United Airlines 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Continental

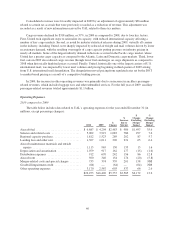

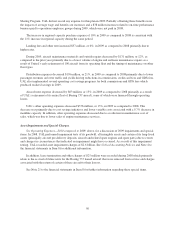

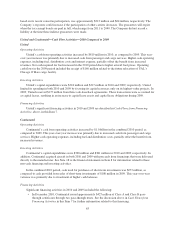

The table below presents the Continental Successor and Predecessor periods in 2010. The combined

presentation for the year ended December 31, 2010 does not represent a GAAP presentation. Management

believes that the combined non-GAAP results provide a more meaningful comparison to the full year 2009.

Continental’s operating income and net income in the combined 2010 period were $698 million and $346

million, respectively, as compared to operating and net losses of $144 million and $282 million, respectively, in

2009. This improvement was largely due to the improvement in global economic conditions following the severe

recession in 2009, consistent with the improvement in UAL’s results described above.

(in millions)

Successor

Three

Months

Ended

December 31,

2010

Predecessor

Nine Months

Ended

September 30,

2010

Combined

2010

Predecessor

Year Ended

December 31,

2009

%

Change

Operating Revenue:

Passenger revenue ....................... $3,167 $ 9,503 $12,670 $11,040 14.8

Cargo and other revenue .................. 396 1,285 1,681 1,583 6.2

Total revenue ....................... $3,563 $10,788 $14,351 $12,623 13.7

Operating Expenses:

Aircraft fuel ............................ $ 986 $ 2,872 $ 3,858 $ 3,401 13.4

Salaries and related costs .................. 786 2,527 3,313 3,137 5.6

Regional capacity purchase ................ 202 608 810 826 (1.9)

Landing fees and other rent ................ 231 656 887 841 5.5

Aircraft maintenance materials and outside

repairs .............................. 135 399 534 597 (10.6)

Depreciation and amortization .............. 177 380 557 494 12.8

Distribution expenses .................... 156 474 630 537 17.3

Aircraft rent ............................ 174 689 863 934 (7.6)

Merger-related costs and special charges ..... 201 47 248 145 NM

Other operating expenses .................. 537 1,416 1,953 1,855 5.3

Total operating expenses .............. $3,585 $10,068 $13,653 $12,767 6.9

Operating income (loss) ................... $ (22) $ 720 $ 698 $ (144) NM

Nonoperating expense .................... 77 278 355 295 20.3

Total revenues increased 14% in the combined 2010 period, as compared to 2009, primarily due to higher

passenger fares, which were driven by improving global economic conditions and an increased demand for air

travel.

In the combined 2010 period, aircraft fuel expense increased 13% as compared to 2009 primarily due to an

increase in fuel prices. Fuel hedge losses were $9 million and $380 million in 2010 and 2009, respectively.

Continental’s fuel purchase cost, without hedge impacts, increased approximately 27% in 2010 as compared to

2009, which is relatively consistent with UAL’s unhedged cost of fuel summarized in the tables above.

Salaries and related costs increased 6% in the combined 2010 period as compared to 2009. The significant

factors contributing to the increase in 2010 were profit sharing and related taxes of $77 million, variable

incentive compensation and annual employee wage increases.

Aircraft maintenance materials and outside repairs decreased 11% in the combined 2010 period as compared

to 2009 primarily due to the timing of maintenance events and savings from renegotiated rates on certain

contracts.

Continental’s depreciation and amortization expense increased in the combined 2010 period as compared to

2009 primarily due to increased expense in the Successor period associated with recording Continental’s assets at

fair value as of the Merger closing date.

54