SunTrust 2004 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 SUNTRUST 2004 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

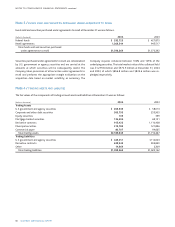

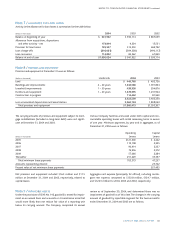

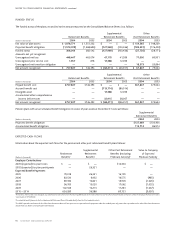

(Dollars in thousands) 2004 2003

Deferred tax assets

Allowance for loan losses $ 399,436 $ 342,510

Accrued expenses 98,252 76,522

Other 124,430 97,462

Gross deferred tax assets $ 622,118 $ 516,494

Deferred tax liabilities

Net unrealized gains on securities available for sale 649,688 847,538

Leasing 769,630 677,515

Employee benefits 248,374 248,225

Mortgage 146,858 118,379

Intangible assets 77,820 20,757

Fixed assets 48,509 65,159

Loans 53,959 41,518

Gross deferred tax liabilities $1,994,838 $2,019,091

Net deferred tax liability $1,372,720 $1,502,597

Note 15 / INCOME TAXES

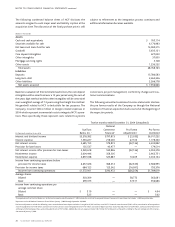

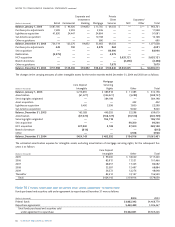

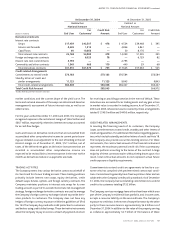

The components of income tax expense (benefit) included in the Consolidated Statements of Income were as follows:

(Dollars in thousands) 2004 2003 2002

Current income tax expense (benefit)

Federal $517,508 $381,250 $360,851

State 21,629 15,686 (15,662)

Total $539,137 $396,936 $345,189

Deferred income tax expense

Federal 123,883 154,348 121,319

State 21,105 25,557 25,007

Total $144,988 $179,905 $146,326

Total income tax expense $684,125 $576,841 $491,515

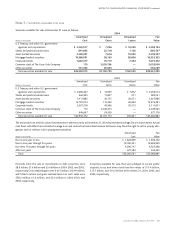

The Company’s income from international operations, before

provision for income taxes, was not significant. Additionally, the

tax effect of unrealized gains and losses on securities available

for sale was recorded in other comprehensive income and had

no effect on income tax expense.

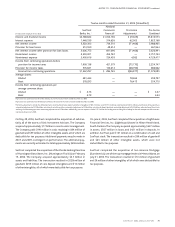

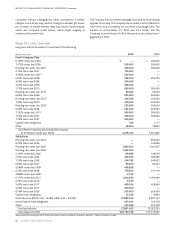

A reconciliation of the expected income tax expense at the

statutory federal income tax rate of 35% to the Company’s

actual income tax expense (benefit) and effective tax rate for

the past three years is as follows:

Deferred income tax liabilities and assets result from differences

between assets and liabilities measured for financial reporting pur-

poses and for income tax return purposes. These assets and liabili-

ties are measured using the enacted tax rates and laws that are

currently in effect. The significant components of the net deferred

tax liability are as follows:

2004 2003 2002

Percent Percent Percent

of Pre-Tax of Pre-Tax of Pre-Tax

(Dollars in thousands) Amount Income Amount Income Amount Income

Income tax expense at federal statutory rate $789,959 35.0% $668,198 35.0% $638,163 35.0%

Increase (decrease) resulting from:

Tax-exempt interest (38,610) (1.7%) (31,951) (1.7%) (29,366) (1.6%)

Income tax credits, net (51,264) (2.3%) (39,653) (2.1%) (51,243) (2.8%)

State income taxes, net of federal benefit 27,777 1.2% 26,807 1.4% 6,074 0.3%

Dividends on subsidiary preferred stock (23,037) (1.0%) (23,567) (1.2%) (25,530) (1.4%)

Reversal of deferred liability — 0.0% — 0.0% (25,000) (1.4%)

Other (20,700) (0.9%) (22,993) (1.2%) (21,583) (1.1%)

Total income tax expense and rate $684,125 30.3% $576,841 30.2% $491,515 27.0%