SunTrust 2004 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 95

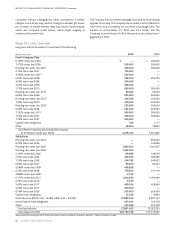

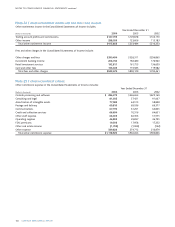

NET PERIODIC COST

Components of net periodic benefit cost were as follows:

Supplemental Other

Retirement Benefits Retirement Benefits Post Retirement Benefits

(Dollars in thousands) 2004 2003 2002 2004 2003 2002 2004 2003 2002

Service cost $ 50,085 $ 43,071 $ 42,530 $ 1,713 $ 1,520 $ 823 $ 2,277 $ 2,515 $ 4,146

Interest cost 82,084 74,574 69,067 5,082 4,991 4,995 9,803 10,823 11,052

Expected return on

plan assets (134,625) (111,656) (112,670) ———(8,606) (8,489) (8,218)

Amortization of prior

service cost (480) (443) (443) 1,992 1,941 2,201 ———

Recognized net

actuarial loss 37,910 57,307 16,657 4,751 4,358 3,180 5,554 6,840 3,372

Amortization of initial

transition obligation ————44 44 2,322 2,322 3,809

Net periodic benefit cost $ 34,974 $ 62,853 $ 15,141 $13,538 $12,854 $11,243 $11,350 $14,011 $14,161

Weighted-average

assumptions used to

determine net cost

Discount Rate16.25% 6.75% 7.25% 4.91% 6.75% 7.25% 6.25% 6.75% 7.25%

Expected return on

plan assets 8.50 8.75 9.50 N/A N/A N/A 6.00 6.25 7.00

Rate of compensation

increase 3.50 3.50 4.00 3.50 3.50 4.00 N/A N/A N/A

1The discount rate shown for 2004 reflects the rate used for the SunTrust Plans for fiscal 2004.The NCF Plans were measured for the period from October 1, 2004 through December 31, 2004 using a discount rate

of 5.75%.

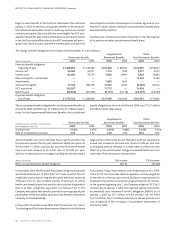

Based on the investment policy for the Retirement Plan and the

other Post Retirement Benefit Plan, as well as an asset study that

was performed in 2003 and 2004 based on SunTrust’s asset alloca-

tions and future expectations, the expected rate of return on plan

assets was 8.50% in 2004.The asset study forecasted rates of return

for the approximate duration of SunTrust’s benefit obligations,

using capital market data and historical relationships. Based on this

study, SunTrust anticipates leaving the return on asset assumption

at 8.50% for 2005.

In addition, SunTrust sets pension asset values equal to their market

value, in contrast to the use of a smoothed asset value that incorpo-

rates gains and losses over a period of years.The poor economic

environment over the three years prior to 2003 may have led to

inflated asset values in cases where a smoothed asset value is used.

Utilization of market value of assets provides a more realistic eco-

nomic measure of the plan’s funded status and cost. Assumed dis-

count rates and expected returns on plan assets affect the amounts

of net periodic pension cost reported.A 25 basis points decrease in

the discount rate or expected long-term return on plan assets

would increase the net periodic pension cost approximately $9 mil-

lion and $4 million, respectively.

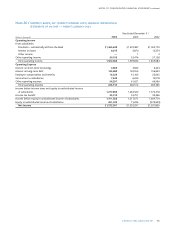

Assumed health care cost trend rates have a significant effect on

the amounts reported for the health care plan.A one-percentage-

point change in the assumed health care cost trend rates would

have had the following effect in fiscal 2004:

(Dollars in thousands) 1% Increase 1% Decrease

Effect on total of service and

interest cost $423 $(372)

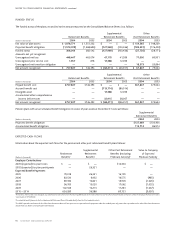

Note 17 / DERIVATIVES AND OFF-BALANCE SHEET

ARRANGEMENTS

In the normal course of business, the Company utilizes various

financial instruments to meet the needs of customers and to man-

age the Company’s exposure to interest rate and other market risks.

These financial instruments, which consist of derivatives contracts

and credit-related arrangements, involve, to varying degrees,

elements of credit and market risk in excess of the amount recorded

on the balance sheet in accordance with generally accepted

accounting principles.

Credit risk represents the potential loss that may occur because a

party to a transaction fails to perform according to the terms of the

contract. Market risk is the possibility that a change in market prices

may cause the value of a financial instrument to decrease or

become more costly to settle.The contract/notional amounts of

financial instruments, which are not included in the Consolidated

Balance Sheets, do not necessarily represent credit or market risk.

However, they can be used to measure the extent of involvement in

various types of financial instruments.