United Airlines 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

though they are free-standing derivatives. As a result, the acquisition date fair value of Continental’s long-term

debt is $71 million lower and the acquisition date fair value of Continental’s other liabilities is $230 million

higher than the UAL amounts shown above.

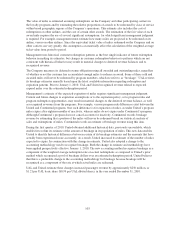

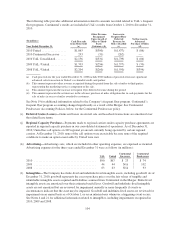

Pro-forma Impact of the Merger

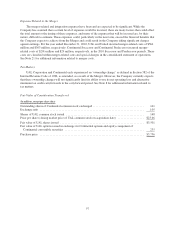

The UAL unaudited pro-forma results presented below include the effects of the Continental acquisition as

if it had been consummated as of January 1, 2009. The pro-forma results include the depreciation and

amortization associated with the acquired tangible and intangible assets, lease fair value adjustments, elimination

of any deferred gains or losses from other comprehensive income and the impact of income changes on profit

sharing expense, among others. However, pro-forma results do not include any anticipated synergies or other

expected benefits of the acquisition. Accordingly, the unaudited pro-forma financial information below is not

necessarily indicative of either future results of operations or results that might have been achieved had the

acquisition been consummated as of January 1, 2009.

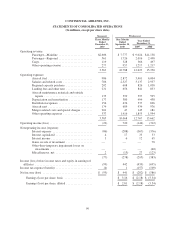

(In millions, except per share data)

Year Ended

December 31,

2010 2009

Revenue ....................................................... $33,946 $28,677

Net income (loss) ................................................ 958 (689)

Basic earnings (loss) per share ...................................... 3.02 (2.41)

Diluted earnings (loss) per share .................................... 2.62 (2.41)

(a) Not applicable.

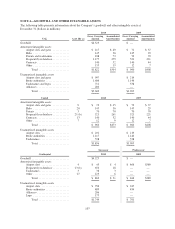

Reclassifications

UAL and United

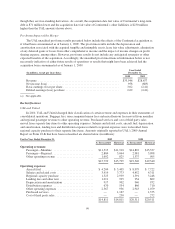

In 2010, UAL and United changed their classification of certain revenue and expenses in their statements of

consolidated operations. Baggage fees, unaccompanied minor fees and miscellaneous fees moved from mainline

and regional passenger revenue to other operating revenue. Purchased services and cost of third party sales

moved from separate line items to other operating expenses. Salaries and related costs, aircraft fuel, depreciation

and amortization, landing fees and distribution expenses related to regional expenses were reclassified from

regional capacity purchase to their separate line items. Amounts originally reported in UAL’s 2009 Annual

Report on Form 10-K that have been reclassified are shown below (in millions):

For the Year Ended December 31, 2009 2008

As Reclassified Historical As Reclassified Historical

Operating revenues:

Passenger—Mainline ........................... $11,313 $11,910 $14,822 $15,337

Passenger—Regional ............................ 2,884 3,064 2,981 3,098

Other operating revenue ......................... 1,602 825 1,537 905

$15,799 $15,799 $19,340 $19,340

Operating expenses:

Aircraft fuel ................................... $ 4,204 $ 3,405 $ 8,979 $ 7,722

Salaries and related costs ......................... 3,919 3,773 4,452 4,311

Regional capacity purchase ....................... 1,523 2,939 1,391 3,248

Landing fees and other rent ....................... 1,011 905 954 862

Depreciation and amortization .................... 917 902 946 932

Distribution expenses ........................... 670 534 846 710

Other operating expenses ........................ 2,567 956 2,943 1,079

Purchased services .............................. — 1,167 — 1,375

Cost of third party sales .......................... — 230 — 272

$14,811 $14,811 $20,511 $20,511

99