SunTrust 2004 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

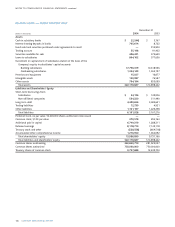

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 103

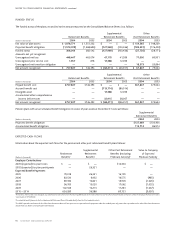

Note 23 / COMPREHENSIVE INCOME

The Company’s comprehensive income, which includes certain

transactions and other economic events that bypass the income

statement, consists of net income and unrealized gains and losses

on securities available for sale, and derivatives net of income taxes

and other comprehensive income related to retirement plans.

Comprehensive income for the years ended December 31, 2004,

2003, and 2002 is calculated as follows:

(Dollars in thousands) 2004 2003 2002

Unrealized (loss) gain on available for sale securities, net,

recognized in other comprehensive income:

Before income tax $ (604,347) $ 177,314 $ (195,217)

Income tax (209,004) 62,060 (68,326)

Net of income tax (395,343) 115,254 (126,891)

Amounts reported in net income:

(Loss) gain on sale of securities (41,691) 123,876 204,547

Net amortization 62,034 172,434 47,654

Reclassification adjustment 20,343 296,310 252,201

Income tax (7,120) (103,709) (88,270)

Reclassification adjustment, net of tax 13,223 192,601 163,931

Unrealized (loss) gain on available for sale securities

arising during period, net of tax (382,120) 307,855 37,040

Reclassification adjustment, net of tax (13,223) (192,601) (163,931)

Net unrealized (loss) gain on available for sale securities

recognized in other comprehensive income (395,343) 115,254 (126,891)

Unrealized gain on derivative financial instruments, net,

recognized in other comprehensive income:

Before income tax 16,402 45,366 13,822

Income tax (5,741) (15,878) (4,838)

Net of income tax 10,661 29,488 8,984

Reclassification of losses from other comprehensive

income to earnings —— 4,786

Income tax expense —— (1,675)

Reclassification adjustment, net of tax —— 3,111

Unrealized gain on derivative financial instruments

arising during period, net of tax 10,661 29,488 5,873

Reclassification adjustment, net of tax —— 3,111

Net unrealized gain on derivative instruments

recognized in other comprehensive income 10,661 29,488 8,984

Change in accumulated other comprehensive income

related to retirement plans: (2,460) 9,881 (27,876)

Total unrealized (losses) gains recognized in

other comprehensive income (387,142) 154,623 (145,783)

Net income 1,572,901 1,332,297 1,331,809

Total comprehensive income $1,185,759 $1,486,920 $1,186,026

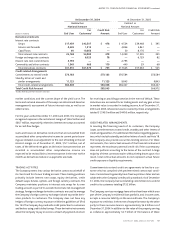

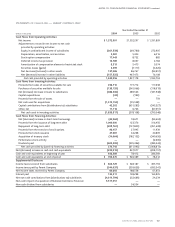

The components of accumulated other comprehensive income at December 31 were as follows:

(Dollars in thousands) 2004 2003 2002

Net unrealized gain on available for sale securities $1,304,000 $1,699,344 $1,584,091

Net unrealized loss on derivative financial instruments (6,595) (17,257) (46,745)

Accumulated other comprehensive income related to retirement plans (20,455) (17,995) (27,876)

Total accumulated other comprehensive income $1,276,950 $1,664,092 $1,509,470