SunTrust 2004 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2004 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

SUNTRUST 2004 ANNUAL REPORT 99

or an equity security of the indemnified party; and (iv) indirect

guarantees of the indebtedness of others.The issuance of a guaran-

tee imposes an obligation for the Company to stand ready to per-

form, and should certain triggering events occur, it also imposes an

obligation to make future payments. Payments may be in the form

of cash, financial instruments, other assets,shares of stock, or provi-

sions of the Company’s services.The following is a discussion of the

guarantees that the Company has issued as of December 31, 2004,

which have characteristics as specified by FIN 45.

LETTERS OF CREDIT

Letters of credit are conditional commitments issued by the

Company generally to guarantee the performance of a client to a

third party in borrowing arrangements, such as commercial paper,

bond financing and similar transactions.The credit risk involved in

issuing letters of credit is essentially the same as that involved in

extending loan facilities to customers and may be reduced by sell-

ing participations to third parties. The Company issues letters of

credit that are classified as either financial standby, performance

standby or commercial letters of credit. Commercial letters of

credit are specifically excluded from the disclosure and recognition

requirements of FIN 45.

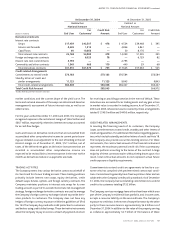

As of December 31, 2004 and December 31, 2003, the maximum

potential amount of the Company’s obligation was $11.0 billion and

$9.7 billion, respectively, for financial and performance standby let-

ters of credit.The Company has recorded $99.4 million in other lia-

bilities for unearned fees related to these letters of credit as of

December 31, 2004.The Company’s outstanding letters of credit

generally have a term of less than one year. If a letter of credit is

drawn upon, the Company may seek recourse through the cus-

tomer’s underlying line of credit. If the customer’s line of credit is

also in default, the Company may take possession of the collateral

securing the line of credit.

CONTINGENT CONSIDERATION

The Company has contingent payment obligations related to

certain business combination transactions. Payments are calcu-

lated using certain post-acquisition performance criteria. As of

December 31, 2004, the potential liability associated with these

arrangements was approximately $205.0 million. As contingent

consideration in a business combination is not subject to the recog-

nition and measurement provisions of FIN 45, the Company cur-

rently has no amounts recorded for these guarantees as of

December 31, 2004. If required, these contingent payments would

be payable within the next five years.

OTHER

In the normal course of business, the Company enters into indemni-

fication agreements and provides standard representations and

warranties in connection with numerous transactions.These trans-

actions include those arising from underwriting agreements, merger

and acquisition agreements, loan sales, contractual commitments,

and various other business transactions or arrangements.The extent

of the Company’s obligations under these indemnification agree-

ments depends upon the occurrence of future events; therefore, the

Company’s potential future liability under these arrangements is

not determinable.

Third party investors hold Series B Preferred Stock in STB Real Estate

Holdings (Atlanta), Inc. (STBREH), a subsidiary of SunTrust.The con-

tract between STBREH and the third party investors contains an

automatic exchange clause which, under certain circumstances,

requires the Series B preferred shares to be automatically

exchanged for guaranteed preferred beneficial interest in deben-

tures of the Company.The guaranteed preferred beneficial interest

in debentures are guaranteed to have a liquidation value equal to

the sum of the issue price, $350 million, and an approximate yield of

8.5% per annum subject to reduction for any cash or property divi-

dends paid to date. As of December 31, 2004 and December 31,

2003, $451.0 and $412.5 million is accrued in other liabilities for

the principal and interest, respectively.This exchange agreement

remains in effect as long as any shares of Series B Preferred Stock are

owned by the third party investors, not to exceed 30 years.

SunTrust Securities, Inc. (STS), SunTrust Capital Markets, Inc.

(STCM), NCF Financial Services, Inc. (NCFFS), and NBC Capital

Markets Group (NBCCMG), broker-dealer affiliates of SunTrust, use

a common third party clearing broker to clear and execute their

clients’ securities transactions and to hold client accounts. Under

their respective agreements,STS, STCM, NCFFS, and NBCCMG agree

to indemnify the clearing broker for losses that result from a client’s

failure to fulfill their contractual obligations.As the clearing broker’s

rights to charge STS, STCM, NCFFS, and NBCCMG have no maxi-

mum amount, the Company believes that the maximum potential

obligation cannot be estimated. However, to mitigate exposure, the

affiliate may seek recourse from the client through cash or securi-

ties held in the defaulting customers’ account. For the year ended

December 31, 2004, SunTrust experienced minimal net losses as a

result of the indemnity.The clearing agreements for STS and STCM

expire in July 2005 and in December 2005, respectively.The clearing

agreements for NCFFS and NBCCMG are currently on a month-to-

month basis until regulatory approval is obtained for the mergers of

NCFFS into STS and NBCCMG into STCM which are anticipated

to occur in 2005. Upon the mergers, NCFFS and NBCCMG will

be covered under the clearing agreements of their respective

SunTrust entity.

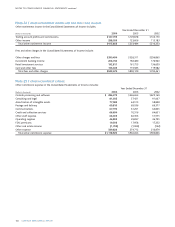

SunTrust Bank has guarantees associated with credit default swaps,

an agreement in which the buyer of protection pays a premium to

the seller of the credit default swap for protection against an event

of default. Events constituting default under such agreements that

would result in the Company making a guaranteed payment to

a counterparty may include (i) default of the referenced asset;

(ii) bankruptcy of the customer; or (iii) restructuring or reorganiza-

tion by the customer. The notional amount outstanding as of

December 31, 2004 and December 31, 2003 was $757.0 million and

$195.0 million, respectively.As of December 31, 2004, the notional

amounts expire as follows: $50.0 million in 2005, $108.0 million in

2006, $60.0 million in 2007, $180.0 million in 2008, $184.0 million

in 2009, and $175.0 million in 2010. In the event of default under