United Airlines 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

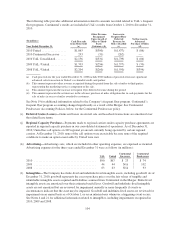

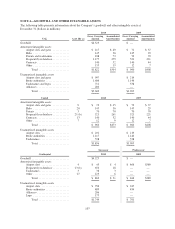

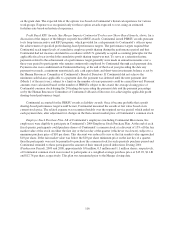

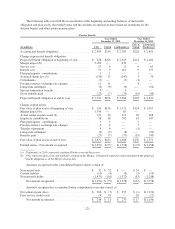

Continental Predecessor

The computations of Continental Predecessor’s basic and diluted earnings (loss) per share for the periods

Continental had outstanding publicly-traded equity securities are set forth below (in millions, except per share

amounts):

Nine Months

Ended

September 30,

2010

Year Ended

December 31,

2009 2008

Basic earnings (loss) per share:

Net income (loss) .............................................. $441 $(282) $ (586)

Earnings (loss) available to common stockholders ..................... $441 $(282) $ (586)

Basic weighted-average shares outstanding .......................... 140 129 106

Earnings (loss) per share, basic .................................... $3.16 $(2.18) $(5.54)

Diluted earnings (loss) per share:

Earnings (loss) available to common stockholders ..................... $441 $(282) $ (586)

Effect of 5% convertible notes .................................... 10 — —

Effect of 6% convertible junior subordinated debentures ................ 10 — —

Effect of 4.5% convertible notes ................................... 7 — —

Earnings (loss) available to common stockholders including the effect of

dilutive securities ............................................ $468 $(282) $ (586)

Basic weighted-average shares outstanding .......................... 140 129 106

Effect of 4.5% convertible notes ................................... 12 — —

Effect of 5% convertible notes .................................... 9 — —

Effect of 6% convertible junior subordinated debentures ................ 4 — —

Effect of employee stock options .................................. 2 — —

Dilutive weighted-average shares outstanding ........................ 167 129 106

Earnings (loss) per share, diluted .................................. $2.81 $(2.18) $(5.54)

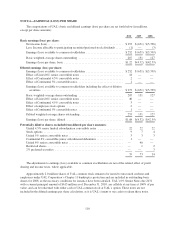

The adjustments to earnings (loss) available to common stockholders are net of the related effect of profit

sharing and income taxes, where applicable.

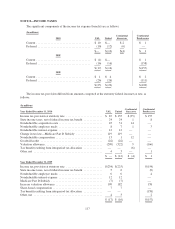

Approximately 2 million, 8 million and 8 million weighted average options to purchase shares of

Continental common stock for the nine months ended September 30, 2010 and the years ended December 31,

2009 and 2008, respectively, were excluded from the computation of diluted earnings (loss) per share because the

effect of including the options would have been antidilutive. In addition, approximately 14 million and 13 million

potential shares of Continental common stock related to Continental’s convertible debt securities were excluded

from the computation of diluted loss per share for the years ended December 31, 2009 and 2008, respectively,

because they were antidilutive.

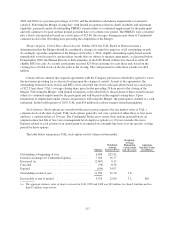

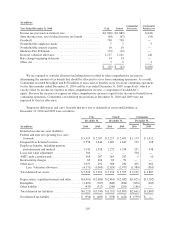

NOTE 7—SHARE-BASED COMPENSATION PLANS

Prior to the Merger, UAL and Continental maintained separate share-based compensation plans. These plans

provide for grants of qualified and non-qualified stock options, stock appreciation rights, restricted stock awards,

restricted stock units (“RSUs”), performance compensation awards, performance units, cash incentive awards

and other types of equity-based and equity-related awards. As part of the Merger, UAL assumed all of

Continental’s outstanding share-based compensation plans.

111