United Airlines 2010 Annual Report Download - page 50

Download and view the complete annual report

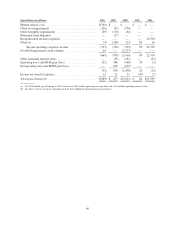

Please find page 50 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.See Note 21 to the financial statements in Item 8 for additional information related to special charges.

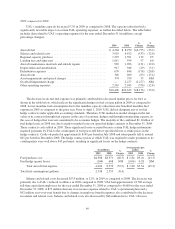

Merger-related costs

Merger-related costs consist of charges related to the Merger and include costs related to the planning and

execution of the Merger, including costs for items such as financial advisor, legal and other advisory fees. Also

included in merger-related costs are salary and severance related costs that are primarily associated with

administrative headcount reductions and compensation costs related to the Merger. Merger-related costs also

include integration costs, costs to terminate certain service contracts that will not be used by the combined

company, costs to write-off system assets that are no longer used or planned to be used by the combined

company and payments to third-party consultants to assist with integration planning and organization design. See

Notes 1 and 21 to the financial statements in Item 8 for additional information.

Asset impairments

The aircraft impairments in 2010 and 2009 are primarily related to a decrease in the estimated market value

of UAL’s nonoperating Boeing 737 and 747 aircraft. In 2010, UAL recorded a $29 million impairment ($18

million net of taxes) of its indefinite-lived Brazil routes due to an estimated decrease in the value of these routes

as a result of the new open skies agreement.

During 2010, UAL determined it overstated its deferred tax liabilities by approximately $64 million when it

applied fresh start accounting upon its exit from bankruptcy in 2006. Under applicable standards in 2008, this

error would have been corrected with a decrease to goodwill, which would have resulted in a decrease in the

amount of UAL’s 2008 goodwill impairment charge. Therefore, UAL corrected this overstatement in the fourth

quarter of 2010 by reducing its deferred tax liabilities and recorded it as a goodwill impairment credit in its

consolidated statement of operations. The adjustment was not made to prior periods as UAL does not believe the

correction is material to the current or any prior period.

In 2009, UAL recorded a $150 million intangible asset impairment ($95 million net of taxes) to decrease the

value of United’s tradename, which was primarily due to a decrease in estimated future revenues resulting from

the weak economic environment and United’s capacity reductions, among other factors.

In 2009, UAL recorded special charges of $27 million related to the final settlement of the LAX municipal

bond litigation and $104 million primarily related to Boeing 737 aircraft lease terminations.

During the fourth quarter of 2010, UAL recorded $130 million to other operating expense, $65 million each

for United and Continental, due to revenue sharing obligations related to the trans-Atlantic joint venture with

Lufthansa and Air Canada. This expense relates to UAL’s payments for the first nine months of 2010, prior to

contract execution.

48