SunTrust 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 79

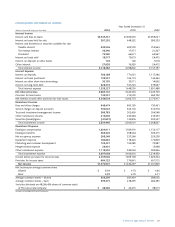

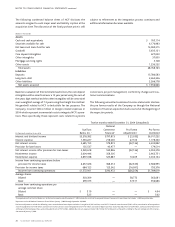

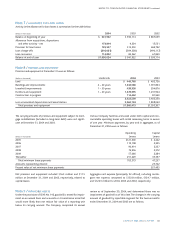

Twelve months ended December 31, 2003 (Unaudited)

National

SunTrust Commerce Pro Forma Pro Forma

(In thousands except per share data) Banks, Inc.1Financial2Adjustments3Combined

Interest and dividend income $4,768,842 $1,054,136 $ (9,405) $5,813,573

Interest expense 1,448,539 314,626 62,003 1,825,168

Net interest income 3,320,303 739,510 (71,408) 3,988,405

Provision for loan losses 313,550 48,414 — 361,964

Net interest income after provision for loan losses 3,006,753 691,096 (71,408) 3,626,441

Noninterest income 2,303,001 454,722 — 2,757,723

Noninterest expense 3,400,616 724,439 4,362 4,129,417

Income from continuing operations before

provision for income taxes 1,909,138 421,379 (75,770) 2,254,747

Provision for income taxes 576,841 134,614 (28,793) 682,662

Income from continuing operations $1,332,297 $ 286,765 $(46,977) $1,572,085

Average shares:

Diluted 281,434 — 78,363 359,797

Basic 278,295 — 76,415 354,710

Income from continuing operations per

average common share:

Diluted $ 4.73 — — $ 4.37

Basic 4.79 — — 4.43

1Represents the reported results of SunTrust Banks, Inc. for the twelve months ended December 31, 2003.

2Represents the reported results of National Commerce Financial for the twelve months ended December 31, 2003.

3Pro forma adjustments include the following items: amortization of core deposit and other intangibles of $65.7 million, net of NCF’s historical amortization of $61.4 million, amortization of loan purchase

accounting adjustment of $12.0 million, accretion of securities purchase accounting adjustment of $2.6 million, accretion of deposit purchase accounting adjustment of $2.0 million, and accretion of short-term

and long-term borrowings purchase accounting adjustments of $7.6 million.Additionally, interest expense includes $71.7 million for funding costs as though the funding for the cash component of the transac-

tion occurred January 1, 2003.

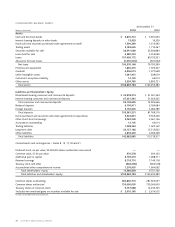

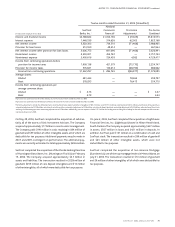

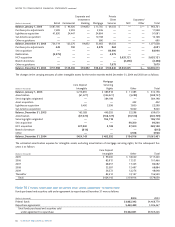

On May 28, 2004, SunTrust completed the acquisition of substan-

tially all of the assets of Seix Investment Advisors.The Company

acquired approximately $17 billion in assets under management.

The Company paid $190 million in cash, resulting in $84 million of

goodwill and $99 million of other intangible assets, all of which are

deductible for tax purposes. Additional payments may be made in

2007 and 2009, contingent on performance.The additional pay-

ments are currently estimated to total approximately $69.6 million.

SunTrust completed the acquisition of the Florida banking franchise

of Huntington Bancshares, Inc. (Huntington-Florida) on February

15, 2002. The Company acquired approximately $4.7 billion in

assets and liabilities. The transaction resulted in $528 million of

goodwill, $255 million of core deposit intangibles and $13 million

of other intangibles, all of which were deductible for tax purposes.

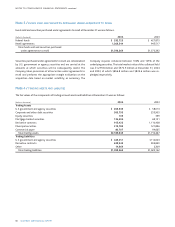

On June 2, 2003, SunTrust completed the acquisition of Lighthouse

Financial Services, Inc. (Lighthouse) based in Hilton Head Island,

South Carolina.The Company acquired approximately $637 million

in assets, $567 million in loans, and $421 million in deposits. In

addition, SunTrust paid $131 million in a combination of cash and

SunTrust stock.The transaction resulted in $99 million of goodwill

and $23 million of other intangible assets, which were not

deductible for tax purposes.

SunTrust completed the acquisition of Sun America Mortgage

(Sun America), one of the top mortgage lenders in Metro Atlanta, on

July 31, 2003.The transaction resulted in $10 million of goodwill

and $9 million of other intangibles, all of which were deductible for

tax purposes.