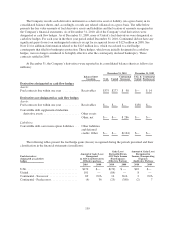

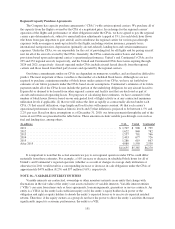

United has a $255 million revolving loan commitment available under Tranche A of its Amended Credit

Facility. As of December 31, 2010 and 2009, United used $253 million and $254 million, respectively, of the

Tranche A commitment capacity for letters of credit. In addition, under a separate agreement, United had a $150

million unused line of credit as of December 31, 2010. As of December 31, 2010, Continental had letters of

credit and performance bonds relating to various real estate, customs and aircraft financing obligations in the

amount of $73 million with expiration dates through December 2014.

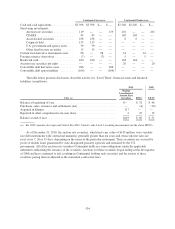

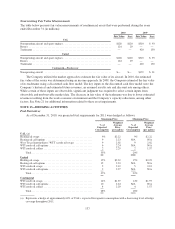

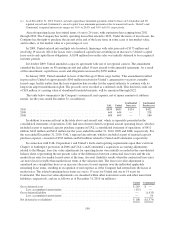

The table below presents the Company’s contractual principal payments at December 31, 2010 under then-

outstanding long-term debt agreements in each of the next five calendar years (in millions):

UAL United Continental

2011 (a) .......................................................... $ 2,411 $1,546 $ 865

2012 ............................................................. 1,320 688 632

2013 ............................................................. 1,835 1,151 684

2014 ............................................................. 2,101 1,718 383

2015 ............................................................. 1,953 403 1,550

After 2015 ........................................................ 4,486 1,801 2,340

$14,106 $7,307 $6,454

(a) Includes $726 million and $150 million of debt related to United’s 4.5% Senior Limited Subordination Convertible

Notes and 5% Senior Convertible Notes, respectively, which are due in 2021. These notes were classified as current

based on the put options available to noteholders in 2011, as further discussed below.

Substantially all of our assets are pledged as collateral for our debt. These assets principally consist of

aircraft and related spare parts, route authorities and, in the case of United, loyalty program intangible assets. As

of December 31, 2010, UAL, United and Continental were in compliance with their respective debt covenants.

Continued compliance depends on many factors, some of which are beyond the Company’s control, including the

overall industry revenue environment and the level of fuel costs.

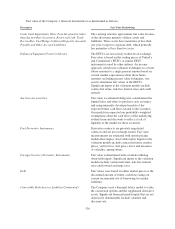

The Company’s significant financing agreements are summarized below:

UAL—Parent Only

6% Senior Convertible Notes.The 6% Senior Convertible Notes due 2029 (the “UAL 6% Senior

Convertible Notes”) are unsecured and may be converted by holders into shares of UAL common stock at an

initial conversion price of approximately $8.69 per share of UAL common stock. UAL does not have the option

to settle in cash upon a noteholder’s conversion; however, noteholders may require UAL to repurchase all or a

portion of the notes for cash, common stock or a combination thereof, at its option, at par plus any accrued and

unpaid interest if certain changes in control of UAL occur. UAL may redeem for cash all or part of the UAL 6%

Senior Convertible Notes on or after October 15, 2014. In addition, holders of the UAL 6% Senior Convertible

Notes have the right to require UAL to repurchase all or a portion of their notes on each of October 15,

2014, October 15, 2019 and October 15, 2024, payable by UAL in cash, shares of UAL common stock or a

combination thereof, at its option.

UAL and United—Push Down of UAL Securities.

The 4.5% Senior Limited Subordination Convertible Notes due 2021 (the “UAL 4.5% Notes”), 5% Senior

Convertible Notes due 2031 (the “UAL 5% Notes”) and 6% Senior Notes due 2031 (the “UAL 6% Senior

Notes”), as further described below, were issued by UAL, have been pushed down to United and are reflected as

debt of United. Each of these notes is guaranteed by United.

142