United Airlines 2010 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In addition to the accruals activity presented above, UAL and United recorded accruals related to UAL

Corporation’s emergence from Chapter 11 bankruptcy protection in 2006. As of December 31, 2008 and 2007,

this bankruptcy-related reserve had a balance of $96 million and $98 million, respectively. During 2009, the

restructuring accruals were finalized with payments of $58 million, expense accrual adjustments of $29 million,

and reclassifications of $67 million. These reclassifications primarily relate to lease settlements that are being

amortized over amended lease terms.

Due to extreme fuel price volatility, tight credit markets, the uncertain economic environment, as well as

other uncertainties, the Company can provide no assurance that a material impairment charge will not occur in a

future period. The Company will continue to monitor circumstances and events in future periods to determine

whether additional asset impairment testing is warranted.

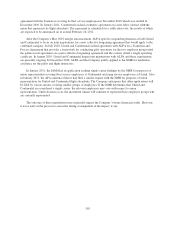

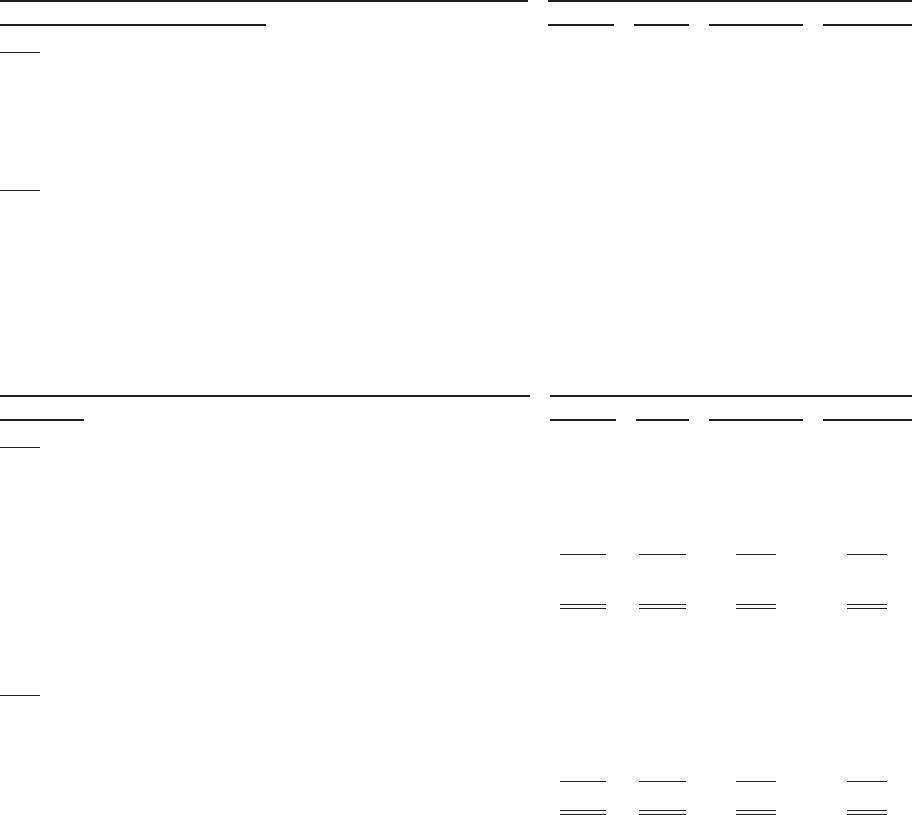

NOTE 22—SELECTED QUARTERLY FINANCIAL DATA (UNAUDITED)

UAL Quarter Ended

(In millions, except per share amounts) March 31 June 30 September 30 December 31

2010

Operating revenues ..................................... $4,241 $5,161 $5,394 $8,433

Income (loss) from operations ............................ 69 434 535 (82)

Net income (loss) ...................................... (82) 273 387 (325)

Basic earnings (loss) per share ............................ (0.49) 1.62 2.30 (1.01)

Diluted earnings (loss) per share .......................... (0.49) 1.29 1.75 (1.01)

2009

Operating revenues ..................................... $3,691 $4,018 $4,433 $4,193

Income (loss) from operations ............................ (282) 107 88 (74)

Net income (loss) ...................................... (382) 28 (57) (240)

Basic and diluted earnings (loss) per share .................. (2.64) 0.19 (0.39) (1.44)

UAL’s quarterly financial data is subject to seasonal fluctuations and historically its second and third

quarter financial results, which reflect higher travel demand, are better than its first and fourth quarter financial

results. UAL’s quarterly results were impacted by the following significant items:

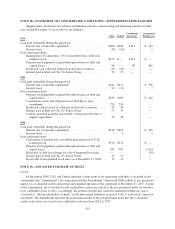

UAL Quarter Ended

(In millions) March 31 June 30 September 30 December 31

2010

Operating earnings:

Merger-related costs ................................ $— $ 28 $ 44 $493

Asset impairments .................................. 17 73 22 53

Lease termination and other special items ............... 1 5 (3) —

Goodwill impairment credit .......................... — — — (64)

Total merger-related costs and special charges in operating

income (loss) ........................................ $ 18 $106 $ 63 $482

Non-cash fuel hedge mark-to-market (gains) losses ........... $ (31) $ 37 $ 12 $ 14

Frequent flyer accounting change (Note 2(h)) ................ $ 64 $ 75 $ 65 $ 45

2009

Operating earnings:

Asset impairments .................................. $110 $ 40 $ 19 $ 74

LAX municipal bond litigation ........................ — 27 — —

Lease termination and other special items ............... 9 21 24 50

Total special charges in operating income (loss) .............. $119 $ 88 $ 43 $124

Fuel hedge mark-to-market:

Non-cash MTM fuel hedge gains ...................... $(191) $(305) $ (25) $ (65)

Non-operating non-cash MTM fuel hedge gains .......... (72) (135) (34) (38)

See Note 21 for further discussion of these items.

166