United Airlines 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

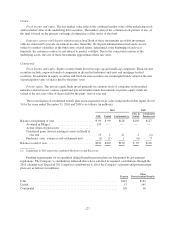

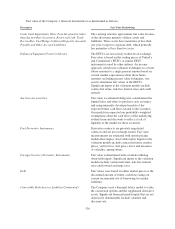

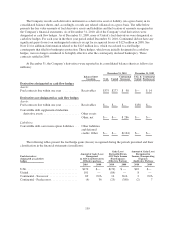

Fair value of the Company’s financial instruments was determined as follows:

Description Fair Value Methodology

Cash, Cash Equivalents, Short Term Investments (other

than Auction Rate Securities), Restricted Cash, Trade

Receivables, Fuel Hedge Collateral Deposits, Accounts

Payable and Other Accrued Liabilities

The carrying amounts approximate fair value because

of the short-term maturity of these assets and

liabilities. These assets have maturities of less than

one year except for corporate debt, which generally

has maturities of less than two years.

Enhanced Equipment Trust Certificates The EETCs are not actively traded on an exchange.

Fair value is based on the trading prices of United’s

and Continental’s EETCs or similar EETC

instruments issued by other airlines. An income

approach, which uses valuation techniques to convert

future amounts to a single present amount based on

current market expectations about those future

amounts, including present value techniques, was

used to determine fair values of the EETCs.

Significant inputs to the valuation models include

contractual terms, risk-free interest rates and credit

spreads.

Auction rate securities Fair value is estimated taking into consideration the

limited sales and offers to purchase such securities

and using internally-developed models of the

expected future cash flows related to the securities.

Our models incorporated our probability-weighted

assumptions about the cash flows of the underlying

student loans and discounts to reflect a lack of

liquidity in the market for these securities.

Fuel Derivative Instruments Derivative contracts are privately negotiated

contracts and are not exchange traded. Fair value

measurements are estimated with option pricing

models that employ observable inputs. Inputs to the

valuation models include contractual terms, market

prices, yield curves, fuel price curves and measures

of volatility, among others.

Foreign Currency Derivative Instruments Fair value is determined with a formula utilizing

observable inputs. Significant inputs to the valuation

models include contractual terms, risk-free interest

rates and forward exchange rates.

Debt Fair values were based on either market prices or the

discounted amount of future cash flows using our

current incremental rate of borrowing for similar

liabilities.

Convertible Debt Asset or Liability (Continental) The Company used a binomial lattice model to value

the conversion options and the supplement derivative

assets. Significant binomial model inputs that are not

objectively determinable include volatility and

discount rate.

136