SunTrust 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

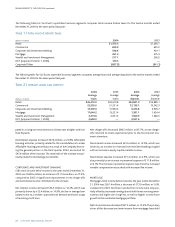

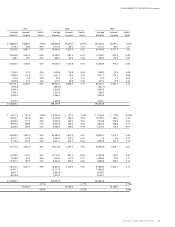

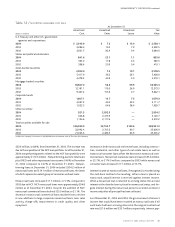

TABLE 3 / ANALYSIS OF CHANGES IN NET INTEREST INCOME1

2004 Compared to 2003 2003 Compared to 2002

Increase (Decrease) Due to Increase (Decrease) Due to

(Dollars in millions on a taxable-equivalent basis) Volume Rate Net Volume Rate Net

Interest Income

Loans:

Taxable $ 454.6 $(106.8) $ 347.8 $240.0 $ (607.8) $(367.8)

Tax-exempt214.6 (0.8) 13.8 18.6 (10.1) 8.5

Securities available for sale:

Taxable 84.6 156.3 240.9 171.2 (313.7) (142.5)

Tax-exempt215.0 (1.4) 13.6 (2.3) (1.5) (3.8)

Funds sold and securities purchased

under agreements to resell (0.1) 3.0 2.9 (0.1) (8.7) (8.8)

Loans held for sale (163.6) (3.4) (167.0) 225.8 (57.8) 168.0

Interest-bearing deposits 0.1 (0.1) — (5.7) (1.2) (6.9)

Trading assets 0.6 10.3 10.9 2.4 (10.0) (7.6)

Total interest income 405.8 57.1 462.9 649.9 (1,010.8) (360.9)

Interest Expense

NOW accounts 9.3 11.0 20.3 9.0 (32.7) (23.7)

Money Market accounts 6.1 (10.7) (4.6) 25.9 (149.2) (123.3)

Savings deposits 7.5 1.3 8.8 (0.7) (37.7) (38.4)

Consumer time deposits 8.9 (28.5) (19.6) (45.6) (99.8) (145.4)

Brokered deposits 16.5 (39.9) (23.4) 45.4 (64.3) (18.9)

Foreign deposits (14.3) 14.5 0.2 46.0 (19.8) 26.2

Other time deposits 9.0 3.9 12.9 (6.8) (15.3) (22.1)

Funds purchased and securities sold

under agreements to repurchase (18.7) 21.1 2.4 15.7 (50.0) (34.3)

Other short-term borrowings (8.3) 5.0 (3.3) 19.4 — 19.4

Long-term debt 199.8 (108.7) 91.1 34.6 (117.1) (82.5)

Total interest expense 215.8 (131.0) 84.8 142.9 (585.9) (443.0)

Net change in net interest income $ 190.0 $ 188.1 $ 378.1 $507.0 $ (424.9) $ 82.1

1Changes in net interest income are attributed to either changes in average balances (volume change) or changes in average rates (rate change) for earning assets and sources of funds on which interest is received

or paid.Volume change is calculated as change in volume times the previous rate,while rate change is change in rate times the previous volume.The rate/volume change, change in rate times change in volume, is

allocated between volume change and rate change at the ratio each component bears to the absolute value of their total.

2Interest income includes the effects of taxable-equivalent adjustments (reduced by the nondeductible portion of interest expense) using a federal income tax rate of 35% and, where applicable, state income

taxes to increase tax-exempt interest income to a taxable-equivalent basis.

$23.7 million for system conversions, project management, con-

formity changes, and customer communications related to the NCF

acquisition. Additionally impacting the increase were higher adver-

tising expenses incurred in 2004.

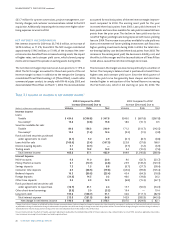

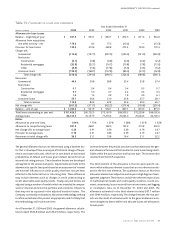

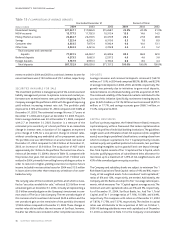

NET INTEREST INCOME/MARGIN

Net interest income for 2004 was $3,743.6 million, an increase of

$378.3 million, or 11.2%, from 2003.The NCF merger contributed

approximately $196.3 million, or 51.9%, of the increase. Net inter-

est income also benefited from increased earning assets, the impact

of higher rates, and a steeper yield curve, which slowed prepay-

ments and increased the spreads on earning assets during 2004.

The net interest margin improved seven basis points to 3.15% in

2004.The NCF merger accounted for three basis points of the net

interest margin increase. In addition to the merger, the Company

consolidated Three Pillars Funding, LLC (Three Pillars), a multi-seller

commercial paper conduit, to comply with FIN 46 in July 2003, and

deconsolidated Three Pillars on March 1, 2004.The deconsolidation

accounted for two basis points of the net interest margin improve-

ment compared to 2003. The earning asset yield for the year

increased three basis points from 2003. Loan yield decreased 14

basis points and securities available for sale yield increased 69 basis

points from the prior year. The decline in loan yield was due to

runoff of higher-yielding loans being replaced with lower-yielding

loans in 2004.The increase in securities available for sale yield was

due to reinvestment of lower-yielding investment cash flows into

higher-yielding investments during 2004. In 2004, the total inter-

est-bearing liability cost declined three basis points from 2003.The

increase in the earning asset yield, the decrease in liability cost, and

the effect of the merger and the deconsolidation of Three Pillars

noted above, caused the net interest margin to increase.

The increase in the margin was due more specifically to a number of

factors.The Company’s balance sheet is positioned to benefit from

higher rates and a steeper yield curve. Since the third quarter of

2003, the yield curve has generally been steeper and rates have

trended higher in anticipation of the Federal Reserve increasing

the Fed Funds rate, which it did starting on June 30, 2004. The