United Airlines 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

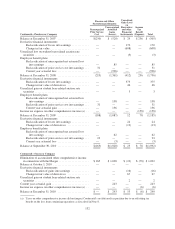

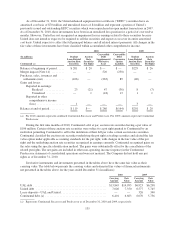

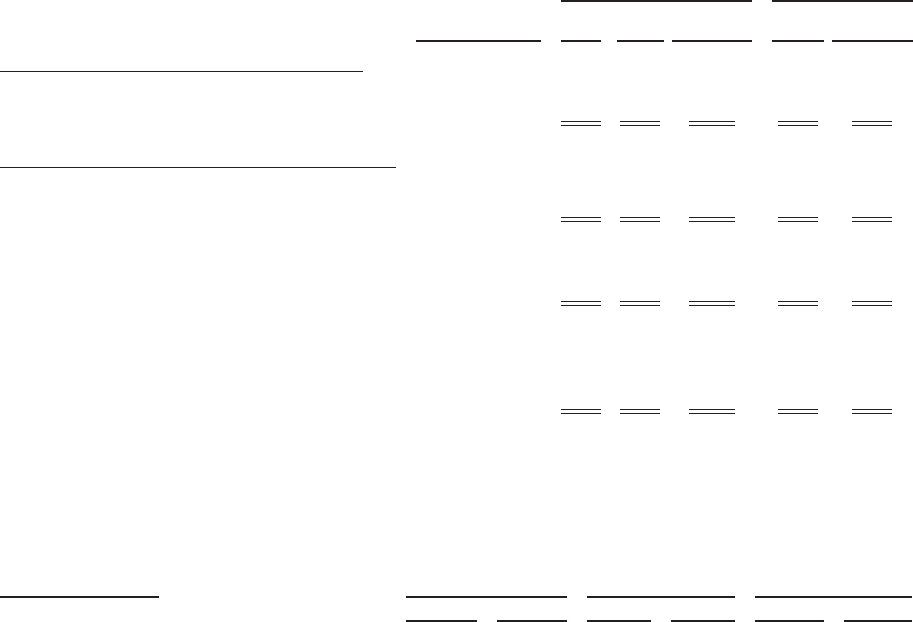

The Company records each derivative instrument as a derivative asset or liability (on a gross basis) in its

consolidated balance sheets,and, accordingly, records any related collateral on a gross basis. The table below

presents the fair value amounts of fuel derivative assets and liabilities and the location of amounts recognized in

the Company’s financial statements. As of December 31, 2010, all of the Company’s fuel derivatives were

designated as cash flow hedges. As of December 31, 2009, none of United’s fuel derivatives were designated as

cash flow hedges. For each year in the three year period ended December 31, 2010, Continental did not have any

significant gains (losses) on undesignated contracts except for recognized losses of $125 million in 2008. See

Note 21 for additional information related to the $125 million loss, which was related to a fuel hedge

counterparty that filed for bankruptcy protection. These hedges, which were initially designated as cash flow

hedges, were no longer considered to be highly effective after the counterparty declared bankruptcy. These

contracts settled in 2009.

At December 31, the Company’s derivatives were reported in its consolidated balance sheets as follows (in

millions):

December 31, 2010 December 31, 2009

Balance Sheet

Location UAL United

Continental

Successor

UAL &

United

Continental

Predecessor

Derivatives designated as cash flow hedges

Assets:

Fuel contracts due within one year ........... Receivables $375 $277 $ 98 $— $ 14

Derivatives not designated as cash flow hedges

Assets:

Fuel contracts due within one year ........... Receivables $— $— $— $138 $—

Convertible debt supplemental indenture

derivative assets ........................ Other assets:

Other, net $— $— $ 286 $— $—

Liabilities:

Convertible debt conversion option liabilities . . . Other liabilities

and deferred

credits: Other $— $— $(164) $— $—

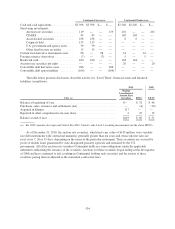

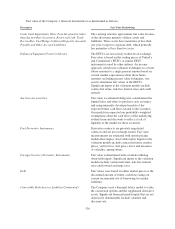

The following tables present the fuel hedge gains (losses) recognized during the periods presented and their

classification in the financial statements (in millions):

Fuel derivatives

designated as cash flow

hedges

Amount of Gain (Loss)

Recognized

in AOCI on Derivatives

(Effective portion)

Gain (Loss)

Reclassified from

AOCI into Income

(Fuel Expense)

(Effective Portion)

Amount of Gain (Loss)

Recognized in

Income (Nonoperating

Expense)

(Ineffective Portion)

2010 2009 2010 2009 2010 2009

UAL .................................. $170 $— $(70) $ — $10 $—

United ................................. 101 — (84) — 8 —

Continental - Successor ................... 69 N/A 14 N/A 2 N/A

Continental - Predecessor .................. (4) 36 (23) (380) (2) 7

139