SunTrust 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 SUNTRUST 2004 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

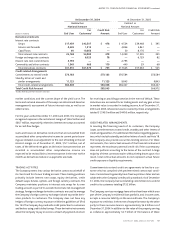

The Company manages the credit risk of its derivatives and

unfunded commitments by limiting the total amount of arrange-

ments outstanding by individual counterparty; by monitoring the

size and maturity structure of the portfolio; by obtaining collateral

based on management’s credit assessment of the counterparty; and

by applying uniform credit standards maintained for all activities

with credit risk. Collateral held varies but may include marketable

securities, accounts receivable, inventory, property, plant and equip-

ment, and income-producing commercial properties.Collateral may

cover the entire expected exposure for transactions or may be

called for when credit exposure exceeds defined thresholds of credit

risk. In addition, the Company enters into master netting agree-

ments which incorporate the right of setoff to provide for the net

settlement of covered contracts with the same counterparty in the

event of default or other termination of the agreement.

DERIVATIVES

The Company enters into various derivative contracts both in a

dealer capacity, to facilitate customer transactions, and also as a

risk management tool.Where contracts have been created for cus-

tomers, the Company enters into transactions with dealers to offset

its risk exposure. Derivatives are also used as a risk management

tool to hedge the Company’s exposure to changes in interest rates

or other defined market risks.

Interest rate swaps are contracts in which a series of interest rate

cash flows, based on a specific notional amount and a fixed and

floating interest rate, are exchanged over a prescribed period. Caps

and floors are contracts that transfer, modify,or reduce interest rate

risk in exchange for the payment of a premium when the contract is

issued.The true measure of credit exposure is the replacement cost

of contracts that have become favorable to the Company.

Futures and forwards are contracts for the delayed delivery of secu-

rities or money market instruments in which the seller agrees to

deliver on a specified future date, a specified instrument, at a speci-

fied price or yield.The credit risk inherent in futures is the risk that

the exchange party may default. Futures contracts settle in cash

daily; therefore, there is minimal credit risk to the Company. The

credit risk inherent in forwards arises from the potential inability of

counterparties to meet the terms of their contracts. Both futures

and forwards are also subject to the risk of movements in interest

rates or the value of the underlying securities or instruments.

Derivative instruments expose the Company to credit and market

risk. If the counterparty fails to perform, the credit risk is equal to

the fair value gain of the derivative.When the fair value of a deriva-

tive contract is positive, this indicates the counterparty owes the

Company, and therefore, creates a repayment risk for the Company.

When the fair value of a derivative contract is negative, the

Company owes the counterparty and has no repayment risk. The

Company minimizes the credit or repayment risk in derivative

instruments by entering into transactions with high quality coun-

terparties that are reviewed periodically by the Company’s credit

committee.The Company also maintains a policy of requiring that

all derivative contracts be governed by an International Swaps and

Derivatives Associations Master Agreement; depending on the

nature of the derivative transactions, bilateral collateral agree-

ments may be required as well.When the Company has more than

one outstanding derivative transaction with a single counterparty,

and there exists a legally enforceable master netting agreement

with the counterparty, the mark to market exposure is the net of the

positive and negative exposures with the same counterparty. When

there is a net negative exposure, the Company considers its expo-

sure to the counterparty to be zero.The net mark to market position

with a particular counterparty represents a reasonable measure of

credit risk when there is a legally enforceable master netting agree-

ment, including a legal right of setoff of receivable and payable

derivative contracts between the Company and a counterparty.

Market risk is the adverse effect that a change in interest rates, cur-

rency or implied volatility rates has on the value of a financial

instrument.The Company manages the market risk associated with

interest rate, credit, and equity derivatives and foreign exchange

contracts by establishing and monitoring limits on the types and

degree of risk that may be undertaken.The Company continually

measures this risk by using a value-at-risk methodology.

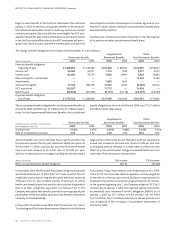

FAIR VALUE HEDGES

The Company enters into interest rate swaps to convert its fixed

rate funding to floating rates. For the years ended December 31,

2004 and 2003, the Company recognized additional income in the

net interest margin of $197.7 and $130.7 million, respectively,

related to cash payments from net settlements and income accrued

for interest rate swaps accounted for as fair value hedges.This hedg-

ing strategy resulted in zero ineffectiveness as of December 31,

2004 and ineffectiveness that reduced earnings by $0.3 million for

the year ended December 31, 2003.

The Company maintains a risk management program to protect and

manage interest rate risk and pricing risk associated with its mort-

gage lending activities. The following derivative instruments are

recorded in the financial statements at fair value and are used to

offset changes in value of the mortgage inventory due to changes in

market interest rates: forward contracts, interest rate lock commit-

ments and option contracts.A portion of the forward contracts have

been documented as fair value hedges of specific pools of loans that

meet the similar assets test as described in SFAS No. 133.The pools

of hedged loans are recorded in the financial statements at their fair

value, resulting in a partial offset of the market value adjustments

on the forward contracts.The pools of loans are matched with a cer-

tain portion of a forward contract so that the expected changes in

market value will inversely offset within a range of 80% to 125%.

This hedging strategy resulted in ineffectiveness that reduced earn-

ings by $50.0 million and $149.7 million for the years ended

December 31, 2004 and 2003, respectively.

CASH FLOW HEDGES

The Company uses various interest rate swaps to convert floating

rate assets and liabilities to fixed rates. Specific types of funding and

principal amounts hedged were determined based on prevailing