SunTrust 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION continued

SUNTRUST 2004 ANNUAL REPORT 37

Financial Statements. SunTrust is committed to remaining well

capitalized.

The Company issued approximately 76.4 million shares of SunTrust

common stock with an aggregate value of approximately $5.4 bil-

lion for the purchase of NCF.The remaining $1.8 billion of the pur-

chase price was funded with cash generated by a combination of

$800 million of wholesale CDs issued by SunTrust Bank in May

of 2004 and $1 billion of senior debt issued by the Company in

August of 2004.

In 2002, the Company raised $350 million of regulatory capital

through the sale of preferred shares issued by a real estate

investment trust subsidiary.This amount is reflected in other liabili-

ties and totaled $451.0 million and $412.5 million, including

accrued interest as of December 31, 2004 and December 31, 2003,

respectively.

SunTrust manages capital through dividend and share repurchases

authorized by the Company’s Board of Directors. Management

assesses capital needs based on expected growth and the current

economic climate. In 2004, the Company repurchased 200,000

shares for $14.1 million compared to 3.3 million shares for $182.1

million repurchased in 2003. As of December 31, 2004, the

Company was authorized to purchase up to an additional 6.0 mil-

lion shares under current Board resolutions.

The Company declared common dividends totaling $603.3 million

during 2004, or $2.00 per share, on net income of $1,572.9 million.

The dividend payout ratio was 38.4% in 2004 versus 37.9% in 2003.

One measure of capital adequacy is the tangible equity ratio, which

is calculated using total shareholders’equity less purchase account-

ing intangibles, including goodwill, divided by total assets less pur-

chase accounting intangibles.This ratio was 5.67% as of December

31, 2004 versus 6.82% as of December 31, 2003. Management ana-

lyzes the Company’s capital position with and without the impact

of the stock of The Coca-Cola Company. As of December 31, 2004,

the amount in total shareholders’ equity related to this security

holding was $1.3 billion compared to $1.6 billion as of December

31, 2003.This decline accounted for 17 basis points of the 115 basis

points decline in the tangible equity ratio. The remainder of the

decline was attributed to the acquisition of NCF.

ENTERPRISE RISK MANAGEMENT

In the normal course of business, SunTrust is exposed to various

risks.To manage the major risks that are inherent to the Company

and to provide reasonable assurance that key business objectives

will be achieved, the Company has established an enterprise risk

governance process. Moreover, the Company has policies and vari-

ous risk management processes designed to effectively identify,

monitor, and manage risk.

Management continually refines and enhances its risk management

policies, processes, and procedures to maintain effective risk man-

agement and governance, including identification, measurement,

monitoring, control, mitigation, and reporting of all material risks.

Over the last few years, the Company has enhanced risk measure-

ment applications and systems capabilities that provide manage-

ment information on whether the Company is being appropriately

compensated for the risk profile it has adopted.The Company bal-

ances its strategic goals, including revenue and profitability objec-

tives, with the risks associated with achieving its goals. Effective risk

management is an important element supporting business decision

making at SunTrust.

The Company is currently implementing an enterprise risk manage-

ment framework that will improve the Company’s ability to manage

its aggregate risk profile.The Company’s Chief Risk Officer (CRO)

reports to the Chief Executive Officer and is responsible for the

oversight of the risk management organization as well as risk

governance processes.The CRO provides overall leadership, vision,

and direction for the Company’s enterprise risk management

framework.

Organizationally, the Company measures and manages risk accord-

ing to three main risk categories: credit risk, market risk (including

liquidity risk), and operating risk (including compliance risk).The

Chief Credit Officer manages the Company’s credit risk.The Chief

Financial Officer and Treasurer manage the Company’s market risk.

The Chief Operational Risk Officer manages the Company’s operat-

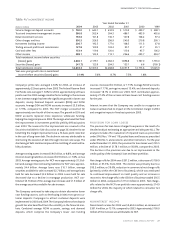

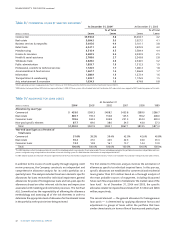

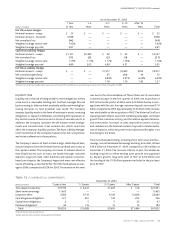

Table 14 / CAPITAL RATIOS

At December 31

(Dollars in millions) 2004 2003 2002 2001 2000 1999

Tier 1 capital1$ 9,783.7 $ 8,930.0 $ 8,106.1 $ 7,994.2 $ 6,850.6 $ 6,579.6

Total capital 14,152.6 13,365.9 12,609.8 12,144.2 10,488.9 9,939.1

Risk-weighted assets 136,642.8 113,711.3 108,501.1 99,700.9 96,656.7 87,866.1

Risk-based ratios

Tier 1 capital 7.16% 7.85% 7.47% 8.02% 7.09% 7.48%

Total capital 10.36 11.75 11.62 12.18 10.85 11.31

Tier 1 leverage ratio 6.64 7.37 7.30 7.94 6.98 7.17

Total shareholders’ equity to assets 10.06 7.76 7.47 7.98 7.95 8.00

1Tier 1 capital includes trust preferred obligations of $1.9 billion at the end of 2004, $1.7 billion at the end of 2003, 2002, and 2001, and $1.1 billion at the end of 2000 and 1999.

Tier 1 capital also includes preferred shares issued by a real estate investment trust subsidiary of $451 million at the end of 2004, 2003, and 2002, and $100 million at the end of 2001, and 2000.