SunTrust 2004 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 SUNTRUST 2004 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

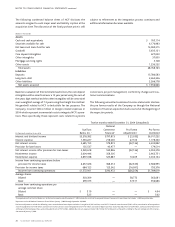

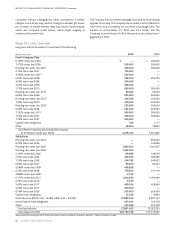

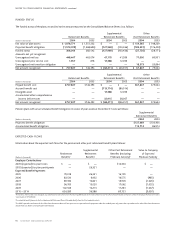

Note 13 / LONG-TERM DEBT

Long-term debt at December 31 consisted of the following:

(Dollars in thousands) 2004 2003

Parent Company Only

6.125% notes due 2004 $— $ 200,000

7.375% notes due 2006 200,000 200,000

Floating rate notes due 2007 300,000 300,000

2.15% notes due 2007 100,000 —

3.625% notes due 2007 250,000 —

6.25% notes due 2008 294,250 294,250

4.00% notes due 2008 350,000 —

4.25% notes due 2009 300,000 —

7.75% notes due 2010 300,000 300,000

Floating rate notes due 2019 50,563 50,563

6.00% notes due 2026 200,000 200,000

Floating rate notes due 20271384,029 350,000

7.90% notes due 20271250,000 250,000

Floating rate notes due 20281250,000 250,000

6.00% notes due 2028 222,925 222,925

7.125% notes due 20311300,000 300,000

7.05% notes due 20311300,000 300,000

7.70% notes due 20311200,000 —

Capital lease obligations 166 1,111

Other 43,800 72,850

Total Parent Company (excluding intercompany

of $193,922 in 2004 and 2003) 4,295,733 3,291,699

Subsidiaries

Floating rate notes due 2004 —850,000

8.75% notes due 2004 —149,966

Floating rate notes due 2005 1,850,455 1,001,057

Floating rate notes due 2006 1,000,000 —

2.125% notes due 2006 149,989 149,979

2.50% notes due 2006 399,553 399,289

7.25% notes due 2006 249,783 249,655

6.90% notes due 2007 99,820 99,747

2.086% notes due 2008 499,838 —

6.50% notes due 2008 140,845 141,119

3.868% notes due 2009 4,165 —

6.375% notes due 2011 1,000,820 1,000,949

2.70% notes due 2014 9,160 —

5.45% notes due 2017 499,034 498,960

5.20% notes due 2017 350,000 —

8.16% notes due 20261200,000 200,000

Capital lease obligations 21,329 15,892

FHLB advances (2004: 0.00 – 8.79%, 2003: 0.50 – 8.79%) 10,893,456 6,847,124

Direct finance lease obligations 207,342 164,718

Other 255,844 253,768

Total subsidiaries 17,831,433 12,022,223

Total long-term debt $22,127,166 $15,313,922

1Notes payable to trusts formed to issue Trust Preferred Securities totaled $1.9 billion at December 31, 2004 and $1.7 billion at December 31, 2003.

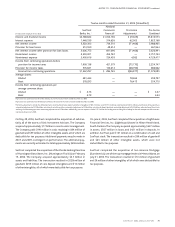

calculated without changing any other assumption; in reality,

changes in one factor may result in changes in another (for exam-

ple, increases in market interest rates may result in lower prepay-

ments and increased credit losses), which might magnify or

counteract the sensitivities.

The Company has securitized mortgage loans and retained varying

degrees of recourse.The Company has recorded in other liabilities a

reserve for recourse liability for securitized mortgage loans.The

balance as of December 31, 2004, was $4.4 million and the

Company incurred losses of $43.6 thousand on securitized mort-

gage loans in 2004.