SunTrust 2004 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 SUNTRUST 2004 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

the contract, the Company would make a cash payment to the

holder of credit protection and would take delivery of the refer-

enced asset from which the Company may recover a portion of the

credit loss.

Note 19 / CONCENTRATIONS OF CREDIT RISK

Credit risk refers to the potential for economic loss arising from the

failure of SunTrust customers to meet their contractual agreements

on all credit instruments, including on-balance sheet exposures

from loans, contingent exposures from unfunded commitments,

letters of credit, credit derivatives, and counterparty risk under

interest rate and foreign exchange derivative products. Concen-

trations of credit risk (whether on or off-balance sheet) arising from

financial instruments, can exist in relation to individual borrowers

or groups of borrowers, certain types of collateral, certain types of

industries, or certain regions of the country. Credit risk associated

with these concentrations could arise when a significant amount of

loans, related by similar characteristics, are simultaneously

impacted by changes in economic or other conditions that cause

their probability of repayment to be adversely affected. The

Company does not have a significant concentration to any individ-

ual client except for the U.S. government and its agencies.The major

concentrations of credit risk for the Company are related to collat-

eral type in relation to loans and credit commitments.The only sig-

nificant concentration in loans by collateral type that exists is in

loans secured by residential real estate. At December 31, 2004, the

Company had $36.1 billion in residential real estate loans, repre-

senting 35.6% of total loans, and an additional $12.1 billion in

commitments to extend credit on such loans. A geographic con-

centration arises because the Company operates primarily in the

Southeastern and Mid-Atlantic regions of the United States.

SunTrust engages in limited international banking activities.The

Company’s total cross-border outstandings were $573.0 million as

of December 31, 2004.

Note 20 / FAIR VALUES OF FINANCIAL INSTRUMENTS

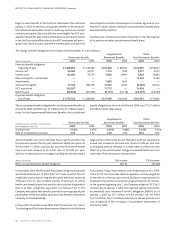

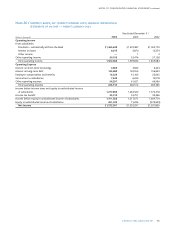

The following table presents the carrying amounts and fair values of the Company’s financial instruments at December 31, 2004 and 2003:

2004 2003

Carrying Fair Carrying Fair

(Dollars in thousands) Amount Value Amount Value

Financial assets

Cash and short-term investments $ 5,488,939 $ 5,488,939 $ 5,321,374 $ 5,321,374

Trading assets 2,183,645 2,183,645 1,710,467 1,710,467

Securities available for sale 28,941,080 28,941,080 25,606,884 25,606,884

Loans held for sale 6,580,223 6,579,482 5,552,060 5,556,142

Loans 100,376,148 100,312,937 79,790,399 80,474,925

Mortgage servicing rights 482,392 631,518 449,293 560,628

Financial liabilities

Consumer and commercial deposits 92,109,695 92,132,281 72,924,646 73,058,073

Brokered deposits 6,100,911 6,101,412 3,184,084 3,195,497

Foreign deposits 5,150,645 5,150,645 5,080,789 5,080,789

Short-term borrowings 11,405,380 11,405,380 13,566,392 13,566,392

Long-term debt 22,127,166 22,837,503 15,313,922 16,018,678

Trading liabilities 1,098,563 1,098,563 1,020,142 1,020,142

The following methods and assumptions were used by the

Company in estimating the fair value of financial instruments:

• Short-term financial instruments are valued at their carrying

amounts reported in the balance sheet, which are reasonable esti-

mates of fair value due to the relatively short period to maturity

of the instruments.This approach applies to cash and cash equiva-

lents, short-term investments, short-term borrowings and certain

other assets and liabilities.

• Trading assets and liabilities are substantially valued at quoted

market prices. If quoted market prices are not available, fair values

are based on quoted market prices of comparable instruments.

Fair values for derivatives are based on quoted market prices,

current settlement values, pricing models or other formulas.

• Securities available for sale are substantially valued at quoted

market prices.

• Loans held for sale are valued based on quoted market prices in

the secondary market.

• Loans are valued on the basis of estimated future receipts of prin-

cipal and interest, discounted at rates currently being offered for

loans with similar terms and credit quality. Loan prepayments are

used to adjust future cash flows based on historical patterns.The

carrying amount of accrued interest approximates its fair value.