SunTrust 2004 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 SUNTRUST 2004 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

loans serviced with recourse as of December 31, 2004, is insured by

governmental agencies and private mortgage insurance firms.

WHEN-ISSUED SECURITIES

The Company enters into transactions involving “when-issued secu-

rities.”When-issued securities are commitments to purchase or sell

securities authorized for issuance but not yet actually issued.

Accordingly, they are not recorded on the balance sheet until issued.

Risks arise from the possible inability of counterparties to meet the

terms of their contracts and from movements in securities values

and interest rates. As of December 31, 2004, the Company did not

have any commitments to purchase or sell when-issued securities.

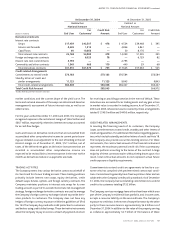

VARIABLE INTEREST ENTITIES AND OFF-BALANCE SHEET

ARRANGEMENTS

SunTrust assists in providing liquidity to select corporate customers

by directing them to a multi-seller commercial paper conduit,Three

Pillars Funding LLC (Three Pillars).Three Pillars provides financing

for direct purchases of financial assets originated and serviced by

SunTrust’s corporate clients.Three Pillars finances this activity by

issuing A-1/P-1 rated commercial paper.The result is a favorable

funding arrangement for these SunTrust clients.

In January 2003, the FASB issued FIN 46, “Consolidation of Variable

Interest Entities,” which addressed the criteria for the consolidation

of off-balance sheet entities similar to Three Pillars. Under the pro-

visions of FIN 46, SunTrust consolidated Three Pillars as of July 1,

2003.

In December 2003, the FASB issued a revision to FIN 46 (FIN 46(R))

which replaced the Interpretation issued in January 2003. FIN 46(R)

is effective for reporting periods ending after March 15, 2004. As of

March 31, 2004, the Company adopted all the provisions of FIN

46(R), and the adoption did not have a material impact on the

Company’s financial position or results of operations.

On March 1, 2004, Three Pillars was restructured through the

issuance of a subordinated note to a third party. Under the terms of

the subordinated note, the holder of the note will absorb the major-

ity of Three Pillars’ expected losses.The subordinated note investor

therefore is Three Pillars’ primary beneficiary, and thus the Company

is not required to consolidate Three Pillars. Due to the issuance of

the subordinated note, the Company deconsolidated Three Pillars

effective March 1, 2004. As of December 31, 2004,Three Pillars had

assets and liabilities not included on the Consolidated Balance

Sheet of approximately $3.4 billion, consisting of primarily secured

loans, marketable asset-backed securities and short-term commer-

cial paper liabilities. As of December 31, 2003, Three Pillars had

assets and liabilities of approximately $3.2 billion which were

included in the Consolidated Balance Sheet.

Activities related to the Three Pillars relationship generated fee rev-

enue for the Company of approximately $24.2 million, $21.3 mil-

lion, and $16.4 million for the years ended December 31, 2004,

2003, and 2002, respectively.These activities include: client refer-

rals and investment recommendations to Three Pillars; the issuing

of a letter of credit, which provides partial credit protection to the

commercial paper holders; and providing a majority of the tempo-

rary liquidity arrangements that would provide funding to Three

Pillars in the event it can no longer issue commercial paper or in cer-

tain other circumstances.

As of December 31, 2004, off-balance sheet liquidity commitments

and other credit enhancements made by the Company to Three

Pillars totaled $5.9 billion and $548.7 million, respectively, which

represent the Company’s maximum exposure to potential loss.The

Company manages the credit risk associated with these commit-

ments by subjecting them to the Company’s normal credit approval

and monitoring processes.

As part of its community reinvestment initiatives, the Company

invests in multi-family Affordable Housing properties throughout

its footprint as a limited and/or general partner. The Company

receives Affordable Housing federal and state tax credits for these

limited partner investments. Partnership assets of approximately

$884.2 million and $731.8 million in partnerships where SunTrust is

only a limited partner were not included in the Consolidated

Balance Sheets at December 31, 2004 and 2003, respectively.The

Company’s maximum exposure to loss for these partnerships at

December 31, 2004 was $198.1 million, consisting of the limited

partnership investments plus unfunded commitments.

SunTrust is the managing general partner of a number of non-regis-

tered investment limited partnerships which have been established

to provide alternative investment strategies for its customers. In

reviewing the partnerships for consolidation, SunTrust determined

that these were voting interest entities and accordingly considered

the consolidation guidance contained in SOP 78-9, “Accounting for

Investments in Real Estate Ventures.” Under the terms of SunTrust’s

non-registered investment limited partnerships, the limited part-

nerships have certain rights, such as those specifically indicated in

SOP 78-9 (including the right to remove the general partner, or

“kick-out rights”). As such, SunTrust, as the general partner, is pre-

cluded from consolidating the limited partnerships under the provi-

sions of SOP 78-9.

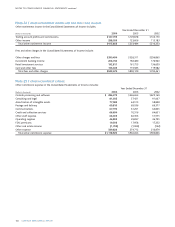

Note 18 / GUARANTEES

The Company has undertaken certain guarantee obligations in the

ordinary course of business. In following the provisions of FASB

Interpretation No. 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees” (FIN 45), the Company must con-

sider guarantees that have any of the following four characteristics

(i) contracts that contingently require the guarantor to make pay-

ments to a guaranteed party based on changes in an underlying fac-

tor that is related to an asset, a liability, or an equity security of the

guaranteed party; (ii) contracts that contingently require the guar-

antor to make payments to a guaranteed party based on another

entity’s failure to perform under an obligating agreement; (iii)

indemnification agreements that contingently require the indemni-

fying party to make payments to an indemnified party based on

changes in an underlying factor that is related to an asset, a liability,