SunTrust 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

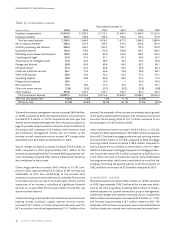

Trust and investment management income increased $84.4 million,

or 16.8%, compared to 2003 and retail investment services income

increased $31.0 million, or 19.2%, compared to the prior year.The

Wealth and Investment Management line of business analysis on

page 25 provides analysis related to these line items. In addition to

this analysis, NCF contributed $10.9 million of the increase in trust

and investment management income and $4.9 million of the

increase in retail investment services income. NCF’s assets under

advisement were $4.3 billion as of December 31, 2004.

Service charges on deposit accounts increased $56.9 million, or

8.9%, compared to 2003. Approximately $32.1 million of the

increase was attributable to NCF. Increased NSF/stop payment vol-

umes, increased pricing and other revenue enhancement initiatives

also contributed to the increase.

Other charges and fees increased $64.2 million, or 19.7%, com-

pared to 2003. Approximately$12.6 million of the increase was

attributable to NCF. Also contributing to the increase were

increases in insurance revenue and letter of credit fees.The increase

in insurance revenue was due to increased sales volume and the

acquisition of an insurance subsidiary of Lighthouse Financial

Services, Inc. in June 2003.The increase in letter of credit fees was

due to increased volumes.

Combined trading account profits and commissions and investment

banking income, SunTrust’s capital markets revenue sources,

increased $32.1 million, or 10.6%, compared to the prior year.The

NCF acquisition contributed approximately $10.7 million of the

increase.The remainder of the increase was primarily due to growth

in the equity capital markets business.The Company incurred net

securities losses during 2004 of $41.7 million compared to net

securities gains of $123.9 million in 2003.

Other noninterest income increased $164.6 million, or 133.3%,

compared to 2003.Approximately $18.9 million of the increase was

due to NCF. Combined mortgage production and servicing income

increased $96.3 million, or 351.8%, compared to 2003. Mortgage

servicing related income increased $188.6 million compared to

2003 primarily due to a decline in amortization of service rights

related to a decrease in mortgage prepayments. Mortgage produc-

tion income decreased $92.3 million compared to 2003 due to a

$12.9 billion decrease in production volume. Certain Affordable

Housing partnerships, which were consolidated as a result of the

Company becoming the general partner in the third quarter of

2003, resulted in an increase of $15.8 million compared to 2003.

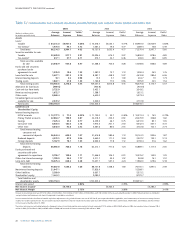

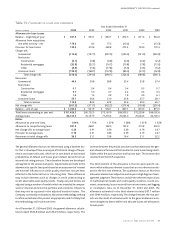

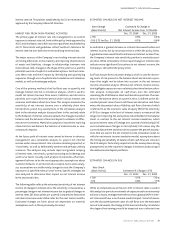

NONINTEREST EXPENSE

Noninterest expense increased $496.4 million, or 14.6%, compared

to 2003. Approximately $184.5 million of the increase was attrib-

uted to the NCF acquisition including $28.4 million of merger-

related expenses for system conversions, project management,

conformity changes, and customer communications. Compared to

2003, total personnel expense increased $223.8 million, or 11.5%,

and included approximately $78.7 million related to NCF. The

remainder of the increase was primarily due to increased historical

SunTrust headcount, normal merit increases and increased incen-

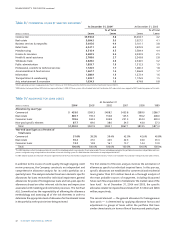

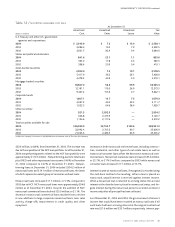

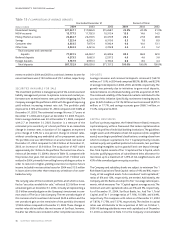

Table 6 / NONINTEREST EXPENSE

Year Ended December 31

(Dollars in millions) 2004 2003 2002 2001 2000 1999

Employee compensation $1,804.9 $1,585.9 $1,512.1 $1,484.5 $1,469.0 $1,522.6

Employee benefits 363.4 358.6 306.4 193.0 175.0 175.8

Total personnel expense 2,168.3 1,944.5 1,818.5 1,677.5 1,644.0 1,698.4

Net occupancy expense 268.2 237.3 229.3 210.4 202.6 197.4

Outside processing and software 286.3 246.7 225.2 199.1 172.3 150.3

Equipment expense 184.9 178.4 174.8 189.8 193.7 198.5

Marketing and customer development 128.3 100.3 80.0 104.0 106.2 105.4

Consulting and legal 81.0 57.4 91.1 87.7 59.6 62.5

Amortization of intangible assets 77.6 64.5 58.9 46.3 35.5 32.8

Postage and delivery 69.8 69.0 69.4 64.0 63.3 68.1

Communications 67.2 61.3 64.8 59.2 59.8 66.3

Credit and collection services 66.7 70.3 64.6 74.6 56.9 68.7

Other staff expense 66.0 60.4 52.0 58.5 51.5 50.1

Operating supplies 46.8 39.8 46.8 48.3 47.3 51.9

Merger-related expense 28.4 — 16.0 — 42.4 45.6

FDIC premiums 19.5 18.0 17.4 16.0 13.5 18.1

Other real estate income (1.8) (2.0) (0.1) (4.2) (3.8) (4.8)

Other expense 339.8 254.7 210.7 168.7 83.7 96.0

Total noninterest expense $3,897.0 $3,400.6 $3,219.4 $2,999.9 $2,828.5 $2,905.3

Year over year growth rate 14.6% 5.6% 7.3% 6.1% (2.6%)

Efficiency ratio 61.4% 60.0% 58.0% 56.1% 57.5% 60.4%