United Airlines 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

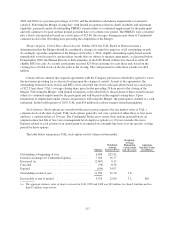

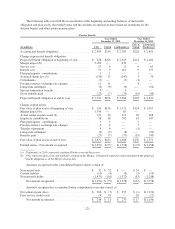

Continental Predecessor

Stock-Based Compensation Expense. Total stock-based compensation expense included in salaries and

related costs for the nine months ended September 30, 2010, and the years ended December 31, 2009 and 2008

was $57 million, $(3) million and $47 million, respectively.

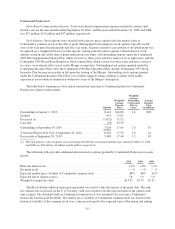

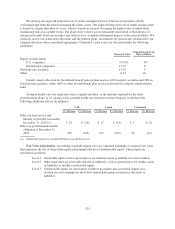

Stock Options. Stock options were awarded with exercise prices equal to the fair market value of

Continental’s common stock on the date of grant. Management level employee stock options typically vested

over a four year period and generally had five year terms. Expense related to each portion of an option grant was

recognized on a straight-line basis over the specific vesting period for those options. Outside director stock

options vested in full on the date of grant and had ten year terms. All outstanding options under the Continental

2005 Pilot Supplemental Option Plan, which vested over three years and have terms of six to eight years, and the

Continental 2005 Broad Based Employee Stock Option Plan, which vested over three years and have a term of

six years, were already fully vested on the Merger closing date. Outstanding stock options granted under the

Continental Incentive Plan 2000, the Continental 1998 Stock Incentive Plan, and the Continental 1997 Stock

Incentive Plan became exercisable in full upon the closing of the Merger. Outstanding stock options granted

under the Continental Incentive Plan 2010 vest on their original vesting schedule or earlier if the holder

experiences an involuntary termination within two years of the Merger closing date.

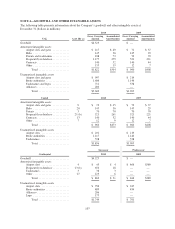

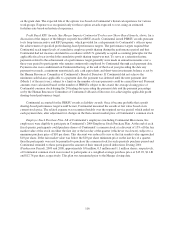

The table below summarizes stock option transactions pursuant to Continental plans for Continental

Predecessor (shares in thousands):

Options

Weighted-

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (in

years)

Average

Intrinsic

Value

(in millions)

Outstanding at January 1, 2010 ............................. 8,114 $16.08 2.4 $38

Granted ............................................... 654 23.83

Exercised (a) ........................................... (1,652) 11.92

Canceled .............................................. (92) 29.59

Outstanding at September 30, 2010 ......................... 7,024 17.60 2.0 61

Vested and Expected to Vest at September 30, 2010 ............ 6,943 17.59 2.0 61

Exercisable at September 30, 2010 .......................... 5,448 17.46 1.5 49

(a) The total intrinsic value of options exercised during 2010 Predecessor period and the years ended December 31, 2009

and 2008 was $18 million, $2 million and $3 million, respectively.

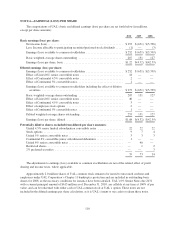

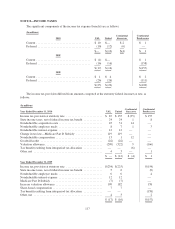

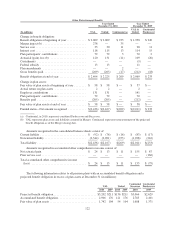

The following table provides additional information for options granted by Continental Predecessor in each

period.

2010 2009 2008

Risk-free interest rate ................................................... 1.4% 2.0% 3.1%

Dividend yield ........................................................ — % — % — %

Expected market price volatility of Continental common stock .................. 88% 86% 62%

Expected life of options (years) ........................................... 3.8 3.9 3.9

Weighted average fair value .............................................. $14.55 $5.75 $5.32

The Black-Scholes-Merton option-pricing model was used to value the options at the grant date. The risk-

free interest rate was based on the U.S. Treasury yield curve in effect for the expected term of the option at the

time of grant. The dividend yield on Continental common stock was assumed to be zero since Continental

historically had not paid dividends. The market price volatility of Continental common stock was based on the

historical volatility of the common stock over a time period equal to the expected term of the option and ending

115