United Airlines 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Following the Merger, UAL is now the sole issuer of all stock-based compensation awards. All awards are

recorded as equity or a liability in UAL’s consolidated balance sheet. The stock-based compensation expense

specifically attributable to the employees of United and Continental is directly recorded to salaries and related

costs, or merger-related expense, within each of their respective statements of operations. United and Continental

record an allocation of share-based expense for employees that devote a significant amount of time to both

companies. As United and Continental do not sponsor their own share-based compensation plans, the disclosures

below primarily relate to UAL. See Continental Predecessor below, for share-based compensation disclosures

applicable to Continental prior to the Merger.

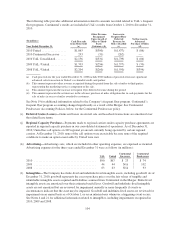

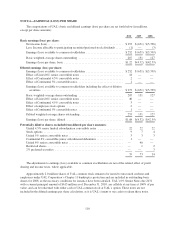

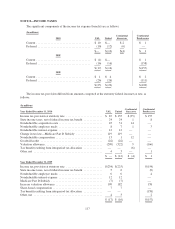

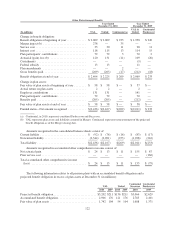

The following table provides information related to UAL share-based compensation plan cost, for the years

ended December 31 (in millions):

2010 2009 2008

Compensation cost: (a), (b)

Share-based awards converted to cash awards (c) ................................. $ 84 $— $—

Restricted stock units ....................................................... 20 10 —

Restricted stock ............................................................ 6 6 18

Stock options .............................................................. 7 5 13

Total ................................................................ $117 $ 21 $ 31

(a) All compensation cost is recorded to Salaries and related benefits, with the exception of $70 million in 2010 that was

recorded in merger-related costs.

(b) In 2010, United and Continental Successor recorded $63 and $54 million, respectively, of compensation cost related to

UAL’s share-based plans. These amounts included $24 million and $46 million that were classified as merger-related

expense by United and Continental, respectively. All UAL share-based compensation expense in 2009 and 2008 was

recorded by United.

(c) As described below, in connection with the Merger, certain awards were converted into fixed cash equivalents.

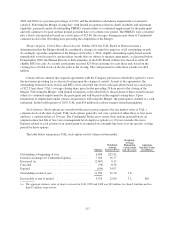

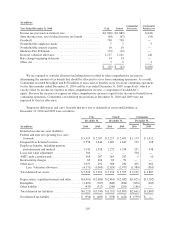

The table below summarizes UAL’s unearned compensation and weighted-average remaining period to

recognize costs for all outstanding share-based awards for the year ended December 31, 2010 ($ in millions):

Unearned

Compensation

Weighted-

Average

Remaining

Period

Share-based awards converted to cash awards (a) .............................. $27 1.6

Restricted stock (b) ...................................................... 9 1.6

Stock options (b) ........................................................ 7 2.2

Total ............................................................. $43

(a) Compensation cost attributable to future service related to unvested awards remaining to be recognized is allocated

equally between United and Continental.

(b) Compensation cost attributable to future service related to unvested awards remaining to be recognized by United and

Continental consists of $10 million and $6 million, respectively.

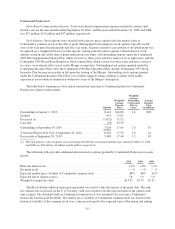

Merger Impacts- Continental Predecessor Share-Based Awards. Prior to completion of the Merger,

Continental had outstanding stock options, non-employee director restricted stock awards and performance

compensation awards (profit based RSUs) that were issued pursuant to its incentive compensation plans. Under

the terms of Continental’s incentive plans, substantially all of the outstanding equity awards fully vested as a

result of the Merger. The equity awards were assumed and issued by UAL using a 1.05 conversion rate and had a

fair value of approximately $78 million at the Merger closing date which was included in the acquisition cost. In

addition, as a result of the Merger, the performance criteria related to the profit based RSUs (“PBRSUs”) was

deemed to be achieved for each open performance period (the three-year periods beginning January 1, 2008,

112