SunTrust 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 SUNTRUST 2004 ANNUAL REPORT

MANAGEMENT’S DISCUSSION continued

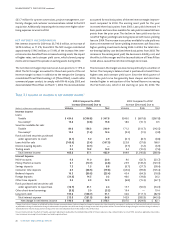

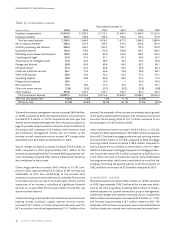

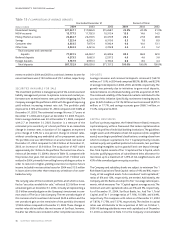

Table 13 / COMPOSITION OF AVERAGE DEPOSITS

Year Ended December 31 Percent of Total

(Dollars in millions) 2004 2003 2002 2004 2003 2002

Noninterest bearing $21,047.1 $17,826.9 $15,268.1 24.2% 22.3% 21.5%

NOW accounts 13,777.5 11,702.0 10,315.4 15.8 14.6 14.5

Money Market accounts 22,864.7 22,218.5 20,470.9 26.2 27.8 28.8

Savings 7,225.4 6,259.3 6,310.0 8.3 7.8 8.9

Consumer time 8,333.5 7,975.4 9,342.4 9.6 10.0 13.1

Other time 3,843.3 3,461.6 3,722.8 4.4 4.3 5.2

Total consumer and commercial

deposits 77,091.5 69,443.7 65,429.6 88.5 86.8 92.0

Brokered deposits 4,273.5 3,662.0 2,537.2 4.9 4.6 3.6

Foreign deposits 5,767.9 6,933.3 3,190.4 6.6 8.6 4.4

Total deposits $87,132.9 $80,039.0 $71,157.2 100.0% 100.0% 100.0%

ments recorded in 2004 and 2003 as cash basis interest income for

nonaccrual loans were $19.0 million and $14.1 million, respectively.

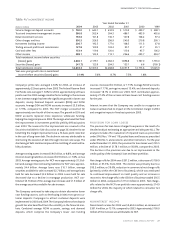

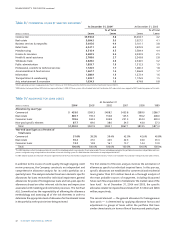

SECURITIES AVAILABLE FOR SALE

The investment portfolio is managed as part of the overall asset and

liability management process to optimize income and market per-

formance over an entire interest rate cycle while mitigating risk.The

Company managed the portfolio in 2004 with the goal of improving

yield without increasing interest rate risk. The portfolio yield

improved to 4.16% at December 31, 2004 compared with 3.66% at

December 31, 2003. The estimated average life was 3.7 years at

December 31, 2004 and 4.0 years at December 31, 2003.The port-

folio’s average duration was 3.0 at December 31, 2004, compared

with 2.7 at December 31, 2003. Duration is a measure of the

estimated price sensitivity of a bond portfolio to an immediate

change in interest rates. A duration of 3.0 suggests an expected

price change of 3.0% for a one percent change in interest rates,

without considering any embedded call or prepayment options.

The portfolio size was $26.9 billion on an amortized cost basis at

December 31, 2004 compared to $23.0 billion at December 31,

2003, an increase of $3.9 billion. The acquisition of NCF added

approximately $6.1 billion to the portfolio.The current mix of secu-

rities as of December 31, 2004 is shown in Table 12, compared with

the previous two years. Net securities losses of $41.7 million were

realized in 2004, primarily from selling lower-yielding securities in

order to reinvest in higher-yielding securities to improve future

income. Included in net securities losses for 2004 was $15.3 million

in losses due to the other than temporary writedown of an asset-

backed security.

The carrying value of the investment portfolio, all of which is classi-

fied as “securities available for sale,” reflected $2.0 billion in net

unrealized gains at December 31, 2004, virtually all representing a

$2.0 billion unrealized gain on the Company’s investment in com-

mon stock of The Coca-Cola Company.The net unrealized gain of

this common stock investment decreased $445.6 million and the

net unrealized gain on the remainder of the portfolio decreased

$158.8 million compared to December 31, 2003.These changes in

market value did not affect the net income of SunTrust, however,

the after tax effects were included in other comprehensive income.

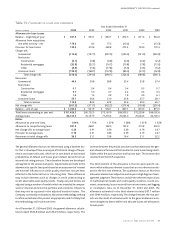

DEPOSITS

Average consumer and commercial deposits increased $7,647.8

million, or 11.0%, in 2004 and comprised 88.5%, 86.8%, and 92.0%

of average total deposits in 2004, 2003, and 2002, respectively.The

growth was primarily due to initiatives to grow retail deposits,

reduced reliance on wholesale funding, and the acquisition of NCF.

The continued volatility of the financial markets contributed to the

success of this initiative. Specifically, noninterest-bearing deposits

grew $3,220.2 million, or 18.1%, NOW accounts increased $2,075.5

million, or 17.7%, and savings accounts grew $966.1 million, or

15.4%, compared to 2003.

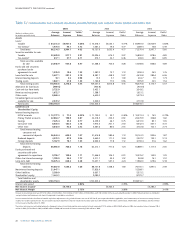

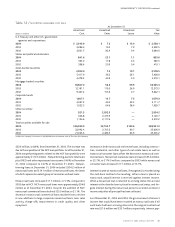

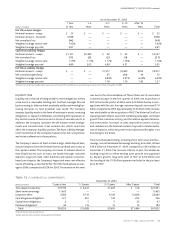

CAPITAL RESOURCES

SunTrust’s primary regulator, the Federal Reserve Board, measures

capital adequacy within a framework that makes capital sensitive

to the risk profiles of individual banking institutions.The guidelines

weight assets and off-balance sheet risk exposures (risk-weighted

assets) according to predefined classifications, creating a base from

which to compare capital levels.Tier 1 Capital primarily includes

realized equity and qualified preferred instruments, less purchase

accounting intangibles such as goodwill and core deposit intangi-

bles.Total Capital consists of Tier 1 Capital and Tier 2 Capital, which

includes qualifying portions of subordinated debt, allowance for

loan losses up to a maximum of 1.25% of risk-weighted assets, and

45% of the unrealized gain on equity securities.

The Company and subsidiary banks are subject to minimum Tier 1

Risk-Based Capital and Total Capital ratios of 4% and 8%, respec-

tively, of risk weighted assets.To be considered “well capitalized,”

ratios of 6% and 10%, respectively, are needed.Additionally, the

Company and the Banks are subject to Tier 1 Leverage ratio require-

ments, which measures Tier 1 Capital against average assets.The

minimum and well capitalized ratios are 3% and 5%, respectively.

As of December 31, 2004, SunTrust Banks, Inc. had Tier 1, Total

Capital, and Tier 1 Leverage ratios of 7.16%, 10.36%, and 6.64%,

respectively. This compares with ratios as of December 31, 2003

of 7.85%, 11.75%, and 7.37%, respectively.The decline in capital

ratios was attributable to the acquisition of NCF on October 1,

2004. All banking subsidiaries were well capitalized as of December

31, 2004 as detailed in Note 14 to the Company’s Consolidated